Answered step by step

Verified Expert Solution

Question

1 Approved Answer

, Unit 3 - Case Analysis 1 Question - Protected View * Saved Search Design Layout References Mailings Review View Help as been verified by

Unit Case Analysis Question Protected View Saved

Search

Design

Layout

References

Mailings

Review

View

Help

as been verified by Microsoft Defender Advanced Threat Protection and it hasn't detected any threats. If you need to edit this file, click enable editing. Enable Editing

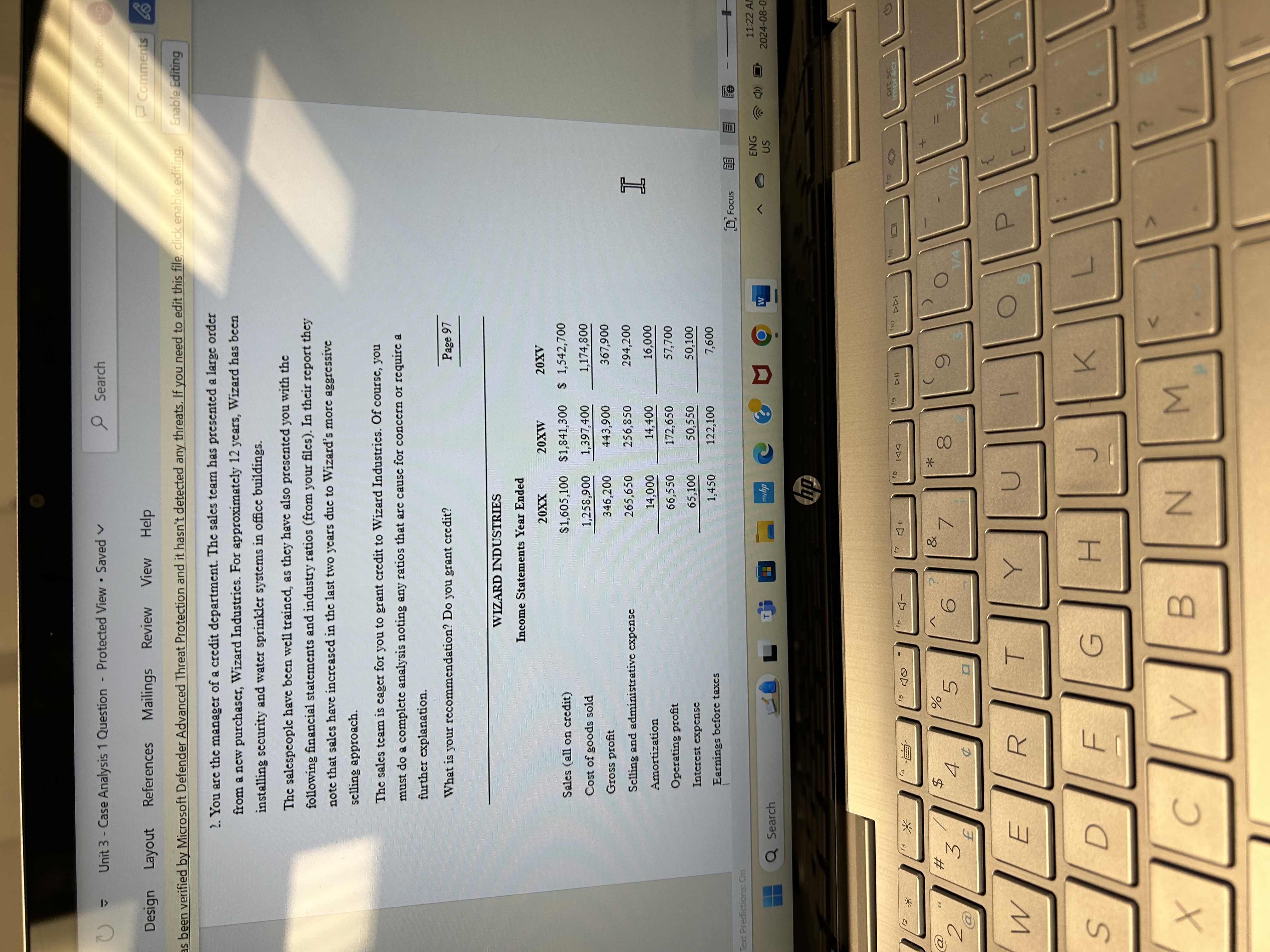

You are the manager of a credit department. The sales team has presented a large order from a new purchaser, Wizard Industries. For approximately years, Wizard has been installing security and water sprinkler systems in office buildings.

The salespeople have been well trained, as they have also presented you with the following financial statements and industry ratios from your files In their report they note that sales have increased in the last two years due to Wizard's more aggressive selling approach.

The sales team is eager for you to grant credit to Wizard Industries. Of course, you must do a complete analysis noting any ratios that are cause for concern or require a further explanation.

What is your recommendation? Do you grant credit?

Page

WIZARD INDUSTRIES

Income Statements Year Ended

Sales all on credit

Cost of goods sold

Gross profit

Selling and administrative expense Amortization

Operating profit

Interest expense

Earnings before taxes

tableYear Endedxxxwxv$$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started