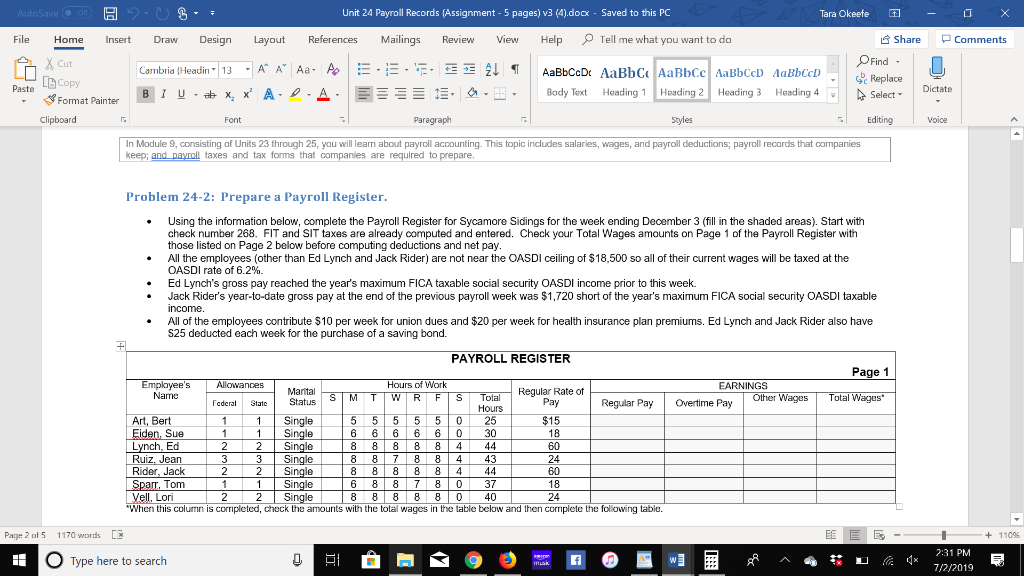

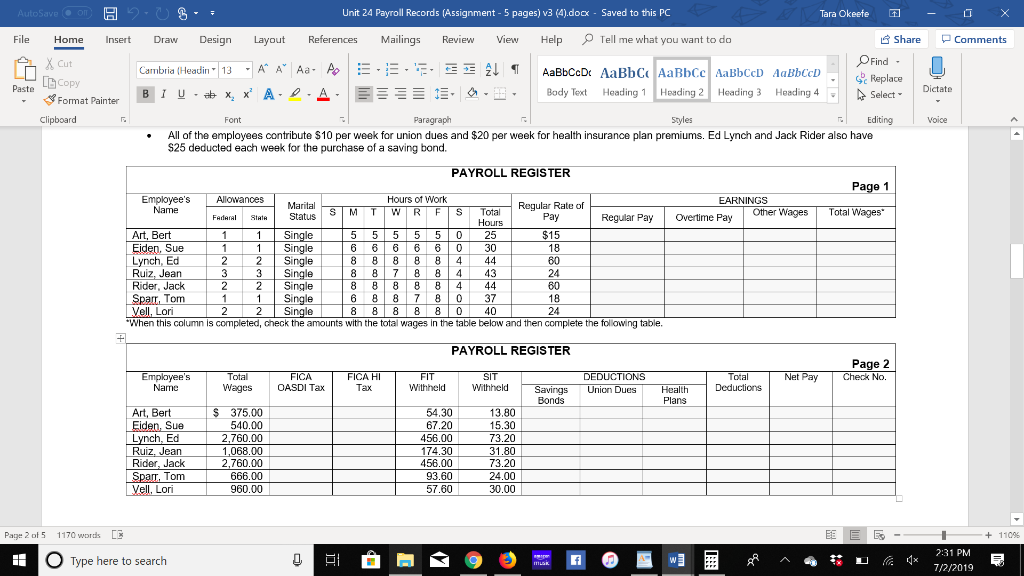

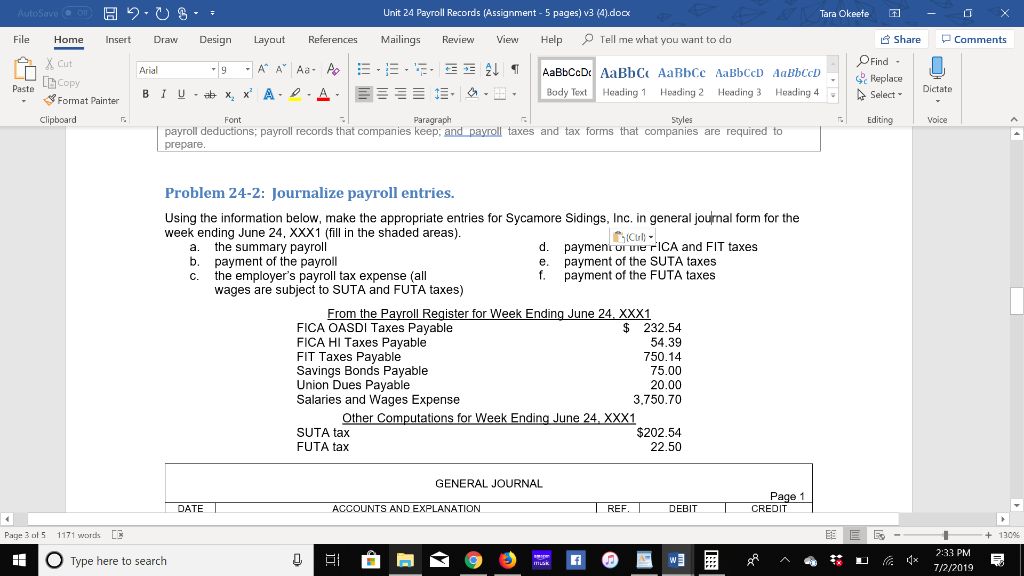

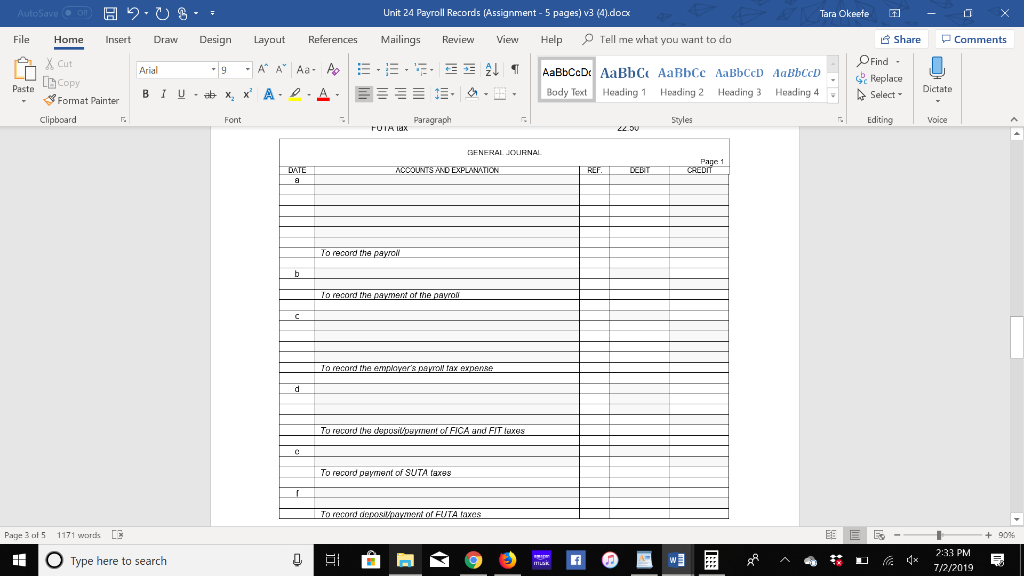

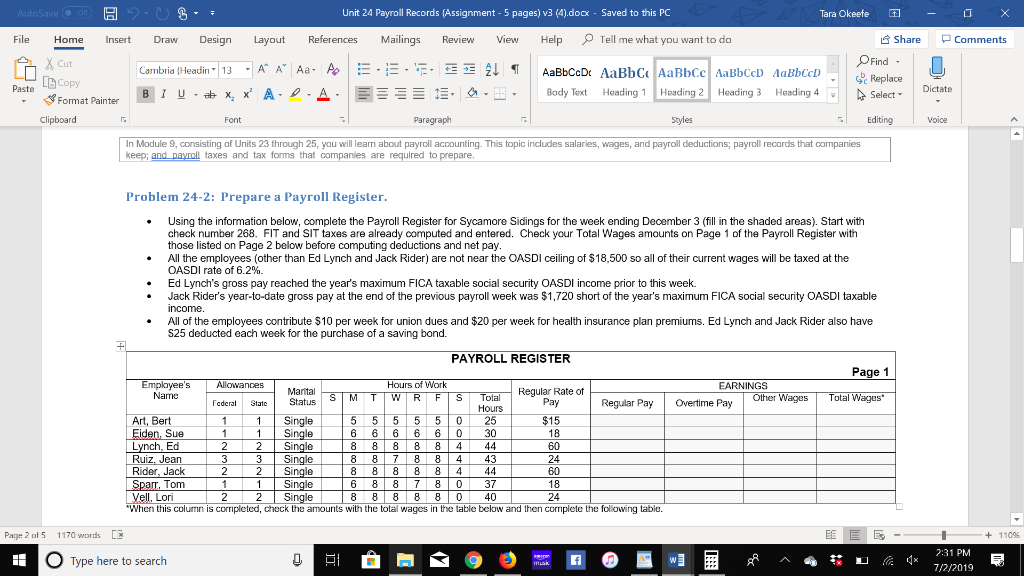

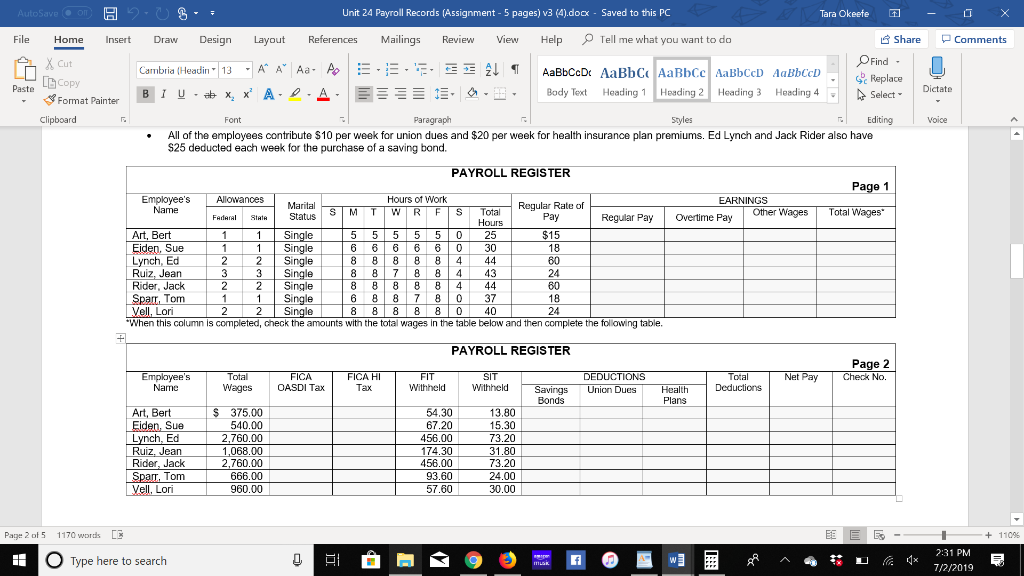

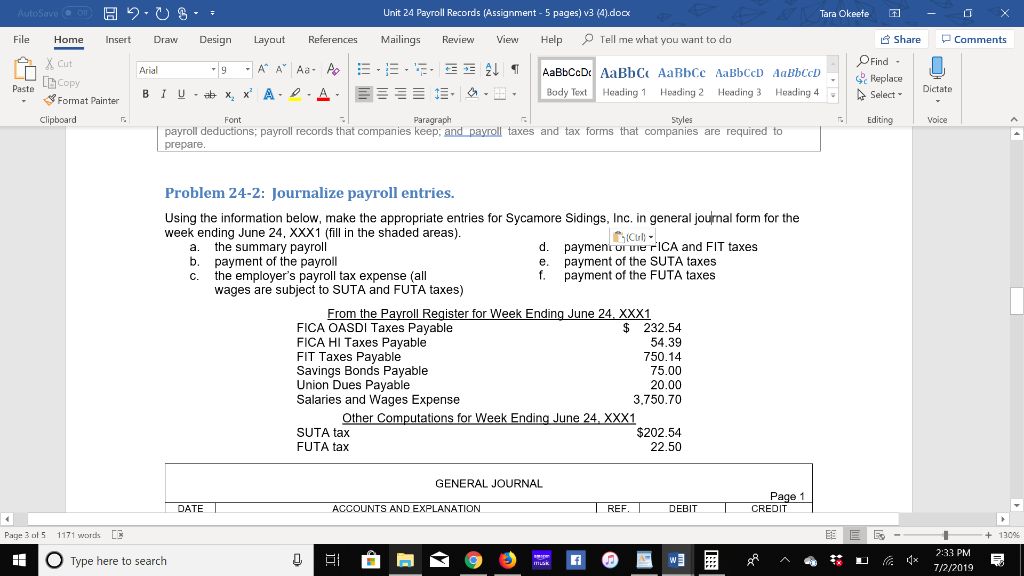

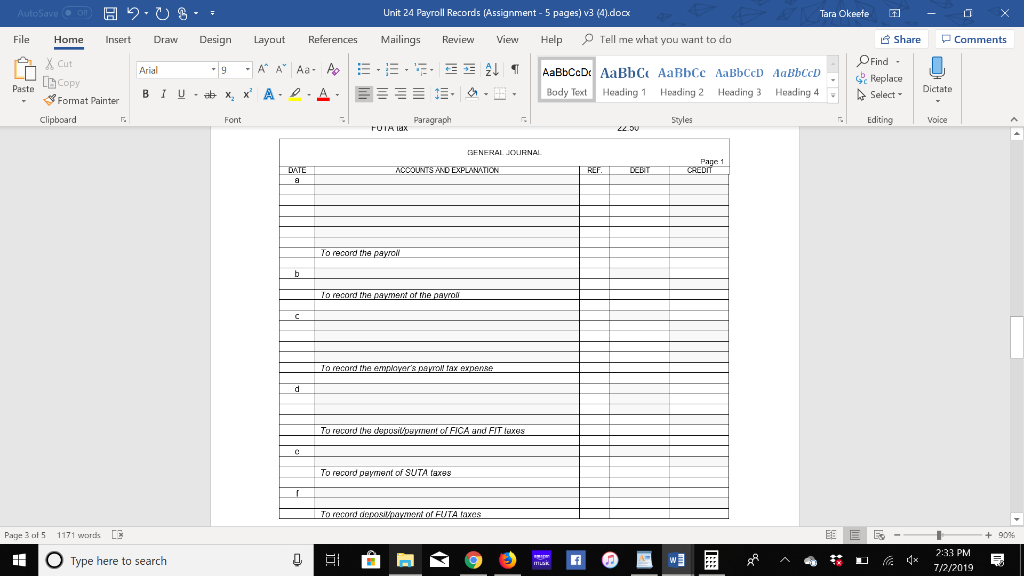

Unit 24 Payroll Records (Assignment-5 pages) v3 (4).docx Saved to this PC Tara Okeefe Tell me what you want to do Comments File Design References Mailings Review View Help Share Home Insert Draw Layout OFind Cut Cambria (Headi 13-A A Aa Ao AaBbCcD AaBbC AaBbCc AaBbCcD AaBbCcD Replace Paste LCopy Format Painter Dictate . A Heading 4 IU x, x A Bady Text Heading 3 Heading " Heading 2 Select Clipboard Paragraph Styles Editing Voice Font In Module 9, consisting of Units 23 through 25, you will learn about payroll accounting. This topic includes salaries, wages, and payroll deductions; payroll records that companies keep; and payroll taxes and tax forms that companies are required to prepare. Problem 24-2: Prepare a Payroll Register. Using the information below, complete the Payroll Register for Sycamore Sidings for the week ending December 3 (fill in the shaded areas). Start with check number 268. FIT and SIT taxes are already computed and entered. Check your Total Wages amounts those listed on Page 2 below before computing deductions and net pay. Page 1 of the Payroll Register with OASDLrate fCother than Ed Lynch and Jack Rider) are not near the OASDI ceiling of $18.500 so all of their current wages will be taxed at the Ed Lynch's gross pay reached the year's maximum FICA taxable social security OASDI income prior to this week. Jack Rider's year-to-date gross pay at the end of the previous