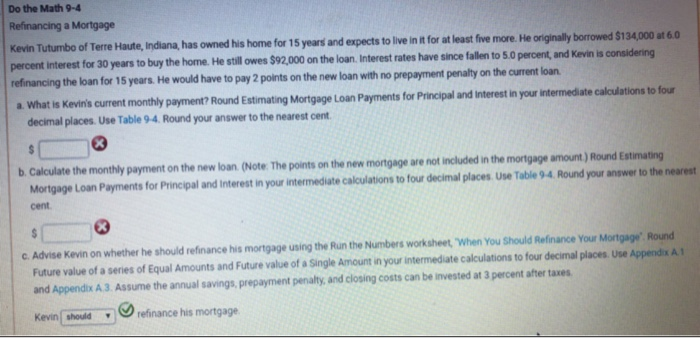

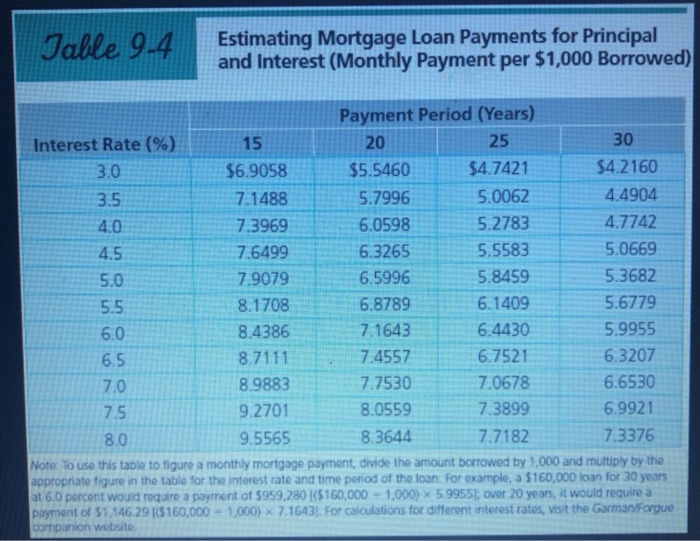

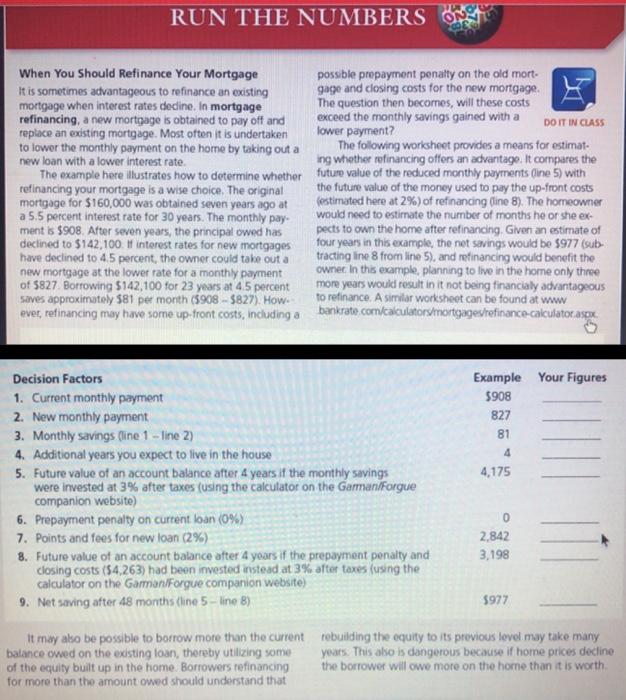

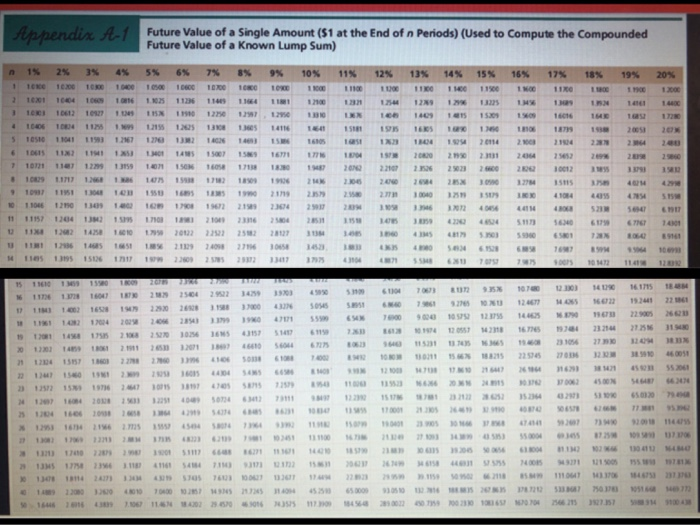

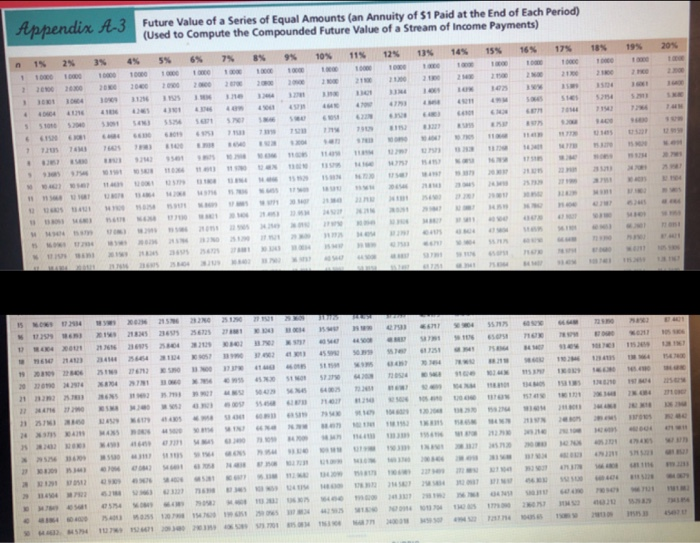

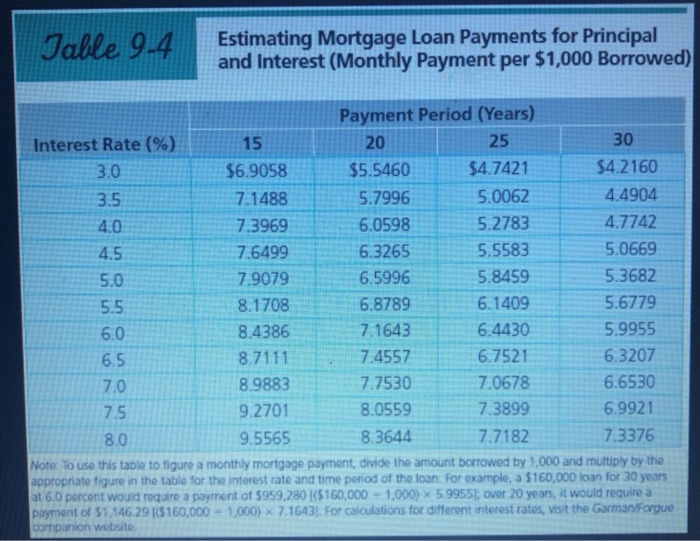

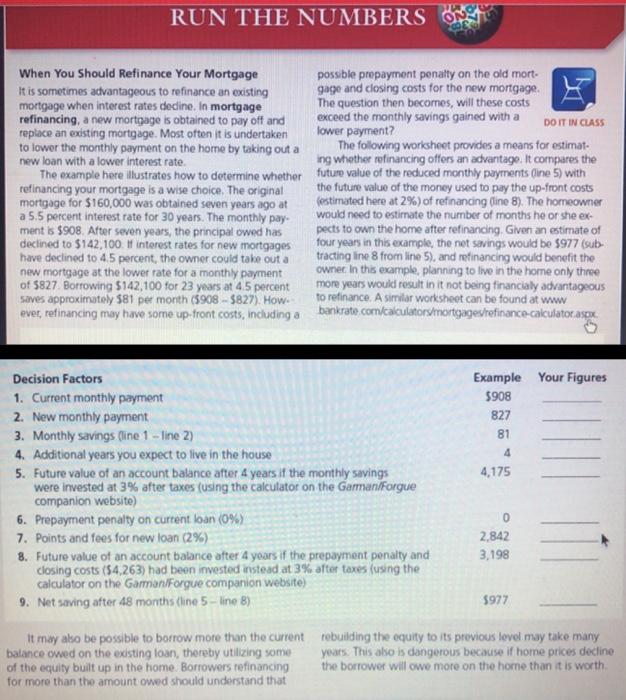

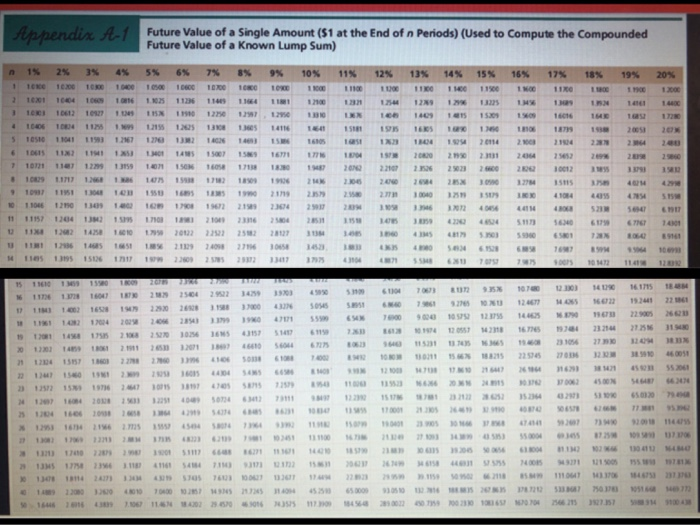

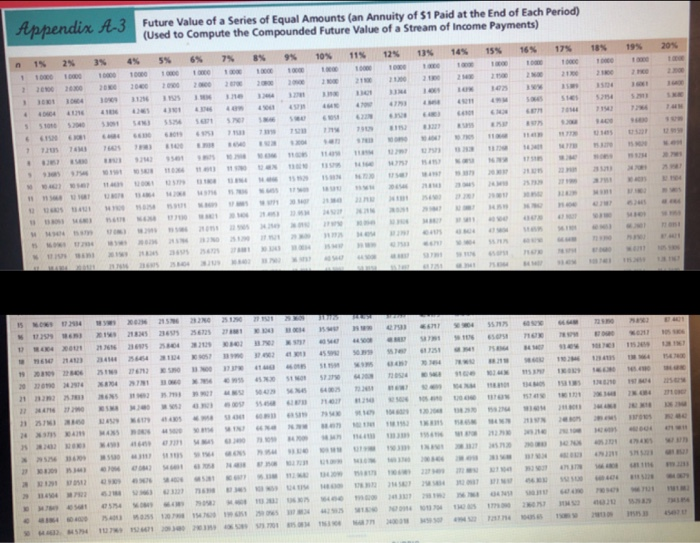

Une May- Refinancing a Mortgage Kevin Tutumbo of Terre Haute, Indiana, has owned his home for 15 years and expects to live in it for at least five more. He originally borrowed $134,000 at 6.0 percent interest for 30 years to buy the home. He still owes $92,000 on the loan. Interest rates have since fallen to 5.0 percent, and Kevin is considering refinancing the loan for 15 years. He would have to pay 2 points on the new loan with no prepayment penalty on the current loan a. What is Kevin's current monthly payment? Round Estimating Mortgage Loan Payments for Principal and interest in your intermediate calculations to four decimal places. Use Table 9-4. Round your answer to the nearest cent b. Calculate the monthly payment on the new loan. (Note: The points on the new mortgage are not included in the mortgage amount) Round Estimating Mortgage Loan Payments for Principal and interest in your intermediate calculations to four decimal places. Use Table 9-4. Round your answer to the neares cent c. Advise Kevin on whether he should refinance his mortgage using the Run the Numbers worksheet, When You Should Refinance Your Mortgage Round Future value of a series of Equal Amounts and Future value of a Single Amount in your intermediate calculations to four decimal places. Use Appendix A1 and Appendix A3. Assume the annual savings, prepayment penalty, and closing costs can be invested at 3 percent after taxes Kevin should