Answered step by step

Verified Expert Solution

Question

1 Approved Answer

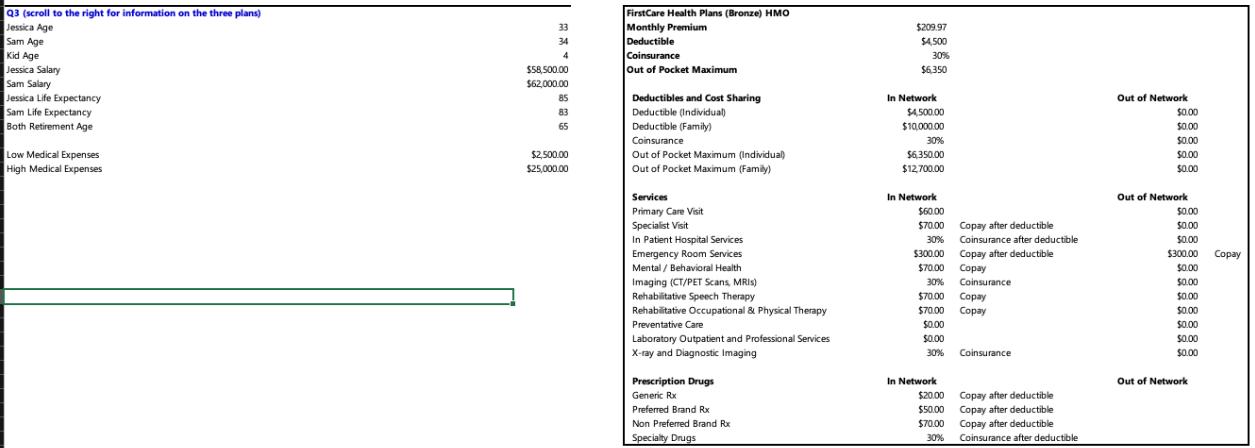

Q3 (scroll to the right for information on the three plans) Jessica Age Sam Age Kid Age Jessica Salary Sam Salary Jessica Life Expectancy

Q3 (scroll to the right for information on the three plans) Jessica Age Sam Age Kid Age Jessica Salary Sam Salary Jessica Life Expectancy Sam Life Expectancy Both Retirement Age Low Medical Expenses High Medical Expenses 33 34 4 $58,500.00 $62,000.00 85 83 65 $2,500.00 $25,000.00 FirstCare Health Plans (Bronze) HMO Monthly Premium Deductible Coinsurance Out of Pocket Maximum Deductibles and Cost Sharing Deductible (Individual) Deductible (Family) Coinsurance Out of Pocket Maximum (Individual) Out of Pocket Maximum (Family) Services Primary Care Visit Specialist Visit In Patient Hospital Services Emergency Room Services Mental / Behavioral Health Imaging (CT/PET Scans, MRIs) Rehabilitative Speech Therapy Rehabilitative Occupational & Physical Therapy Preventative Care Laboratory Outpatient and Professional Services X-ray and Diagnostic Imaging Prescription Drugs Generic Rx Preferred Brand Rx Non Preferred Brand Rx Specialty Drugs $209.97 $4,500 30% $6,350 In Network $4,500.00 $10,000.00 30% $6,350.00 $12,700.00 In Network $60.00 $70.00 30% $300.00 $70.00 30% $70.00 $70.00 Copay $0.00 $0.00 30% In Network $20.00 $50.00 $70.00 30% Copay after deductible Coinsurance after deductible Copay after deductible Copay Coinsurance Copay Coinsurance Copay after deductible Copay after deductible Copay after deductible Coinsurance after deductible Out of Network $0.00 $0.00 $0.00 $0.00 $0.00 Out of Network $0.00 $0.00 $0.00 $300.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Out of Network Copay FirstCare Health Plans (Gold) HMO Monthly Premium Deductible Coinsurance Out of Pocket Maximum Deductibles and Cost Sharing Deductible (Individual) Deductible (Family) Coinsurance Out of Pocket Maximum (Individual) Out of Pocket Maximum (Family) Services Primary Care Visit Specialist Visit In Patient Hospital Services Emergency Room Services Mental / Behavioral Health Imaging (CT/PET Scans, MRIS) Rehabilitative Speech Therapy Rehabilitative Occupational & Physical Therapy Preventative Care Laboratory Outpatient and Professional Services X-ray and Diagnostic Imaging Prescription Drugs Generic Rx Preferred Brand Rx Non Preferred Brand Rx Specialty Drugs $271.26 $0 20% $6,350 In Network $0.00 $0.00 20% $6,350.00 $12,700.00 In Network $30.00 $50.00 20% $250.00 $50.00 20% $50.00 $50.00 $0.00 $0.00 $0.00 In Network Copay after deductible Coinsurance after deductible Copay after deductible Copay Coinsurance Copay Copay Coinsurance $20.00 $50.00 $70.00 20% Coinsurance after deductible Copay after deductible Copay after deductible Copay after deductible Out of Network $0.00 $0.00 $0.00 $0.00 $0.00 Out of Network $0.00 $0.00 $0.00 $250.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Out of Network Copay BlueCross Blue Shield of TX (Blue Choice - Gold) PPO Monthly Premium Deductible Coinsurance Out of Pocket Maximum Deductibles and Cost Sharing Deductible (Individual) Deductible (Family) Coinsurance Out of Pocket Maximum (Individual) Out of Pocket Maximum (Family) Services Primary Care Visit Specialist Visit In Patient Hospital Services Emergency Room Services Mental / Behavioral Health Imaging (CT/PET Scans, MRIs) Rehabilitative Speech Therapy Rehabilitative Occupational & Physical Therapy Preventative Care Laboratory Outpatient and Professional Services X-ray and Diagnostic Imaging Prescription Drugs Generic Rx Preferred Brand Rx Non Preferred Brand Rx Specialty Drugs $333.69 $1,500 20% $3,500 In Network $1,500.00 $4,500.00 20% $3,500.00 $10,500.00 In Network $10.00 $60.00 $200.00 20% $400.00 20% $10.00 20% 20% 20% $0.00 20% 20% In Network $0.00 $35.00 $75.00 $1.50 Copay per Stay AND Coinsurance Copay per Stay AND Coinsurance Copay Coinsurance Coinsurance Coinsurance Coinsurance Coinsurance Out of Network $3,000.00 $9,000.00 40% $7,000.00 $21,000.00 Out of Network 40% 40% 40% $400.00 20% 40% 40% 40% 40% 40% 40% 40% Out of Network Coinsurance Coinsurance Coinsurance Copay per Stay AND Coinsurance Coinsurance Coinsurance Coinsurance Coinsurance Coinsurance Coinsurance Coinsurance Estimated Medical Cost Out of Pocket Expenses Annual Premium Total Costs Low Medical: Which plan should they select, and why? High Medical: Which plan should they select, and why? FirstCare Bronze Low Medical Cost FirstCare Gold Blue Choice Gold High Medical Cost FirstCare Bronze FirstCare Gold Blue Choice Gold

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To determine which health plan is more suitable for Low Medical Expenses and High Medical Expenses scenarios we need to analyze the estimated costs an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started