payroll week was $1,720 short income. the year's maximum FICA social security CASDI taxable e employees contribute $10 per S25 deducted each week for the purchase of a saving bond. and $20 per week du rhealth insurance plan premiums, Ed Lvnch and Jack Rider also have PAYROLL REGISTER Page Employee's Name Allowances Hou Work EARNIN Regular Rate ot Pay Marita Status Other Wages Total Wages M WIRE Total T Federal Regular Pay Overtime Pay Stato Hours Art, Bert Single 5 5 25 $15 5 1 Single Lynch Ed 60 Single Single Single Single completed, check the amounts wit 8 87 8 8 8 Ruiz, Jean Rider, Jack Spar, Tom Vell, Lon 3 8 4 8 4 0 4: 24 44 60 37 7 6 1 1 8 18 8 8 8 e total wages in the table 24 Cruplale column low and then complete the following table Page 2 of 5 1170 words 1100 2:31 PM Type here to search f 7/2/2019 Unit 24 Payroll Records (Assignment - 5 pages) v3 (4).docx Saved to this PC Tara Okeefe Tell me what you want to do Comments File Design References Mailings Review View Help Share Home Insert Draw Layout OFind Cut Cambria (Headin13 A A Aa A E AaBbCcD AaBbC AaBbCc AaBbCcD AaBbCcD Replace Paste Copy Format Painter Dictate Heading 4 IU x x A A Bady Text Heading Heading 2 Heading 3 Select Clipboard Paragraph Styles Editing Voice Font All of the employees contribute $10 per week for union dues and $20 per week $25 deducted each week for the purchase of a saving bond. r health insurance plan premiums. Ed Lynch and Jack Rider also have PAYROLL REGISTER Page 1 Employee's Name Allowances Hours Work EARNINGS Marital S Status Reqular Rate of Pay M W RE Total Wages T Other Wages Federal Regular Pay Overtime Pay State Art, Bert Eiden, Sue Lynch, Ed $15 15 5 5 5 5 0 66 6 6 0 Single 25 30 1 Single Single 2 44 8 8 8 Rider Jack Single