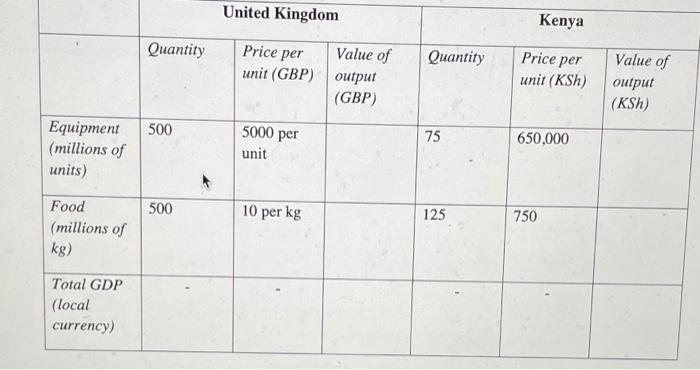

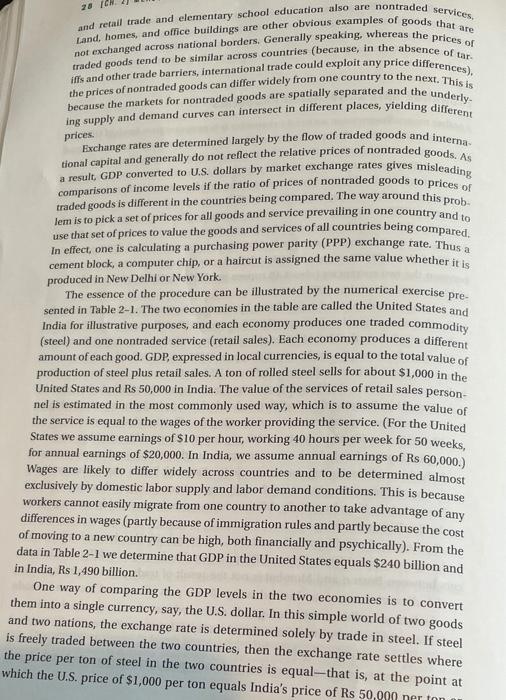

United Kingdom Kenya Quantity Price per Quantity Price per Value of Value of unit (GBP) output (GBP) unit (KSh) output (KSh) 500 5000 per unit 75 Equipment (millions of units) 650,000 500 Food (millions of 10 per kg 125 750 kg) Total GDP (local currency) c. Fill in the table above (ignoring cells with -). What is the UK's total GDP in GBP? What is Kenya's total GDP in KSh? d. What is Kenya's GDP in GBP at market exchange rates? e. Following the calculations on pp 28-29 of ED, what is Kenya's GDP in pounds calculated by using UK prices for each individual product and applying that price to Kenya's quantities (that is, using purchasing power parity (PPP])? f. Is the value you calculated in part d higher or lower than what you calculated in part c? Give a one sentence explanation of why this is. 28 Land, homes, and office buildings are other obvious examples of goods that are and retail trade and elementary school education also are nontraded services, nor exchanged across national borders, Generally speaking, whereas the prices of traded goods tend to be similar across countries (because, in the absence of tar. iffs and other trade barriers, international trade could exploit any price differences). the prices of nontraded goods can differ widely from one country to the next. This is because the markets for nontraded goods are spatially separated and the underly- ing supply and demand curves can intersect in different places, yielding different tional capital and generally do not reflect the relative prices of nontraded goods. As Exchange rates are determined largely by the flow of traded goods and interna a result, GDP converted to US dollars by market exchange rates gives misleading prices. pre- traded goods is different in the countries being compared. The way around this probe comparisons of income levels if the ratio of prices of nontraded goods to prices of lem is to pick a set of prices for all goods and service prevailing in one country and to use that set of prices to value the goods and services of all countries being compared In effect, one is calculating a purchasing power parity (PPP) exchange rate. Thus a cement block, a computer chip, or a haircut is assigned the same value whether it is produced in New Delhi or New York The essence of the procedure can be illustrated by the numerical exercise sented in Table 2-1. The two economies in the table are called the United States and India for illustrative purposes, and each economy produces one traded commodity (steel) and one nontraded service (retail sales). Each economy produces a different amount of each good. GDP, expressed in local currencies, is equal to the total value of production of steel plus retail sales. A ton of rolled steel sells for about $1,000 in the United States and Rs 50,000 in India. The value of the services of retail sales person- nel is estimated in the most commonly used way, which is to assume the value of the service is equal to the wages of the worker providing the service. (For the United States we assume earnings of $10 per hour, working 40 hours per week for 50 weeks, for annual earnings of $20,000. In India, we assume annual earnings of Rs 60,000.) Wages are likely to differ widely across countries and to be determined almost exclusively by domestic