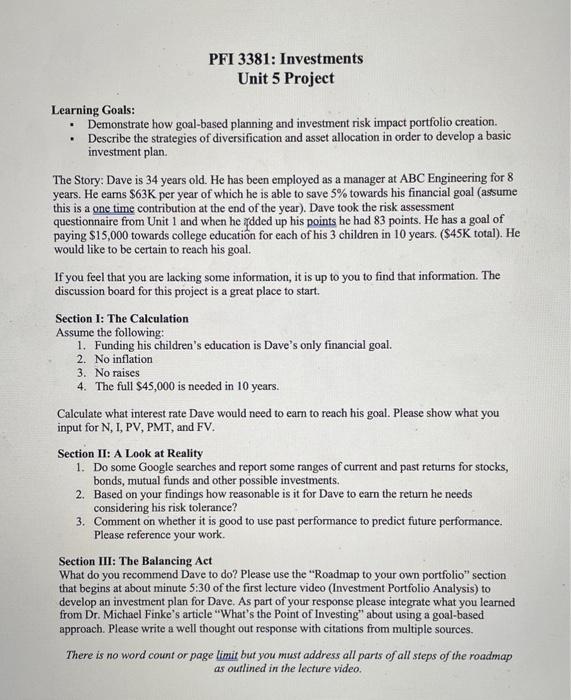

Unit 5 Project Learning Goals: - Demonstrate how goal-based planning and investment risk impact portfolio creation. - Describe the strategies of diversification and asset allocation in order to develop a basic investment plan. The Story: Dave is 34 years old. He has been employed as a manager at ABC Engineering for 8 years. He earns $63K per year of which he is able to save 5% towards his financial goal (assume this is a one time contribution at the end of the year). Dave took the risk assessment questionnaire from Unit 1 and when he Idded up his points he had 83 points. He has a goal of paying $15,000 towards college education for each of his 3 children in 10 years. ( $45K total). He would like to be certain to reach his goal. If you feel that you are lacking some information, it is up to you to find that information. The discussion board for this project is a great place to start. Section I: The Calculation Assume the following: 1. Funding his children's education is Dave's only financial goal. 2. No inflation 3. No raises 4. The full $45,000 is needed in 10 years. Calculate what interest rate Dave would need to earn to reach his goal. Please show what you input for N, I, PV, PMT, and FV. Section II: A Look at Reality 1. Do some Google searches and report some ranges of current and past returns for stocks, bonds, mutual funds and other possible investments. 2. Based on your findings how reasonable is it for Dave to earn the return he needs considering his risk tolerance? 3. Comment on whether it is good to use past performance to predict future performance. Please reference your work. Section III: The Balancing Act What do you recommend Dave to do? Please use the "Roadmap to your own portfolio" section that begins at about minute 5:30 of the first lecture video (Investment Portfolio Analysis) to develop an investment plan for Dave. As part of your response please integrate what you learned from Dr. Michael Finke's article "What's the Point of Investing" about using a goal-based approach. Please write a well thought out response with citations from multiple sources. There is no word count or page limit but you must address all parts of all steps of the roadmap as outlined in the lecture video. Unit 5 Project Learning Goals: - Demonstrate how goal-based planning and investment risk impact portfolio creation. - Describe the strategies of diversification and asset allocation in order to develop a basic investment plan. The Story: Dave is 34 years old. He has been employed as a manager at ABC Engineering for 8 years. He earns $63K per year of which he is able to save 5% towards his financial goal (assume this is a one time contribution at the end of the year). Dave took the risk assessment questionnaire from Unit 1 and when he Idded up his points he had 83 points. He has a goal of paying $15,000 towards college education for each of his 3 children in 10 years. ( $45K total). He would like to be certain to reach his goal. If you feel that you are lacking some information, it is up to you to find that information. The discussion board for this project is a great place to start. Section I: The Calculation Assume the following: 1. Funding his children's education is Dave's only financial goal. 2. No inflation 3. No raises 4. The full $45,000 is needed in 10 years. Calculate what interest rate Dave would need to earn to reach his goal. Please show what you input for N, I, PV, PMT, and FV. Section II: A Look at Reality 1. Do some Google searches and report some ranges of current and past returns for stocks, bonds, mutual funds and other possible investments. 2. Based on your findings how reasonable is it for Dave to earn the return he needs considering his risk tolerance? 3. Comment on whether it is good to use past performance to predict future performance. Please reference your work. Section III: The Balancing Act What do you recommend Dave to do? Please use the "Roadmap to your own portfolio" section that begins at about minute 5:30 of the first lecture video (Investment Portfolio Analysis) to develop an investment plan for Dave. As part of your response please integrate what you learned from Dr. Michael Finke's article "What's the Point of Investing" about using a goal-based approach. Please write a well thought out response with citations from multiple sources. There is no word count or page limit but you must address all parts of all steps of the roadmap as outlined in the lecture video