B88 84 8 8 7 8 8 8 8 "When this column is completed, check the amounts with the total wages in the table below and then complete the following table. Spa, Tom Vell, Lori 1 1 Single Single 37 18 0 8 40 24 PAYROLL REGISTER Page 2 -Check No. Employee's Name Total Wages FICA FICA HI SIT DEDUCTIONS Total Net Pay El OASDI Tax Tax Withheld Withheld Union Dues Deductions Savings Health Plans ds Art, Bert Eiden, Sue Lynch, Ed 375.00 13.80 54.30 540,00 67.20 15.30 2,760.00 456,00 73.20 Jean Rider. Tom 456.00 3.0 bu.00 m Vell Lori 30.00 960.00 57,60 1170 words R Page 2 of 5 1100 2:31 PM Type here to search muak 7/2/2019 Unit 24 Payroll Records (Assignment - 5 pages) v3 (4).docx Tara Okeefe Tell me what you want to do Comments File Design References Mailings Review View Help Share Home Insert Draw Layout OFind Cut 9 A A Aa A E - A Arial AaBbCcD AaBbC AaBbCc AaBbCcD AaBb CcD Replace Paste Copy Dictate Heading 4 I XxA A Bady Text Heading 1 Heading 2 Heading 3 Select Format Painten Clipboard Voice Paragraph Styles Editing Font payroll deductions; payroll records that companies keep; and payroll taxes and tax forms that companies are required to prepare. Problem 24-2: Journalize payroll entries. Using the information below, make the appropriate entries for Sycamore Sidings, Inc. in general joumal form for the week ending June 24, XXX1 (fill in the shaded areas) Cu paymentur ue FICA and FIT taxes payment of the SUTA taxes payment of the FUTA taxes the summary payroll b. a. payment of the payroll the employer's payroll tax expense (all wages are subject to SUTA and FUTA taxes) c. From the Payroll Register for Week Ending June 24. XXX1 FICA OASDI Taxes Payable FICA HI Taxes Payable FIT Taxes Payable Savings Bonds Payable $ 232.54 54.39 