Answered step by step

Verified Expert Solution

Question

1 Approved Answer

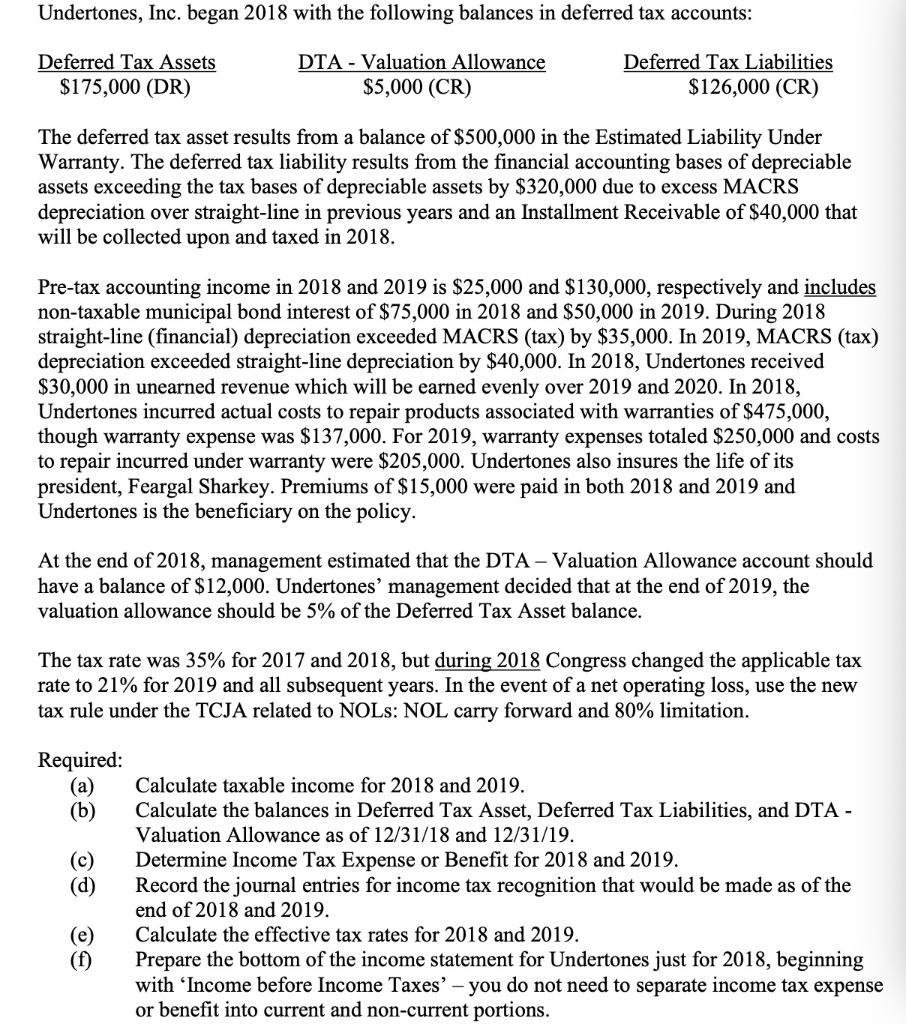

Undertones, Inc. began 2018 with the following balances in deferred tax accounts: DTA - Valuation Allowance $5,000 (CR) Deferred Tax Assets $175,000 (DR) The

Undertones, Inc. began 2018 with the following balances in deferred tax accounts: DTA - Valuation Allowance $5,000 (CR) Deferred Tax Assets $175,000 (DR) The deferred tax asset results from a balance of $500,000 in the Estimated Liability Under Warranty. The deferred tax liability results from the financial accounting bases of depreciable assets exceeding the tax bases of depreciable assets by $320,000 due to excess MACRS depreciation over straight-line in previous years and an Installment Receivable of $40,000 that will be collected upon and taxed in 2018. Pre-tax accounting income in 2018 and 2019 is $25,000 and $130,000, respectively and includes non-taxable municipal bond interest of $75,000 in 2018 and $50,000 in 2019. During 2018 straight-line (financial) depreciation exceeded MACRS (tax) by $35,000. In 2019, MACRS (tax) depreciation exceeded straight-line depreciation by $40,000. In 2018, Undertones received $30,000 in unearned revenue which will be earned evenly over 2019 and 2020. In 2018, Undertones incurred actual costs to repair products associated with warranties of $475,000, though warranty expense was $137,000. For 2019, warranty expenses totaled $250,000 and costs repair incurred under warranty were $205,000. Undertones also insures the life of its president, Feargal Sharkey. Premiums of $15,000 were paid in both 2018 and 2019 and Undertones is the beneficiary on the policy. Deferred Tax Liabilities $126,000 (CR) At the end of 2018, management estimated that the DTA - Valuation Allowance account should have a balance of $12,000. Undertones' management decided that at the end of 2019, the valuation allowance should be 5% of the Deferred Tax Asset balance. The tax rate was 35% for 2017 and 2018, but during 2018 Congress changed the applicable tax rate to 21% for 2019 and all subsequent years. In the event of a net operating loss, use the new tax rule under the TCJA related to NOLS: NOL carry forward and 80% limitation. Required: (a) (b) (c) (d) (e) (f) Calculate taxable income for 2018 and 2019. Calculate the balances in Deferred Tax Asset, Deferred Tax Liabilities, and DTA - Valuation Allowance as of 12/31/18 and 12/31/19. Determine Income Tax Expense or Benefit for 2018 and 2019. Record the journal entries for income tax recognition that would be made as of the end of 2018 and 2019. Calculate the effective tax rates for 2018 and 2019. Prepare the bottom of the income statement for Undertones just for 2018, beginning with 'Income before Income Taxes' - you do not need to separate income tax expense or benefit into current and non-current portions.

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Calcul ate taxable income for 2018 and 2019 2018 Tax able Income 25 000 75 000 non tax able mun i ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started