refinance his mortgage Table 9.4 Estimating Mortgage Loan Payments for Principal and Interest (Monthly Payment per $1,000 Borrowed) 20 30 3.0 Payment Period (Years) Interest Rate (%) 25 $6.9058 $5.5460 $4.7421 $4.2160 3.5 7.1488 5.7996 5.0062 4.4904 4.0 7.3969 6.0598 5.2783 4.7742 7.6499 6.3265 5.5583 5.0669 7.9079 6.5996 5.8459 5.3682 5.5 8.1708 6.8789 6.1409 5.6779 8.4386 7.1643 6.4430 5.9955 6.5 8.7111 7.4557 6.7521 6.3207 8.9883 7.7530 7.0678 6.6530 7.5 9.2701 8.0559 7.3899 6.9921 9.5565 8.3644 7.7182 7.3376 Note: To use this table to figure a monthly mortgage payment, divide the amount borrowed by 1,000 and multiply by the appropriate figure in the table for the interest rate and time period of the loan. For example, a $160,000 loan for 30 years at 6,0 percent would require a payment of $959.280 (5160,000 - 1,000) X 5.9955]: over 20 years, it would require a payment of 51.146.29 (5160,000 1,000) X 7.1643). For calculations for different interest rates, visit the Garman Forgue companion website 6.0 70 RO RUN THE NUMBERS ON When You Should Refinance Your Mortgage It is sometimes advantageous to refinance an existing mortgage when interest rates dedine. In mortgage refinancing, a new mortgage is obtained to pay off and replace an existing mortgage. Most often it is undertaken to lower the monthly payment on the home by taking out a new loan with a lower interest rate. The example here illustrates how to determine whether refinancing your mortgage is a wise choice. The original mortgage for $160,000 was obtained seven years ago at a 5.5 percent interest rate for 30 years. The monthly pay- ment is $908. After seven years, the principal owed has declined to $142,100. If interest rates for new mortgages have declined to 4.5 percent, the owner could take out a new mortgage at the lower