750.14 75.00 Salaries and Wages Expense 3,750.70 Other Computations for Week Ending June 24, XXX1 $202.54 22.50 SUTA FUTA tax GENERAL JOURNAL Page 1 CR DATE ACCOUNTS AND EXPLANATION REF DEBIT EEE , 1300 1171 words R Page 3 of 5 2:33 PM Type here to search 7/2/2019 Unit 24 Payroll Records (Assignment - 5 pages) v3 (4).docx Tara Okeefe Tell me what you want to do Comments File Design References Mailings Review View Help Share Home Insert Draw Layout OFind Cut 9 A A Aa A E - A Arial AaBbCcD AaBbC AaBbCc AaBbCcD AaBbCcD Replace Paste LCopy Format Painter Dictate Heading 4 XxA-- A Bady Text Heading 1 Heading 2 Heading 3 BIU Select Clipboard Font Styles Editing Voice FUTA lax graph SENERAL JORNAI CBEDI TATE ACCOUNTS AND DXPLANATION REF. LEET o record the payro b gavro lo record the payment of the To record the emplayer's payrol tax expense d To record the deposityoyment of FICA and FIT texes To record payment of SUTA taxes To record oenosinayment of FUTA faxes 1171 words Page 3 of 5 onas 2:33 PM O Type here to search mak f 7/2/2019 Unit 24 Payroll Records (Assignment-5 pages) v3 (4).docx Saved to this PC Tara Okeefe Tell me what you want to do Comments File Design References Mailings Review View Help Share Home Insert Draw Layout OFind Cut Cambria (Headi 13-A A Aa Ao AaBbCcD AaBbC AaBbCc AaBbCcD AaBbCcD Replace Paste LCopy Format Painter Dictate . A Heading 4 IU x, x A Bady Text Heading 3 Heading " Heading 2 Select Clipboard Paragraph Styles Editing Voice Font In Module 9, consisting of Units 23 through 25, you will learn about payroll accounting. This topic includes salaries, wages, and payroll deductions; payroll records that companies keep; and payroll taxes and tax forms that companies are required to prepare. Problem 