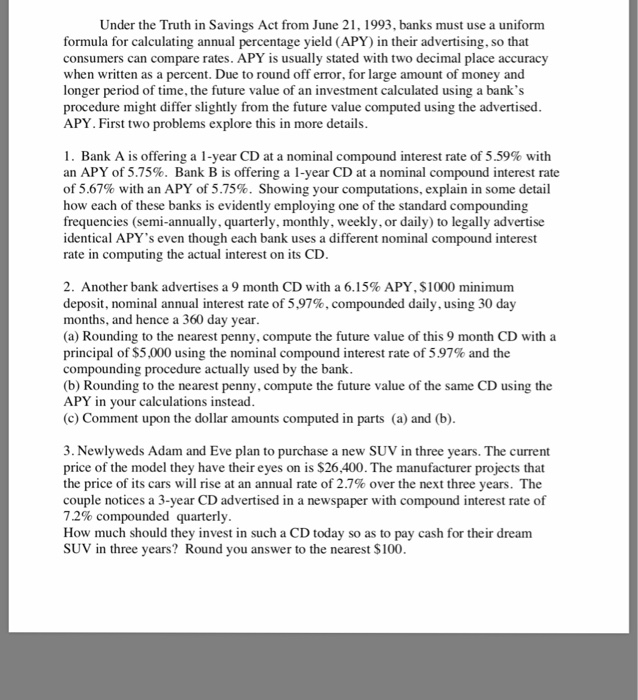

Under the Truth in Savings Act from June 21, 1993, banks must use a uniform formula for calculating annual percentage yield (APY) in their advertising, so that consumers can compare rates. APY is usually stated with two decimal place accuracy when written as a percent. Due to round off error, for large amount of money and longer period of time, the future value of an investment calculated using a bank's procedure might differ slightly from the future value computed using the advertised APY. First two problems explore this in more details 1 , Bank A is offering a 1-year CD at a nominal compound interest rate of 5.59% with an APY of 5.75%. Bank B is offering a 1-year CD at a nominal compound interest rate of 5.67% with an APY of 5.75%. Showing your computations, explain in some detail how each of these banks is evidently employing one of the standard compounding frequencies (semi-annually, quarterly, monthly, weekly,or daily) to legally advertise identical APY's even though each bank uses a different nominal compound interest rate in computing the actual interest on its CD 2. Another bank advertises a 9 month CD with a 6.15% APY, $1000 minimum deposit, nominal annual interest rate of 5.97%, compounded daily, using 30 day months, and hence a 360 day year (a) Rounding to the nearest penny, compute the future value of this 9 month CD with a principal of $5,000 using the nominal compound interest rate of 5.97% and the compounding procedure actually used by the bank (b) Rounding to the nearest penny, compute the future value of the same CD using the APY in your calculations instead (c) Comment upon the dollar amounts computed in parts (a) and (b) 3. Newlyweds Adam and Eve plan to purchase a new SUV in three years. The current price of the model they have their eyes on is $26,400. The manufacturer projects that the price of its cars will rise at an annual rate of 2.7% over the next three years couple notices a 3-year CD advertised in a newspaper with compound interest rate of 72% compounded quarterly How much should they invest in such a CD today so as to pay cash for their dream SUV in three years? Round you answer to the nearest $100 The