Answered step by step

Verified Expert Solution

Question

1 Approved Answer

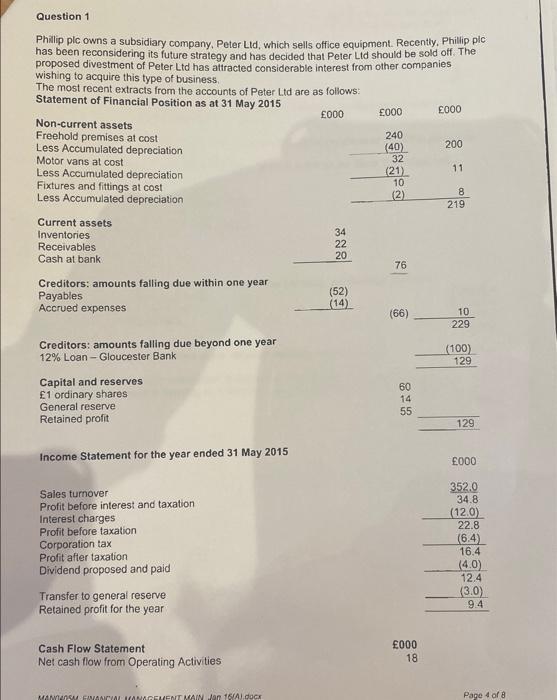

Question 1 Phillip plc owns a subsidiary company, Peter Ltd, which sells office equipment. Recently, Phillip plc has been reconsidering its future strategy and

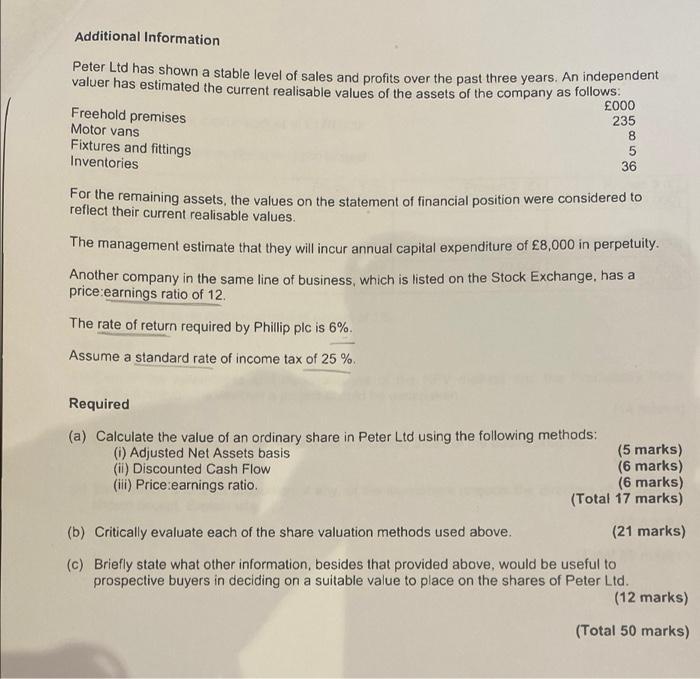

Question 1 Phillip plc owns a subsidiary company, Peter Ltd, which sells office equipment. Recently, Phillip plc has been reconsidering its future strategy and has decided that Peter Ltd should be sold off. The proposed divestment of Peter Ltd has attracted considerable interest from other companies wishing to acquire this type of business. The most recent extracts from the accounts of Peter Ltd are as follows: Statement of Financial Position as at 31 May 2015 Non-current assets Freehold premises at cost Less Accumulated depreciation Motor vans at cost Less Accumulated depreciation Fixtures and fittings at cost Less Accumulated depreciation Current assets Inventories Receivables Cash at bank Creditors: amounts falling due within one year Payables Accrued expenses Creditors: amounts falling due beyond one year 12% Loan-Gloucester Bank Capital and reserves 1 ordinary shares General reserve Retained profit Income Statement for the year ended 31 May 2015 Sales turnover Profit before interest and taxation Interest charges Profit before taxation Corporation tax Profit after taxation Dividend proposed and paid Transfer to general reserve Retained profit for the year Cash Flow Statement Net cash flow from Operating Activities MANDOS FINANCIAL MANAGEMENT MAIN Jan 16(A).docx 000 34 22 20 (52) (14) 000 240 (40) 32 (21) 10 (2) 76 (66) 60 14 55 000 18 000 200 11 8 219 10 229 (100) 129 129 000 352.0 34.8 (12.0) 22.8 (6.4) 16.4 (4.0) 12.4 (3.0) 94 Page 4 of 8 Additional Information Peter Ltd has shown a stable level of sales and profits over the past three years. An independent valuer has estimated the current realisable values of the assets of the company as follows. Freehold premises Motor vans Fixtures and fittings Inventories 000 235 Required (a) Calculate the value of an ordinary share in Peter Ltd using the following methods: (i) Adjusted Net Assets basis (ii) Discounted Cash Flow (iii) Price:earnings ratio. 8 5 36 For the remaining assets, the values on the statement of financial position were considered to reflect their current realisable values. The management estimate that they will incur annual capital expenditure of 8,000 in perpetuity. Another company in the same line of business, which is listed on the Stock Exchange, has a price:earnings ratio of 12. The rate of return required by Phillip plc is 6%. Assume a standard rate of income tax of 25 %. (5 marks) (6 marks) (6 marks) (Total 17 marks) (21 marks) (b) Critically evaluate each of the share valuation methods used above. (c) Briefly state what other information, besides that provided above, would be useful to prospective buyers in deciding on a suitable value to place on the shares of Peter Ltd. (12 marks) (Total 50 marks)

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a i Adjusted Net Assets basis The adjusted net assets basis of valuation is calculated by adding the value of noncurrent assets to the value of curren...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started