Answered step by step

Verified Expert Solution

Question

1 Approved Answer

unit 2 Inbox Ohio Ohio DoD post Milita Welce | + | ui / evo / index . html ? deploymentld = 6 0 3

unit

Inbox

Ohio

Ohio

DoD

post

Milita

Welce

uievoindexhtmldeploymentld dots

TAP

Search this c

inancial Statements, Cash Flow, and Taxes

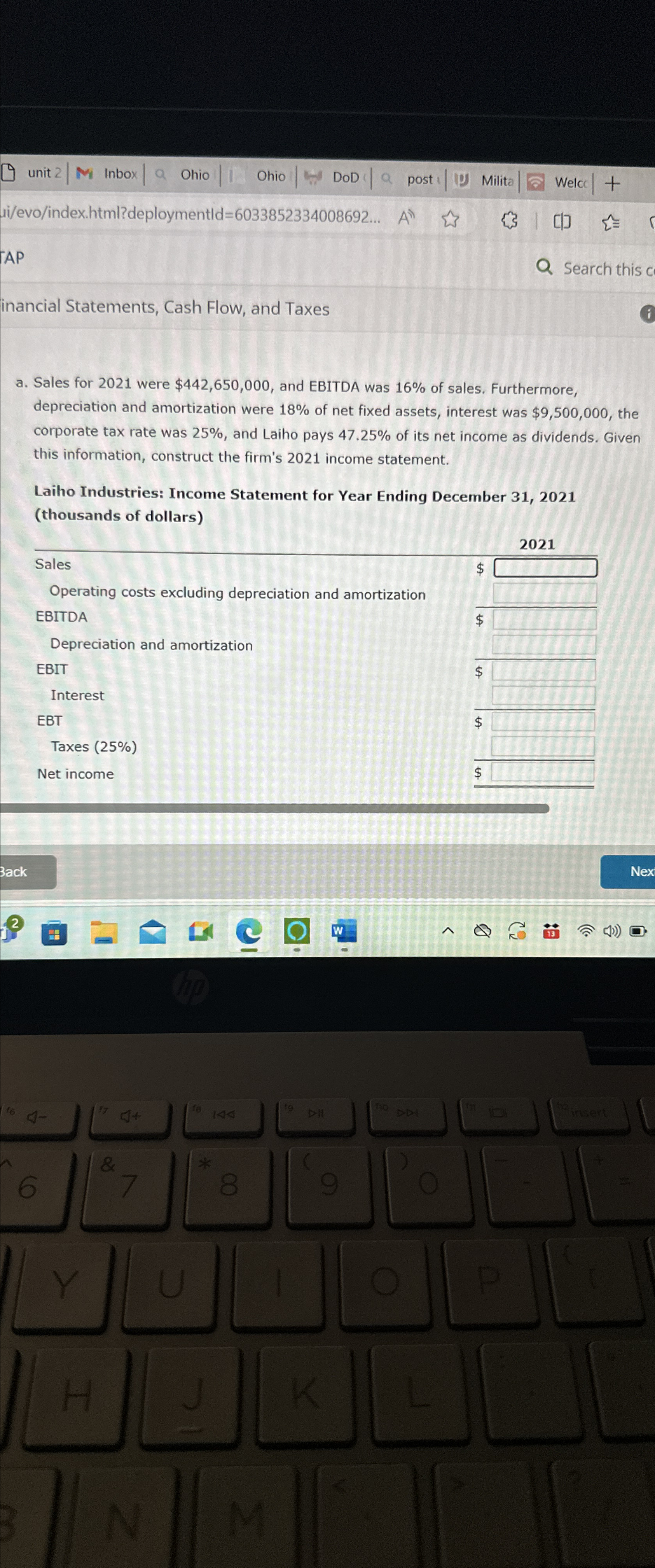

a Sales for were $ and EBITDA was of sales. Furthermore, depreciation and amortization were of net fixed assets, interest was $ the corporate tax rate was and Laiho pays of its net income as dividends. Given this information, construct the firm's income statement.

Laiho Industries: Income Statement for Year Ending December thousands of dollars

Sales

Operating costs excluding depreciation and amortization EBITDA

Depreciation and amortization

EBIT

Interest

EBT

Taxes

Net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started