rate for a monthly payment of 5827. Borrowing $142,100 for 23 years at 4.5 percent Saves approximately $81 per month (5908 - $827). How ever, refinancing may have some up front costs, including a possible prepayment penalty on the old mort- gage and closing costs for the new mortgage. The question then becomes, will these costs exceed the monthly savings gained with a DO IT IN CLASS lower payment? The following worksheet provides a means for estimat- ing whether refinancing offers an advantage. It compares the future value of the reduced monthly payments (line 5) with the future value of the money used to pay the up-front costs estimated here at 2%) of refinancing (line 8). The homeowner would need to estimate the number of months he or she ex- pects to own the home after refinancing. Given an estimate of four years in this example, the net savings would be 5977 (sub- tracting line 8 from line 5), and refinancing would benefit the owner. In this example, planning to live in the home only three more years would result in it not being financialy advantageous to refinance. A similar worksheet can be found at www bankrate.com/calculators/mortgages/refinance calculator aspx Your Figures Example $908 827 81 4,175 Decision Factors 1. Current monthly payment 2. New monthly payment 3. Monthly savings (line 1 - line 2) 4. Additional years you expect to live in the house 5. Future value of an account balance after 4 years if the monthly savings were invested at 3% after taxes (using the calculator on the Garman/Forgue companion website) 6. Prepayment penalty on current loan (0%) 7. Points and fees for new loan (2%) 8. Future value of an account balance after 4 years if the prepayment penal closing costs (54,263) had been invested instead at 3% after taxes (using the calculator on the