Answered step by step

Verified Expert Solution

Question

1 Approved Answer

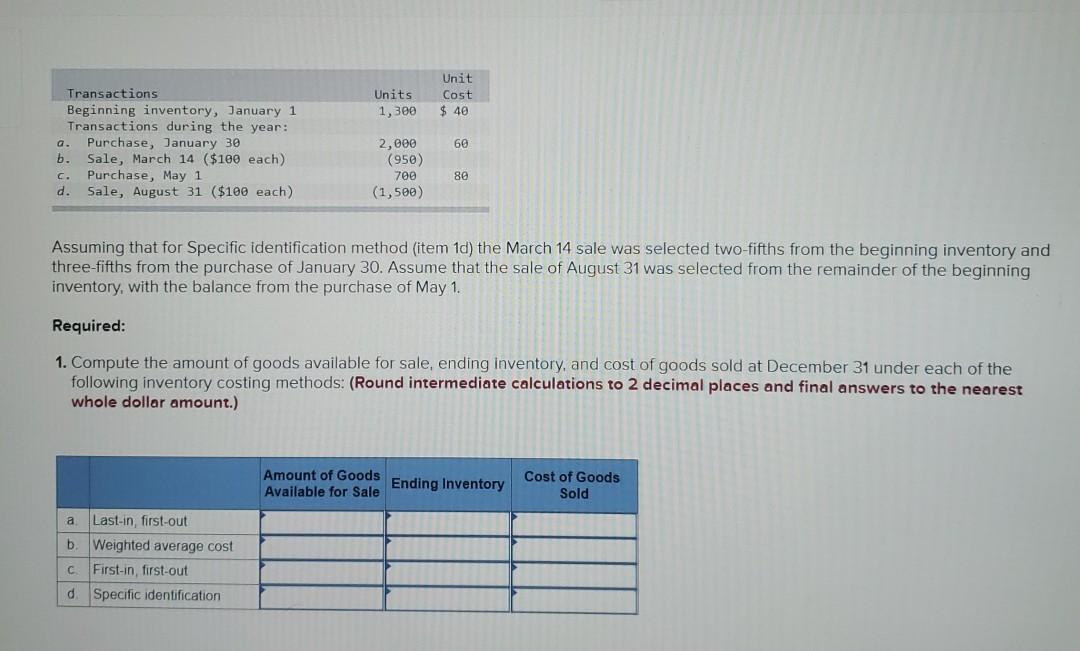

Units 1,300 Unit Cost $ 40 Transactions Beginning inventory, January 1 Transactions during the year: Purchase, January 30 b. Sale, March 14 ($100 each) C.

