Answered step by step

Verified Expert Solution

Question

1 Approved Answer

United Paper Products recently received its bank statement for the month of October, 2018 from City of Kingston Commercial Bank. The bank balance as

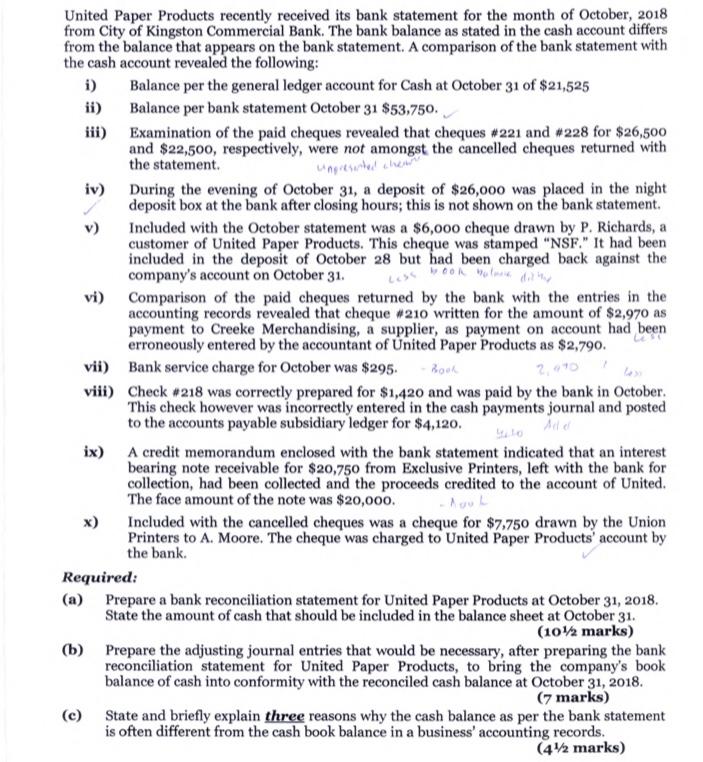

United Paper Products recently received its bank statement for the month of October, 2018 from City of Kingston Commercial Bank. The bank balance as stated in the cash account differs from the balance that appears on the bank statement. A comparison of the bank statement with the cash account revealed the following: Balance per the general ledger account for Cash at October 31 of $21,525 Balance per bank statement October 31 $53,750. i) ii) iii) (b) iv) (c) vi) vii) viii) x) Examination of the paid cheques revealed that cheques #221 and #228 for $26,500 and $22,500, respectively, were not amongst the cancelled cheques returned with the statement. unpresented chea During the evening of October 31, a deposit of $26,000 was placed in the night deposit box at the bank after closing hours; this is not shown on the bank statement. Included with the October statement was a $6,000 cheque drawn by P. Richards, a customer of United Paper Products. This cheque was stamped "NSF." It had been included in the deposit of October 28 but had been charged back against the book bular diliy company's account on October 31. Less Comparison of the paid cheques returned by the bank with the entries in the accounting records revealed that cheque #210 written for the amount of $2,970 as payment to Creeke Merchandising, a supplier, as payment on account had been erroneously entered by the accountant of United Paper Products as $2,790. Bank service charge for October was $295.- Book 2,410 Check #218 was correctly prepared for $1,420 and was paid by the bank in October. This check however was incorrectly entered in the cash payments journal and posted to the accounts payable subsidiary ledger for $4,120. ix) A credit memorandum enclosed with the bank statement indicated that an interest bearing note receivable for $20,750 from Exclusive Printers, left with the bank for collection, had been collected and the proceeds credited to the account of United. The face amount of the note was $20,000. Required: (a) Prepare a bank reconciliation statement for United Paper Products at October 31, 2018. State the amount of cash that should be included in the balance sheet at October 31. (10% marks) Included with the cancelled cheques was a cheque for $7,750 drawn by the Union Printers to A. Moore. The cheque was charged to United Paper Products' account by the bank. Prepare the adjusting journal entries that would be necessary, after preparing the bank reconciliation statement for United Paper Products, to bring the company's book balance of cash into conformity with the reconciled cash balance at October 31, 2018. (7 marks) State and briefly explain three reasons why the cash balance as per the bank statement is often different from the cash book balance in a business' accounting records. (4 marks)

Step by Step Solution

★★★★★

3.40 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

a Bank Reconciliation Statement for United Paper Products at October 31 2018 Balance per cash account general ledger 21525 Add Deposit in transit 26000 Adjusted cash balance per books 47525 Balance pe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started