Garman/Forgue companion website) 9. Net saving after 48 months (line 5 - line 8) 2,842 3,198 5977 It may also be possible to borrow more than the current balance owed on the existing loan, thereby utilizing some of the equity built up in the home. Borrowers refinancing for more than the amount owed should understand that rebuilding the equity to its previous level may take many years. This also is dangerous because if home prices decline the borrower will owe more on the home than it is worth in hendix A Future Value of a Single Amount ($1 at the End of n Periods) (Used to Compute the compounded Future Value of a known Lump Sum) 15 2% 3% 4% 5% 6% 7% 8% 10% 13% 14% 15% 16% 17% 18% 19% 20% 1 tee te tee 100 TO 10X CO 11 1 MOC 1170 1 Text 164 165 166 1126 114 13325 I TOGETTO 12 10 10 1 1 12 13168 2 5 test 11041119 117 120 32 2014 6 10615 TIM 258 1011 110 12299 13159 1 1566 19 # 109 11 to 1 2 1981 1950 TO 10 12 NS1 10 meter 1 to 10 21923 11111571104 1 15 1 210 560 619 The 101 1812143816010 201122222 1 16 708 316 0 16 tas 156 1 2 3 17 S u 0 0 10 11 12 151 150 00 10 2 320 564 61304 161715 76030 1 0190230) 11100 12 268 000 SOS UN 102 104 17 1 6 0 6005752127 210 2 1 550 200 468 NS 2017 157 14 2018 3 16 101 142 1830 34 23214 56 6 1 o 1 1 3104 1 1 0 5 ESTON 215 0051 225 52061 2 16 SSS 1 OSO 53 7257 ON 3 SEE 15 17 000 # 10 200 S002 50 220 15 64 24 S 2 11100 1 ms w as 7 7 7 1 0 1 1 1 0 112 11101 1 0111 1 1 7 118 116 4 1 S S 1 0 1 10 So 76030101 1 1 10118 1111073 101 11 1016 2 0 16 2014 06 25 1004 hendi 3 Future Value of a Series of Equal Amounts (an Annuity of 51 Paid at the End of Each Period) (Used to compute the Compounded Future Value of a Stream of Income Payments) 16% 18% 20% 19% 17% toe 15 5% 6% 2% 3% 100 00 200 4% 1000 1 0 71 0 0 0 0 1 2 SH 1 3 50 151 E I was to an was su WEST E 360 IN How To