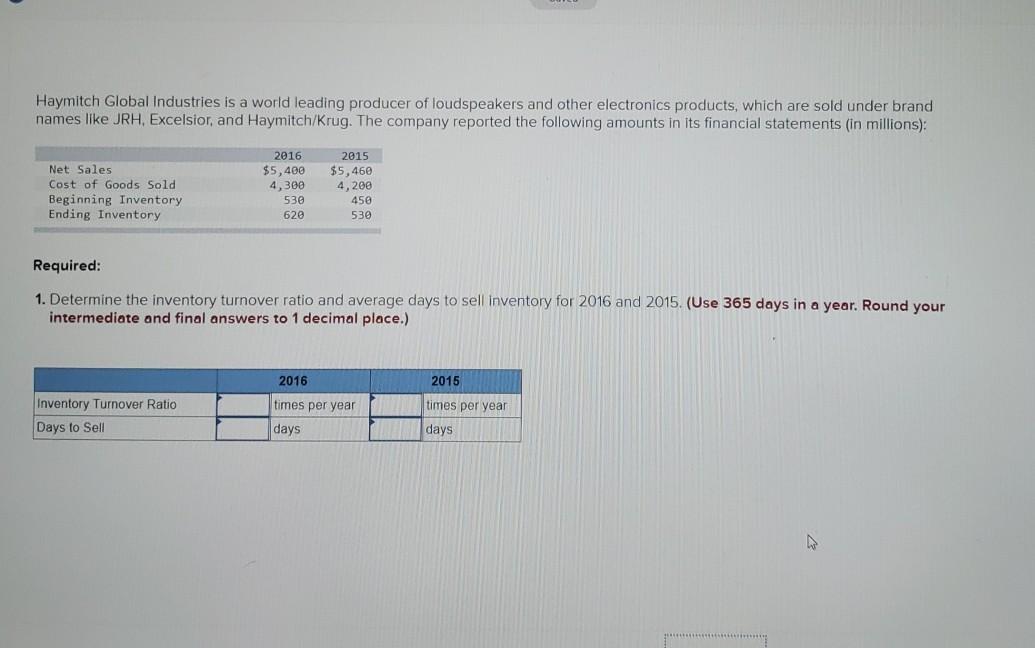

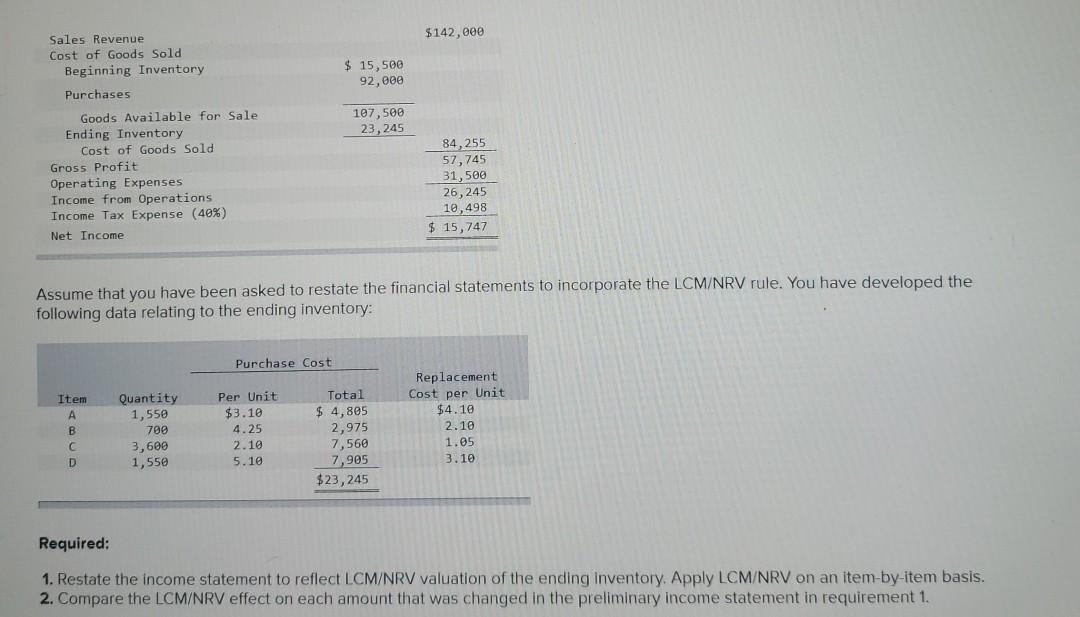

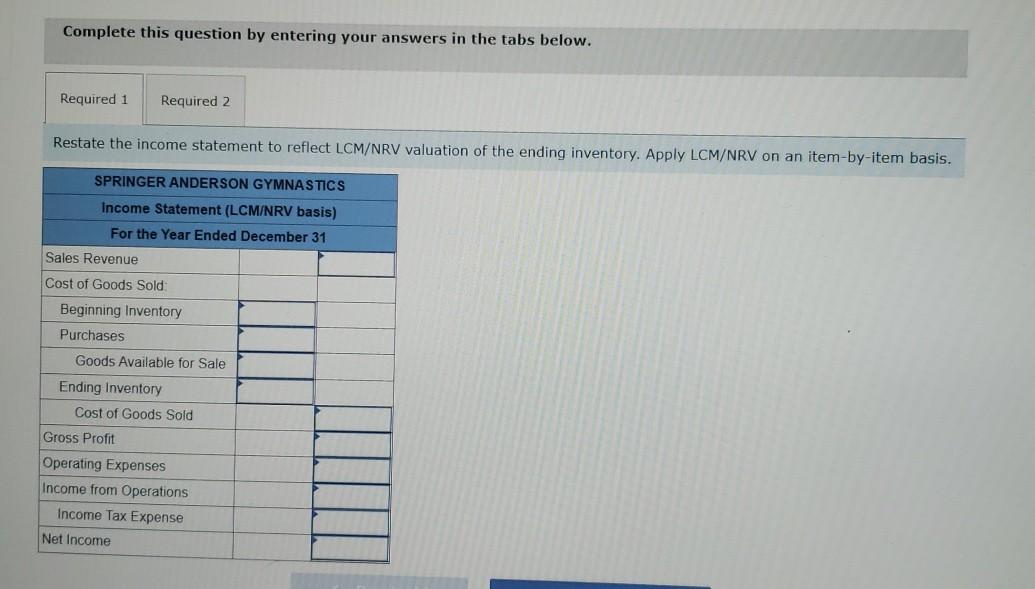

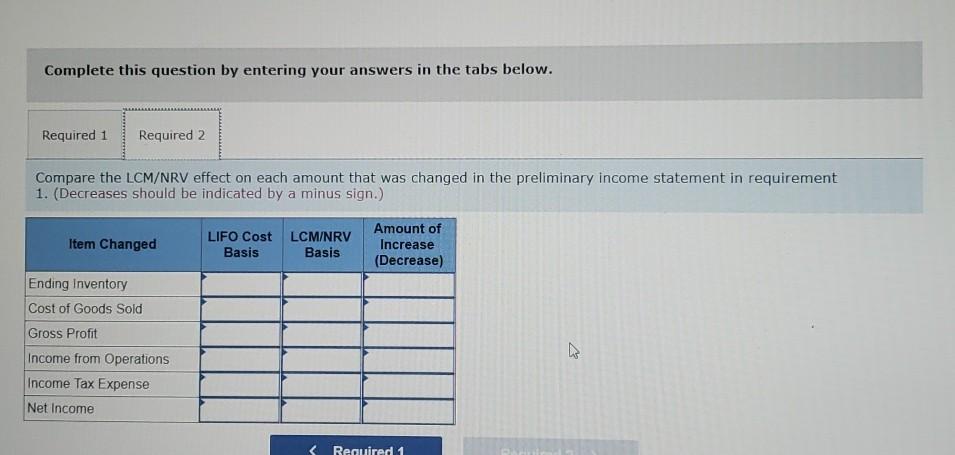

Units 1,300 Unit Cost $ 40 Transactions Beginning inventory, January 1 Transactions during the year: Purchase, January 30 b. Sale, March 14 ($100 each) C. Purchase, May 1 d. Sale, August 31 $100 each) a 60 2,000 (950) 700 (1,500) 80 Assuming that for Specific identification method (item 1d) the March 14 sale was selected two-fifths from the beginning inventory and three-fifths from the purchase of January 30. Assume that the sale of August 31 was selected from the remainder of the beginning inventory, with the balance from the purchase of May 1. Required: 1. Compute the amount of goods available for sale, ending inventory, and cost of goods sold at December 31 under each of the following inventory costing methods: (Round intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount.) Amount of Goods Ending Inventory Available for Sale Cost of Goods Sold a Last-in, first-out b Weighted average cost First-in, first-out d Specific identification Haymitch Global Industries is a world leading producer of loudspeakers and other electronics products, which are sold under brand names like JRH, Excelsior, and Haymitch/Krug. The company reported the following amounts in its financial statements (in millions): Net Sales Cost of Goods Sold Beginning Inventory Ending Inventory 2016 $5,400 4,300 530 620 2015 $5,460 4,200 450 530 Required: 1. Determine the inventory turnover ratio and average days to sell inventory for 2016 and 2015. (Use 365 days in a year. Round your intermediate and final answers to 1 decimal place.) 