Answered step by step

Verified Expert Solution

Question

1 Approved Answer

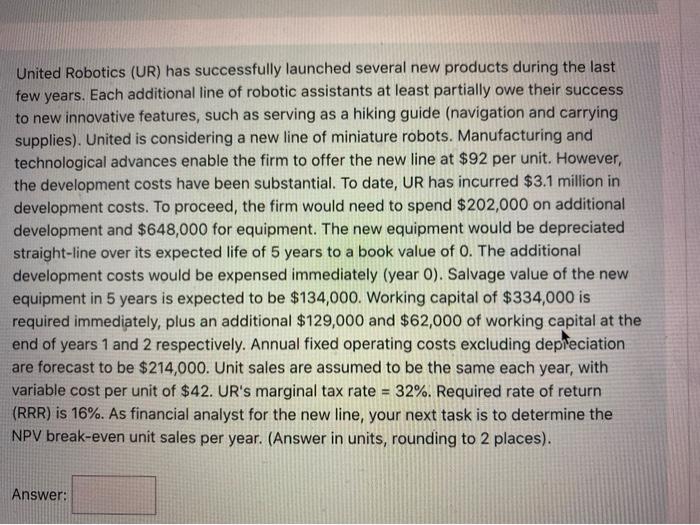

United Robotics (UR) has successfully launched several new products during the last few years. Each additional line of robotic assistants at least partially owe their

United Robotics (UR) has successfully launched several new products during the last few years. Each additional line of robotic assistants at least partially owe their success to new innovative features, such as a hiking guide (navigation and carrying supplies). United is considering a new line of miniature robots. Manufacturing and technological advances enable the firm to offer the new line at $92 per unit. However the devleopment costs have been substantial. To date, UR has incurred 3.1 million in development cost. To proceed, the firm would need to spend $202,000 on additional development and $648,000 for equipment. The new equipment would be depreciated straight-line over its expected life of 5 years to a book value of 0. The additional development cost would be expensed immediately (year 0). Salvage value of the new equipment in 5 years is expected to be $134,000. Working capital of $334,000 is required immidiately, plus an additional $129,000 and $62,000 of working capital at the end of years 1 and 2 respectively. Annual fixed operating cost excluding depreciation are forecast to be $214,000. Unit sales are assumed to be the same each year worh a variable cost per unit of $42. UR 's marginal tax rate = 32%. Required rate of return (RRR) is 16%. As financial analyst for the new line, your next task is to determine the NPV break-even unit sales per year. Answer in units, rounding to 2 places).

United Robotics (UR) has successfully launched several new products during the last few years. Each additional line of robotic assistants at least partially owe their success to new innovative features, such as serving as a hiking guide (navigation and carrying supplies). United is considering a new line of miniature robots. Manufacturing and technological advances enable the firm to offer the new line at $92 per unit. However, the development costs have been substantial. To date, UR has incurred $3.1 million in development costs. To proceed, the firm would need to spend $ 202,000 on additional develo ment and $648,000 for equipment. The new equipment would be depreciated straight-line over its expected life of 5 years to a book value of 0. The additional development costs would be expensed immediately (year O). Salvage value of the new equipment in 5 years is expected to be $134,000. Working capital of $334,000 is required immediately, plus an additional $129,000 and $62,000 of working capital at the end of years 1 and 2 respectively. Annual fixed operating costs excluding depreciation are forecast to be $ 214,000. Unit sales are assumed to be the same each year, with variable cost per unit of $42. UR's marginal tax rate = 32%. Required rate of return (RRR) is 16%. As financial analyst for the new line, your next task is to determine the NPV break-even unit sales per year. (Answer in units, rounding to 2 places) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started