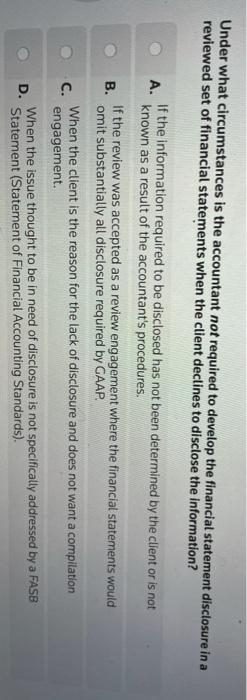

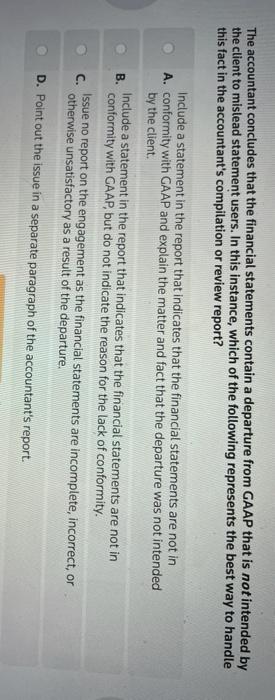

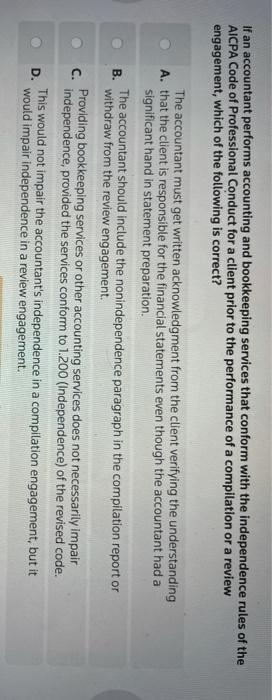

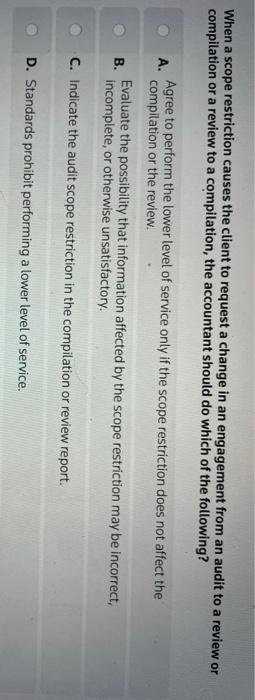

Under what circumstances is the accountant not required to develop the financial statement disclosure in a reviewed set of financial statements when the client declines to disclose the information? B. If the information required to be disclosed has not been determined by the client or is not A. known as a result of the accountant's procedures. If the review was accepted as a review engagement where the financial statements would omit substantially all disclosure required by GAAP. When the client is the reason for the lack of disclosure and does not want a compilation C. engagement. D. When the issue thought to be in need of disclosure is not specifically addressed by a FASB Statement (Statement of Financial Accounting Standards) The accountant concludes that the financial statements contain a departure from GAAP that is not intended by the client to mislead statement users. In this instance, which of the following represents the best way to handle this fact in the accountant's compilation or review report? Include a statement in the report that indicates that the financial statements are not in A. conformity with GAAP and explain the matter and fact that the departure was not intended by the client. B. Include a statement in the report that indicates that the financial statements are not in conformity with GAAP, but do not indicate the reason for the lack of conformity. C. Issue no report on the engagement as the financial statements are incomplete, incorrect, or otherwise unsatisfactory as a result of the departure. D. Point out the issue in a separate paragraph of the accountant's report. If an accountant performs accounting and bookkeeping services that conform with the independence rules of the AICPA Code of Professional Conduct for a client prior to the performance of a compilation or a review engagement, which of the following is correct? B. The accountant must get written acknowledgment from the client verifying the understanding A. that the client is responsible for the financial statements even though the accountant had a significant hand in statement preparation. The accountant should include the nonindependence paragraph in the compilation report or withdraw from the review engagement Providing bookkeeping services or other accounting services does not necessarily impair independence, provided the services conform to 1.200 (Independence) of the revised code. This would not impair the accountant's independence in a compilation engagement, but it D. would impair independence in a review engagement. C. When a scope restriction causes the client to request a change in an engagement from an audit to a review or compilation or a review to a compilation, the accountant should do which of the following? A. Agree to perform the lower level of service only if the scope restriction does not affect the compilation or the review. Evaluate the possibility that information affected by the scope restriction may be incorrect, incomplete, or otherwise unsatisfactory. B. C. Indicate the audit scope restriction in the compilation or review report. D. Standards prohibit performing a lower level of service. ingyu ESEMA VIVENEI in a review engagement, SSARS requires which of the following? A. A representation letter is only required in a review engagement where the scope of inquiries has been limited B. current management must provide the representations for the periods they were present, not for periods they were not. C. The accountant obtains a representation letter. D. These are documents required in audits and should not be a part of a review engagement