2016 2015 times per year Inventory Turnover Ratio Days to Sell times per year days days $142,000 $ 15,500 92,000 107,500 23, 245 Sales Revenue Cost of Goods Sold Beginning Inventory Purchases Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Income Tax Expense (40%) Net Income 84,255 57,745 31,500 26,245 10,498 $ 15,747 Assume that you have been asked to restate the financial statements to incorporate the LCM/NRV rule. You have developed the following data relating to the ending inventory: Purchase Cost Total $ 4,805 Item A B D Quantity 1,550 700 3,600 1,550 Per Unit $3.10 4.25 2.10 5.10 Replacement Cost per Unit $4.10 2.10 1.05 3.10 2,975 7,560 7,905 $23,245 Required: 1. Restate the income statement to reflect LCM/NRV valuation of the ending inventory. Apply LCM/NRV on an item-by-item basis. 2. Compare the LCM/NRV effect on each amount that was changed in the preliminary income statement in requirement 1. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Restate the income statement to reflect LCM/NRV valuation of the ending inventory. Apply LCM/NRV on an item-by-item basis. SPRINGER ANDERSON GYMNASTICS Income Statement (LCM/NRV basis) For the Year Ended December 31 Sales Revenue Cost of Goods Sold: Beginning Inventory Purchases Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Income Tax Expense Net Income Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compare the LCM/NRV effect on each amount that was changed in the preliminary income statement in requirement 1. (Decreases should be indicated by a minus sign.) Item Changed LIFO Cost LCM/NRV Basis Basis Amount of Increase (Decrease) Ending Inventory Cost of Goods Sold Gross Profit Income from Operations Income Tax Expense Net Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started