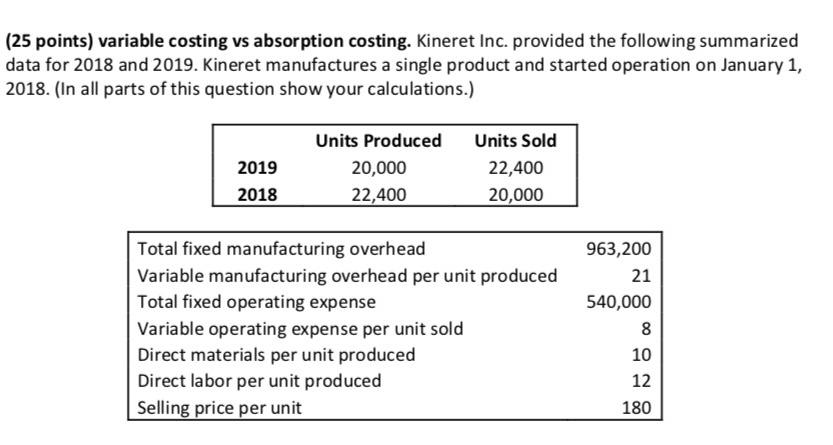

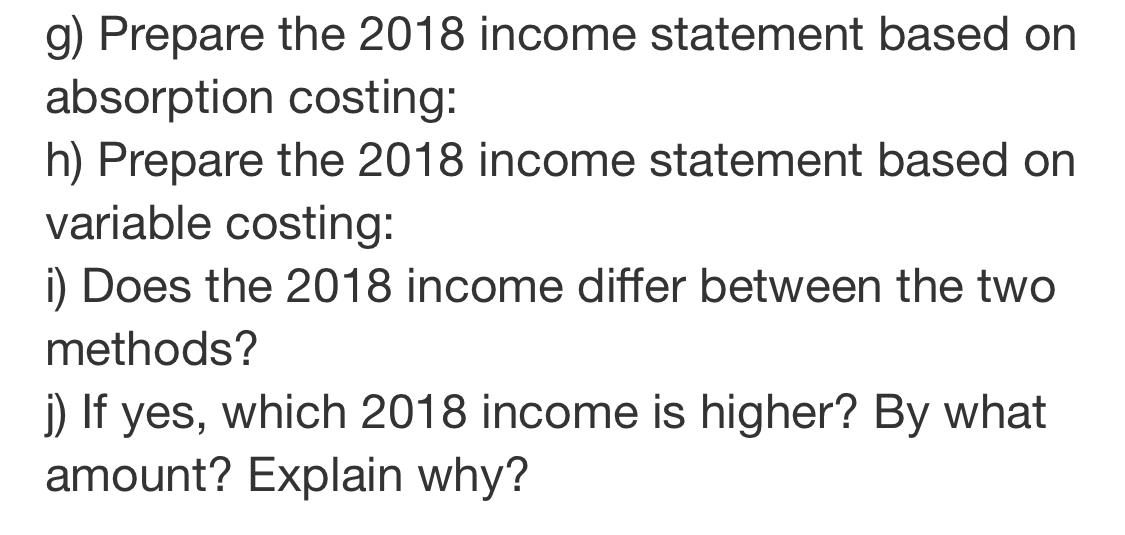

Question

Under what condition your answer to part j would reverse? l) The production manager was not happy to see 2019 inventory going down and wanted

Under what condition your answer to part j would reverse?

l) The production manager was not happy to see 2019 inventory going down and wanted to increase production during 2019. The CFO, on the other hand, argued that based on current demand the company would not be able to sell more than 22,400 units in 2019, therefore increasing production will increase costs but not revenues, and would decrease the net income reported to investors (GAAP net income). The production manager, a NYU Stern graduate, told the CFO that GAAP net income would actually increase and that he did not understand accounting and should seek a career in dancing (yes, he is a little blunt...). Do you agree with CFO or the production manager? Support your answer.

m) Assumethatyoumustdecidequicklywhethertoacceptaspecialonetimeorderfor1000units at $60 per unit. Which income statement presents the most relevant data? Determine the apparent profit or loss on the special order based this information.

Mark Ture or False each of the following statements regarding the advantages and disadvantages of absorption vs. variable costing:

-

n) Variable costing is less consistent with the matching principle of accounting.

-

o) Absorption costing is required under GAAP.

-

p) Variable costing is better suited for decision making.

-

q) Under variable costing income can be increased by increasing production costs.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started