24-2: Prepare a Payroll Register. Using the information below, complete the Payroll Register for Sycamore Sidings for the week ending December 3 (fill in the shaded areas). Start with check number 268. FIT and SIT taxes are already computed and entered. Check your Total Wages amounts those listed on Page 2 below before computing deductions and net pay. Page 1 of the Payroll Register with OASDLrate fCother than Ed Lynch and Jack Rider) are not near the OASDI ceiling of $18.500 so all of their current wages will be taxed at the Ed Lynch's gross pay reached the year's maximum FICA taxable social security OASDI income prior to this week. Jack Rider's year-to-date gross pay at the end of the previous payroll week was $1,720 short income. the year's maximum FICA social security CASDI taxable e employees contribute $10 per S25 deducted each week for the purchase of a saving bond. and $20 per week du rhealth insurance plan premiums, Ed Lvnch and Jack Rider also have PAYROLL REGISTER Page Employee's Name Allowances Hou Work EARNIN Regular Rate ot Pay Marita Status Other Wages Total Wages M WIRE Total T Federal Regular Pay Overtime Pay Stato Hours Art, Bert Single 5 5 25 $15 5 1 Single Lynch Ed 60 Single Single Single Single completed, check the amounts wit 8 87 8 8 8 Ruiz, Jean Rider, Jack Spar, Tom Vell, Lon 3 8 4 8 4 0 4: 24 44 60 37 7 6 1 1 8 18 8 8 8 e total wages in the table 24 Cruplale column low and then complete the following table Page 2 of 5 1170 words 1100 2:31 PM Type here to search f 7/2/2019 Unit 24 Payroll Records (Assignment - 5 pages) v3 (4).docx Saved to this PC Tara Okeefe Tell me what you want to do Comments File Design References Mailings Review View Help Share Home Insert Draw Layout OFind Cut Cambria (Headin13 A A Aa A E AaBbCcD AaBbC AaBbCc AaBbCcD AaBbCcD Replace Paste Copy Format Painter Dictate Heading 4 IU x x A A Bady Text Heading Heading 2 Heading 3 Select Clipboard Paragraph Styles Editing Voice Font All of the employees contribute $10 per week for union dues and $20 per week $25 deducted each week for the purchase of a saving bond. r health insurance plan premiums. Ed Lynch and Jack Rider also have PAYROLL REGISTER Page 1 Employee's Name Allowances Hours Work EARNINGS Marital S Status Reqular Rate of Pay M W RE Total Wages T Other Wages Federal Regular Pay Overtime Pay State Art, Bert Eiden, Sue Lynch, Ed $15 15 5 5 5 5 0 66 6 6 0 Single 25 30 1 Single Single 2 44 8 8 8 Rider Jack Single B88 84 8 8 7 8 8 8 8 "When this column is completed, check the amounts with the total wages in the table below and then complete the following table. Spa, Tom Vell, Lori 1 1 Single Single 37 18 0 8 40 24 PAYROLL REGISTER Page 2 -Check No. Employee's Name Total Wages FICA FICA HI SIT DEDUCTIONS Total Net Pay El OASDI Tax Tax Withheld Withheld Union Dues Deductions Savings Health Plans ds Art, Bert Eiden, Sue Lynch, Ed 375.00 13.80 54.30 540,00 67.20 15.30 2,760.00 456,00 73.20 Jean Rider. Tom 456.00 3.0 bu.00 m Vell Lori 30.00 960.00 57,60 1170 words R Page 2 of 5 1100 2:31 PM Type here to search muak 7/2/2019 Unit 24 Payroll Records (Assignment - 5 pages) v3 (4).docx Tara Okeefe Tell me what you want to do Comments File Design References Mailings Review View Help Share Home Insert Draw Layout OFind Cut 9 A A Aa A E - A Arial AaBbCcD AaBbC AaBbCc AaBbCcD AaBb CcD Replace Paste Copy Dictate Heading 4 I XxA A Bady Text Heading 1 Heading 2 Heading 3 Select Format Painten Clipboard Voice Paragraph Styles Editing Font payroll