Question

UNIT 5 TASK-BASED SIMULATION #2 Simulation (15 minutes) Best Taco Eats Ltd. (BTE) is a private company that owns and operates a chain of restaurants.

UNIT 5 TASK-BASED SIMULATION #2 Simulation (15 minutes) Best Taco Eats Ltd. (BTE) is a private company that owns and operates a chain of restaurants. The restaurants are open for lunch and dinner and are also available for parties and events. BTE follows ASPE in preparing its financial statements. Harriet Waters is an accountant who works as a consultant and is currently helping to prepare BTEs financial statements for the year ended December 31, Year 1. The following documents are attached: Appendix I: BTEs corporate structure and shareholders Appendix II: Email from Jamal Khaira, CFO Complete the tasks in the Excel Task file

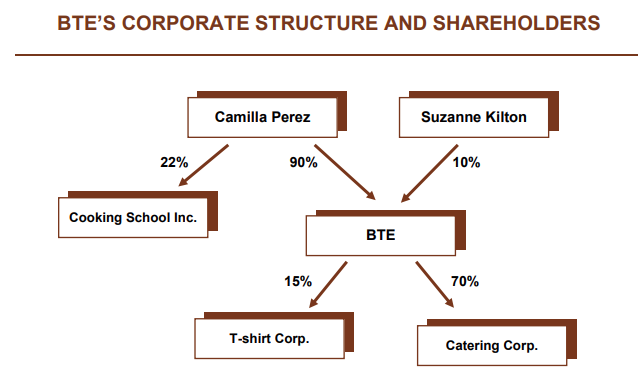

Appendix I: BTEs corporate structure and shareholders BTES CORPORATE STRUCTURE AND SHAREHOLDERS The management team of BTE includes Camilla Perez, CEO, Frank Morris, COO, and Jamal Khaira, CFO. The management team meets regularly and makes all the operating, financing, and strategic decisions. Catering Corp. caters corporate and private events. T-shirt Corp. is a company that sells T-shirts with corporate logos and other clothing for corporate marketing purposes. Although BTE has invested funds, giving T-Shirt Corp. 15%, it is a silent partner and leaves all decisions to the other shareholders of the company. Cooking School Inc. runs regular cooking classes throughout the year. Camilla is very active in this school and very involved in making the day-to-day decisions

Appendix II: Email from Jamal Khaira, CFO Subject: Purchases from FBL January 6, Year 2 TO: Harriett Waters FROM Jamal Khaira, CFO Harriett, During December Year 1, BTE purchased a variety of baked products from FBL that were used in preparing customers meals. The book value of this food purchased from FBL was $7,000. FBL would normally have sold these products for $9,200. In return, BTE hosted FBLs holiday event at the restaurant. The event cost BTE $7,200 (per the work-in-progress account for the event), and normally the selling price of this event would have been $9,000. BTE and FBL agreed to an exchange amount of $9,000. Jama

INTERMEDIATE FINANCIAL REPORTING 1 UNIT 5 TASK-BASED SIMULATION #2 Task 1 Camilla Perez, the CEO of BTE, understands that related parties of BTE have to be identified for financial reporting purposes. She has asked Harriett to assist with this and identify which of the following parties are related to BTE and the rationale for this conclusion, using the corporate structure in Appendix I. Instructions: In Column B, select whether the entity or person described in Column A is a related party to BTE from the drop-down menu. In Column C, select the rationale for your answer in Column B from the drop-down menu. ABC1PartyIs this a related party to BTE?Rationale2Suzanne Kilton 3Catering Corp. 4Cooking School Inc. 5T-shirt Corp. Column B drop-down options Yes No Column C drop-down options BTE and the party are subject to common significant influence or control. BTE has significant influence or control over the party. This is not a related party. The party has significant influence or control over BTE. The party is a member of the immediate family of an individual who is a related party. The party is part of management of BTE.

UNIT 5 TASK-BASED SIMULATION #2 Task 2 During the year, BTE acquired a percentage ownership in Fresh Baked Ltd. (FBL), a company that bakes breads, tortillas, and taco shells. FBL has been identified as a related party to BTE. Prepare the journal entry for BTE for the December transaction with this related party using the information in Appendix II. Instructions: In Column A, select the appropriate account name from the drop-down list. An account name may be used once or not at all for each journal entry. In Column B, enter the corresponding debit amount. Round all amounts to the nearest dollar. In Column C, enter the corresponding credit amount. Round all amounts to the nearest dollar. All rows in the table may not be needed to complete the journal entry. If no journal entry is needed, check the No journal entry required box at the top of the table as your response. To record BTE's journal entry for the transaction with FBL during December Year 1.

BTE'S CORPORATE STRUCTURE AND SHAREHOLDERS \" BTE'S CORPORATE STRUCTURE AND SHAREHOLDERS \

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started