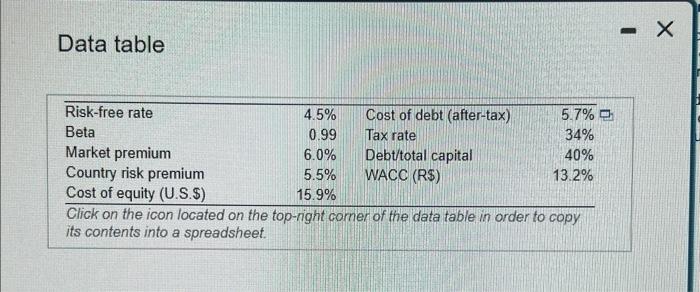

UNIBANCO. Petrobrs Petrleo Brasileiro S A or Petrobras is the national oil company of Brazil. It is publicly traded, but the govemment of Brazil holds the controlling share. It is the largest company in the Southern Hemisphere by market capitalization and the largest in all of Latin America. As an oil company, the primary product of its production has a price set on global markets - the price of oil- and much of its business is conducted in the global currency of oil, the U.S. dollar. Using the data in the popup window, UNIBANCO estimated the weighted average cost of capital for Petrobrs to be 13.2% in Brazilian reais. Evaluate the methodology and assumptions used in the calculation. Which of the following statements is correct? (Select the best choice below.) A. This calculation adds the country risk premium to the risk-free rate in the cost of equity, but not the cost of debt. This cost of equity in U.S. dollars, however is then compounded by a percentage change in the expected exchange rate of the reais against the dollar to arrive at a cost of equity in reais. The cost of debt. which indicates reais-denomination, is not adjusted for the country risk premium or the expected currency movement. B. This calculation adds the country risk premium to the cost of equity in USS dollars, which is then converted at the expected exchange rate to the cost of equity in reals. The cost of debt, which indicates reais-denomination, is adjusted for the country risk premium or the expected currency movement. C. This calculation excludes the country risk premium from the cost of equity in U.S. dollars. which is merely converted at the expected exchange rate to the cost of equity in reais. The cost of debt, which indicates reais-denomination, is adjusted for the country risk premium or the expected currency movement. D. This calculation excludes the country risk premium from the cost of equity in is. dollars, which is merely converted at the expected exchange rate to the cost of equity in reais. The cost of debt. which indicates reais-denomination, is not adjusted for the country risk premium or the expected currency movement. Data table