deductions; payroll records that companies keep; and payroll taxes and tax forms that companies are required to prepare. Problem 24-2: Journalize payroll entries. Using the information below, make the appropriate entries for Sycamore Sidings, Inc. in general joumal form for the week ending June 24, XXX1 (fill in the shaded areas) Cu paymentur ue FICA and FIT taxes payment of the SUTA taxes payment of the FUTA taxes the summary payroll b. a. payment of the payroll the employer's payroll tax expense (all wages are subject to SUTA and FUTA taxes) c. From the Payroll Register for Week Ending June 24. XXX1 FICA OASDI Taxes Payable FICA HI Taxes Payable FIT Taxes Payable Savings Bonds Payable $ 232.54 54.39 750.14 75.00 Salaries and Wages Expense 3,750.70 Other Computations for Week Ending June 24, XXX1 $202.54 22.50 SUTA FUTA tax GENERAL JOURNAL Page 1 CR DATE ACCOUNTS AND EXPLANATION REF DEBIT EEE , 1300 1171 words R Page 3 of 5 2:33 PM Type here to search 7/2/2019 Unit 24 Payroll Records (Assignment - 5 pages) v3 (4).docx Tara Okeefe Tell me what you want to do Comments File Design References Mailings Review View Help Share Home Insert Draw Layout OFind Cut 9 A A Aa A E - A Arial AaBbCcD AaBbC AaBbCc AaBbCcD AaBbCcD Replace Paste LCopy Format Painter Dictate Heading 4 XxA-- A Bady Text Heading 1 Heading 2 Heading 3 BIU Select Clipboard Font Styles Editing Voice FUTA lax graph SENERAL JORNAI CBEDI TATE ACCOUNTS AND DXPLANATION REF. LEET o record the payro b gavro lo record the payment of the To record the emplayer's payrol tax expense d To record the deposityoyment of FICA and FIT texes To record payment of SUTA taxes To record oenosinayment of FUTA faxes 1171 words Page 3 of 5 onas 2:33 PM O Type here to search mak f 7/2/2019