Answered step by step

Verified Expert Solution

Question

1 Approved Answer

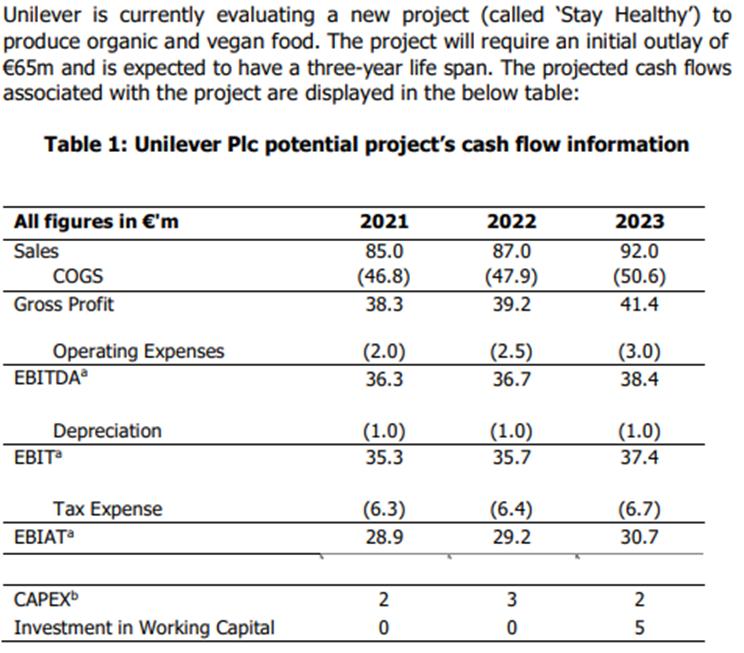

Unilever is currently evaluating a new project (called 'Stay Healthy') to produce organic and vegan food. The project will require an initial outlay of

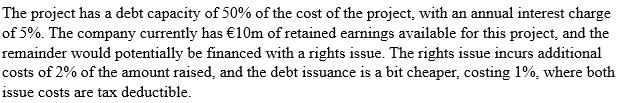

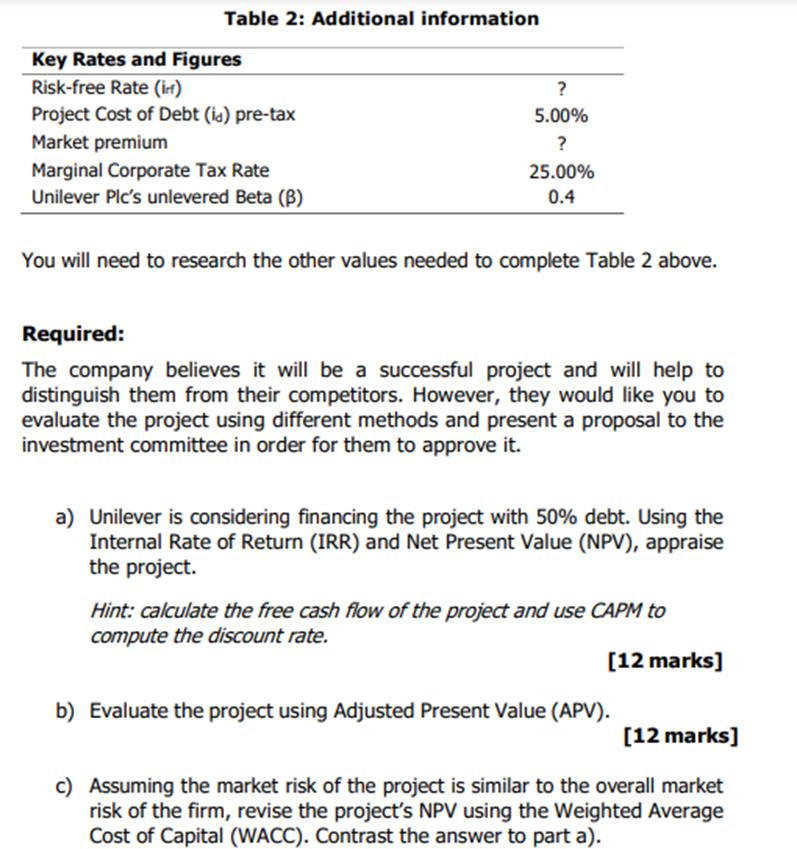

Unilever is currently evaluating a new project (called 'Stay Healthy') to produce organic and vegan food. The project will require an initial outlay of 65m and is expected to have a three-year life span. The projected cash flows associated with the project are displayed in the below table: Table 1: Unilever Plc potential project's cash flow information All figures in 'm Sales COGS Gross Profit Operating Expenses EBITDA* Depreciation EBIT Tax Expense EBIATa CAPEXb Investment in Working Capital 2021 85.0 (46.8) 38.3 (2.0) 36.3 (1.0) 35.3 (6.3) 28.9 20 2022 87.0 (47.9) 39.2 (2.5) 36.7 (1.0) 35.7 (6.4) 29.2 3 0 2023 92.0 (50.6) 41.4 (3.0) 38.4 (1.0) 37.4 (6.7) 30.7 25 2 5 The project has a debt capacity of 50% of the cost of the project, with an annual interest charge of 5%. The company currently has 10m of retained earnings available for this project, and the remainder would potentially be financed with a rights issue. The rights issue incurs additional costs of 2% of the amount raised, and the debt issuance is a bit cheaper, costing 1%, where both issue costs are tax deductible. Table 2: Additional information Key Rates and Figures Risk-free Rate (in) Project Cost of Debt (id) pre-tax Market premium Marginal Corporate Tax Rate Unilever Plc's unlevered Beta (B) ? 5.00% ? 25.00% 0.4 You will need to research the other values needed to complete Table 2 above. Required: The company believes it will be a successful project and will help to distinguish them from their competitors. However, they would like you to evaluate the project using different methods and present a proposal to the investment committee in order for them to approve it. a) Unilever is considering financing the project with 50% debt. Using the Internal Rate of Return (IRR) and Net Present Value (NPV), appraise the project. Hint: calculate the free cash flow of the project and use CAPM to compute the discount rate. [12 marks] b) Evaluate the project using Adjusted Present Value (APV). [12 marks] c) Assuming the market risk of the project is similar to the overall market risk of the firm, revise the project's NPV using the Weighted Average Cost of Capital (WACC). Contrast the answer to part a).

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To evaluate the Stay Healthy project we will calculate the Internal Rate of Return IRR Net Present Value NPV and Adjusted Present Value APV using the provided information and assumptions a Internal Ra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started