UNFLEDGED Co. is contemplating on acquiring IMMATURE, Inc. The following information was gathered through a diligence audit: ? The actual earnings of IMMATURE, Inc. for

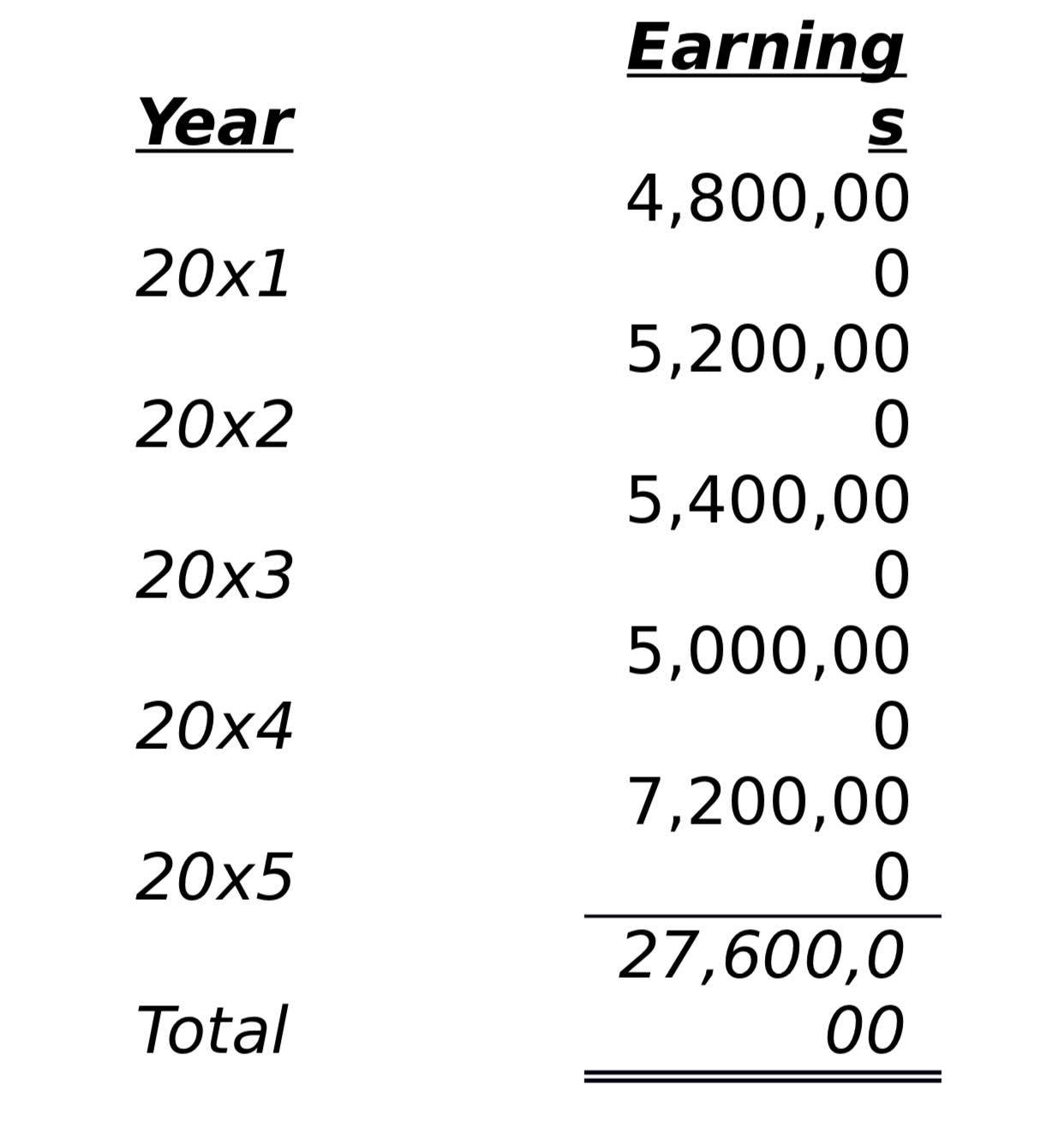

UNFLEDGED Co. is contemplating on acquiring IMMATURE, Inc. The following information was gathered through a diligence audit: ? The actual earnings of IMMATURE, Inc. for the past 5 years are shown below:

- Earnings in 20x5 included an expropriation gain of ?1,600,000. ?

- The fair value of IMMATURE's net assets as of the end of 20x5 is ?40,000,000. ?

- The industry average rate of return is 12%. ?

- Probable duration of "excess earnings" is 5 years.

1. How much is the estimated goodwill using the multiples of average excess earnings method?

2. How much is the estimated goodwill using the capitalization of average excess earnings method? (Assume a capitalization rate of 25%)

3. How much is the estimated goodwill using the capitalization of average earnings method? (Assume a capitalization rate of 12.5%)

4. How much is the estimated goodwill using present value of average excess earnings method? (Assume a discount rate of 10%)

CoursHeroTranscribedText

CoursHeroTranscribedText Earning Year S 4,800,00 20x1 0 5,200,00 20x2 0 5,400,00 20x3 0 5,000,00 20x4 0 7,200,00 20x5 0 27,600,0 Total 00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Analyzing IMMATURE Incs Goodwill Understanding the Problem Were tasked with estimating the goodwill ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started