Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Understanding the NPV profile If mutually exclusive projects with normal cash flows are being analyzed, the net present value ( NPV ) and internal rate

Understanding the NPV profile

If mutually exclusive projects with normal cash flows are being analyzed, the net present value NPV and internal rate of return IRR methods

always grad agree.

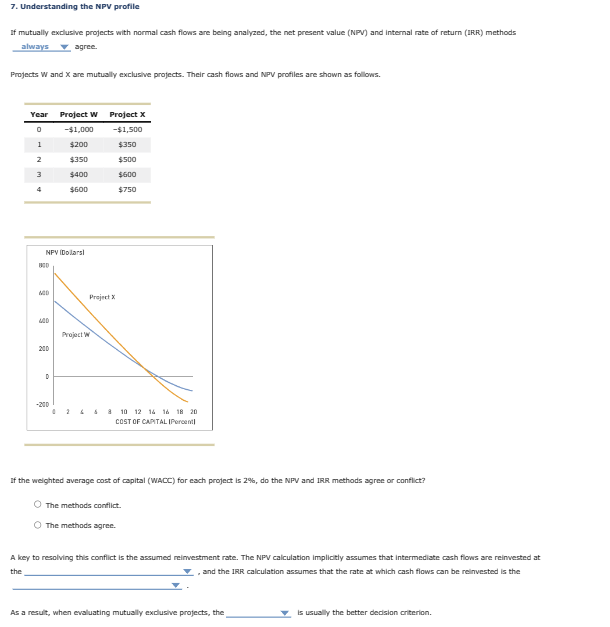

Projects and are mutusly exclusive projects. Their cash flows and NPV profiles are shawn as follows.

If the weighted average cost of capital WACC for each project is do the NPV and IRR methods agree or canflict?

The methods conflict.

The methods agree.

A key to resolving this conflict is the assumed reimestment rate. The NPV calculation implicitly assumes that intermediate cash flows are reinvested at

the

and the IRR calculation assumes that the rate at which cash flows can be relinvested is the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started