Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Unicorn Inc. is an Australian listed firm that pays corporate tax rate of 30%. Unicorn recently conducted an off-market share buyback under tax determination

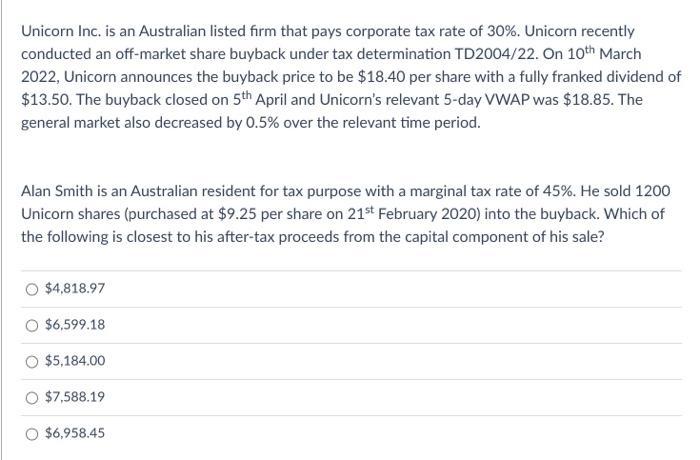

Unicorn Inc. is an Australian listed firm that pays corporate tax rate of 30%. Unicorn recently conducted an off-market share buyback under tax determination TD2004/22. On 10th March 2022, Unicorn announces the buyback price to be $18.40 per share with a fully franked dividend of $13.50. The buyback closed on 5th April and Unicorn's relevant 5-day VWAP was $18.85. The general market also decreased by 0.5% over the relevant time period. Alan Smith is an Australian resident for tax purpose with a marginal tax rate of 45%. He sold 1200 Unicorn shares (purchased at $9.25 per share on 21st February 2020) into the buyback. Which of the following is closest to his after-tax proceeds from the capital component of his sale? $4,818.97 $6,599.18 $5,184.00 $7,588.19 $6,958.45

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Alan Smiths aftertax proceeds from the capital component of his sale we need to conside...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

661e856440d56_880455.pdf

180 KBs PDF File

661e856440d56_880455.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started