labor supply and labor demand conditions. This is because workers cannot easily migrate from one country to another to take advantage of any differences in wages (partly because of immigration rules and partly because the cost of moving to a new country can be high, both financially and psychically). From the data in Table 2-1 we determine that GDP in the United States equals $240 billion and in India, Rs 1,490 billion. One way of comparing the GDP levels in the two economies is to convert them into a single currency, say, the U.S. dollar. In this simple world of two goods and two nations, the exchange rate is determined solely by trade in steel. If steel is freely traded between the two countries, then the exchange rate settles where the price per ton of steel in the two countries is equal-that is, at the point at which the U.S. price of $1,000 per ton equals India's price of Rs 50,000 ner ton TABLE - Marker Exchange Rate Versus Purchasing Power Party Methods of Converting GDP UNITED STATES WO VALUE OF OUTPUT (BILLION US$) 200 QUANTITY VALUE OF BILLIONS 1250 25 PRICE (RUPEES) 50,000 per ton 60,000 perto de PRICE QUANTITY (USS 200 1,000 perton 2 20.000 per person per your Stein 40 240 year 240 Reales personnel miliona To GDP 1,490 local currency billions Rs 50 US$29.8 bbon Market exchange rate based on price Rs 50,000/$1.000 Rs 50 US$1 1.tha's gross domestic product (GOP) in US dollars calculated by using the changes 1.490 2. GDP in U.S. dolars calculated by using US prices for each individual product on pong that price to India's quants that is using purchasing power party IPPP): Retail sales personnel 4 million people X $20,000/person$80 billion Ste 25 milion tone $1.000/ton-$25 billion GOP: $25 billion + $80 billion $105 billion 3. Ratio of PPP calculation of India's GOP to oficial exchange rate calculation $105 bilioni $29 B bio 3.5 hypothetical example. where US$1 = Rs 50. Using this market-determined exchange rate, India's GDP of R$ 1,490 billion equals US$29.8 billion, or about 12 percent of U.S. GDP in this The problem with this comparison is that , although Rs 50 and USSI purchase the same amount of steel in both countries, they purchase different amounts of the nontraded good. To compare the GDP levels of the two nations taking into account this difference in the purchasing power of the respective currencies, we cannot rely on market exchange rates. An alternative approach is to use a common set of prices applied to the output of both countries. We can calculate Indian GDP in U.S. dollars by applying U.S. prices for each product or service to India's quantities. (We could also compute U.S. GDP in terms of India's prices but the convention is to express PPP estimates in terms of U.S. dollars.) This PPP calculation results in India's steel production valued at US$25 billion and retail sales valued at US$80 billion, for an estimated India GDP of US$105 billion. In this example, the PPP calculation of "At any other exchange rate, there would be profitable opportunities to buy more steel from one of the two countries, causing changes in the market for foreign exchange until the two steel prices were equiva- lent and the exchange rate settled at US$1 = Rs 50. This is sometimes referred to as the law of one price reflecting how opportunities for arbitrage in traded goods lead to price convergence in these goods