Answered step by step

Verified Expert Solution

Question

1 Approved Answer

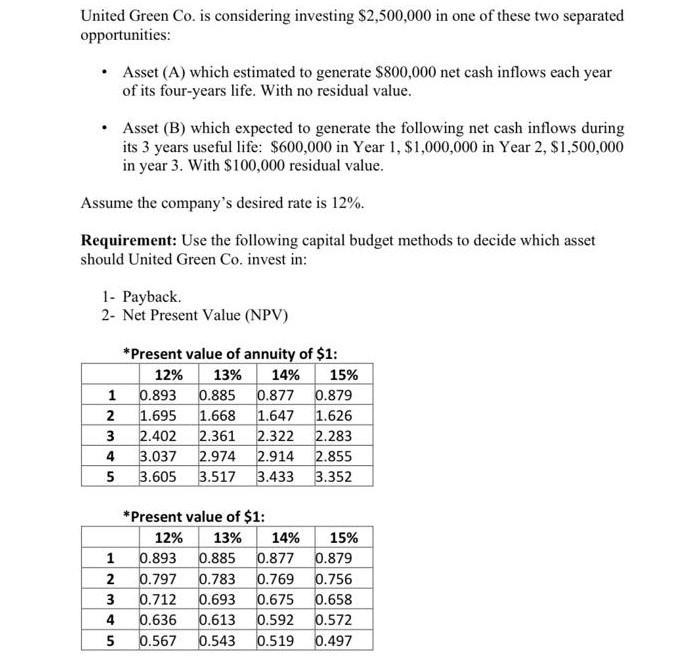

United Green Co. is considering investing $2,500,000 in one of these two separated opportunities: Asset (B) which expected to generate the following net cash

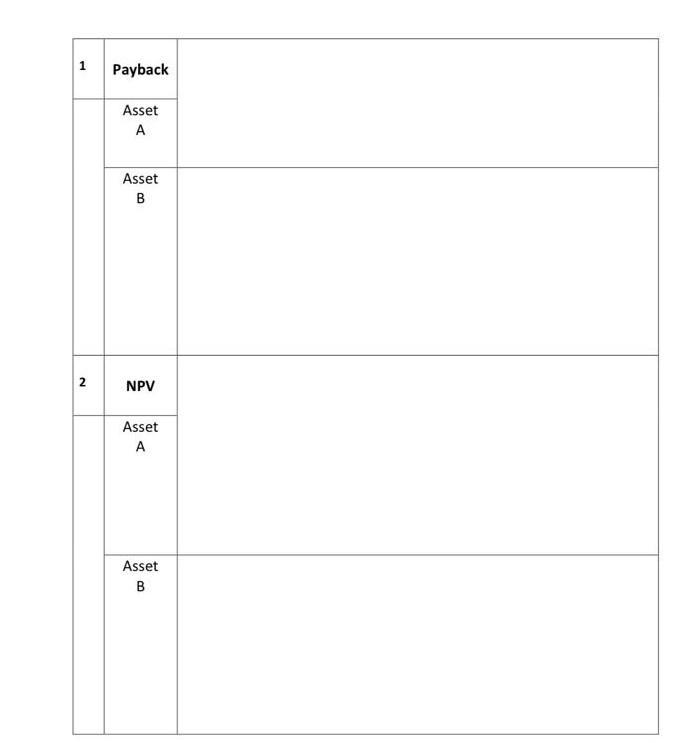

United Green Co. is considering investing $2,500,000 in one of these two separated opportunities: Asset (B) which expected to generate the following net cash inflows during its 3 years useful life: $600,000 in Year 1, $1,000,000 in Year 2, $1,500,000 in year 3. With $100,000 residual value. Assume the company's desired rate is 12%. Requirement: Use the following capital budget methods to decide which asset should United Green Co. invest in: 1- Payback. 2- Net Present Value (NPV) 1 Asset (A) which estimated to generate $800,000 net cash inflows each year of its four-years life. With no residual value. 2 3 4 5 *Present value of annuity of $1: 12% 13% 14% 0.893 0.885 0.877 0.879 1.695 1.668 1.647 1.626 2.402 2.361 2.322 2.283 3.037 2.974 2.914 2.855 3.605 3.517 3.433 3.352 *Present value of $1: 13% 12% 14% 15% 0.885 0.877 0.879 0.756 3 0.712 0.693 0.675 0.658 4 0.636 0.613 0.592 0.572 5 0.567 0.543 0.519 0.497 15% 1 0.893 2 0.797 0.783 0.769 1 2 Payback Asset A Asset B NPV Asset A Asset B

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started