Answered step by step

Verified Expert Solution

Question

1 Approved Answer

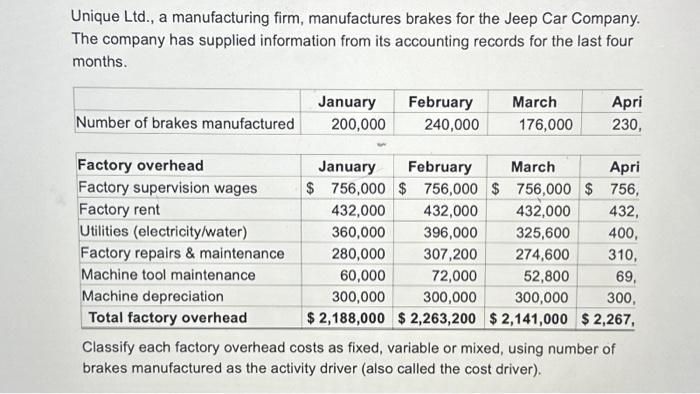

Unique Ltd., a manufacturing firm, manufactures brakes for the Jeep Car Company. The company has supplied information from its accounting records for the last

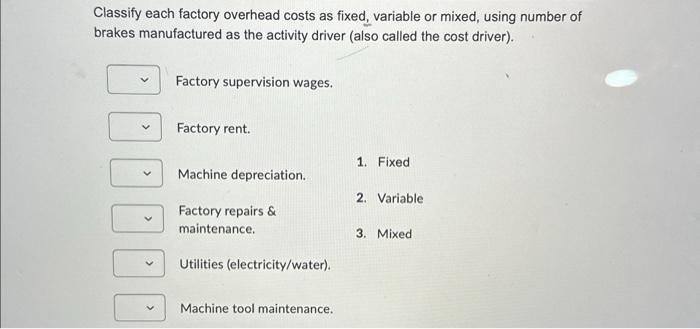

Unique Ltd., a manufacturing firm, manufactures brakes for the Jeep Car Company. The company has supplied information from its accounting records for the last four months. Number of brakes manufactured Factory overhead Factory supervision wages Factory rent Utilities (electricity/water) Factory repairs & maintenance Machine tool maintenance Machine depreciation Total factory overhead January 200,000 February 240,000 432,000 360,000 280,000 60,000 300,000 March 176,000 Apri 230, January February March Apri $756,000 $ 756,000 $ 756,000 $ 756, 432,000 432,000 432, 396,000 325,600 400, 307,200 274,600 310, 72,000 52,800 69, 300,000 300,000 300, $2,188,000 $2,263,200 $2,141,000 $2,267, Classify each factory overhead costs as fixed, variable or mixed, using number of brakes manufactured as the activity driver (also called the cost driver). Classify each factory overhead costs as fixed, variable or mixed, using number of brakes manufactured as the activity driver (also called the cost driver). v Factory supervision wages. Factory rent. Machine depreciation. Factory repairs & maintenance. Utilities (electricity/water). Machine tool maintenance. 1. Fixed 2. Variable 3. Mixed

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided and the use of the number of brakes ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started