Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Unive 3 (3) W X Al De Chat Al De X Para Chat Al De X D2L Week X WP Ques JPG t Black

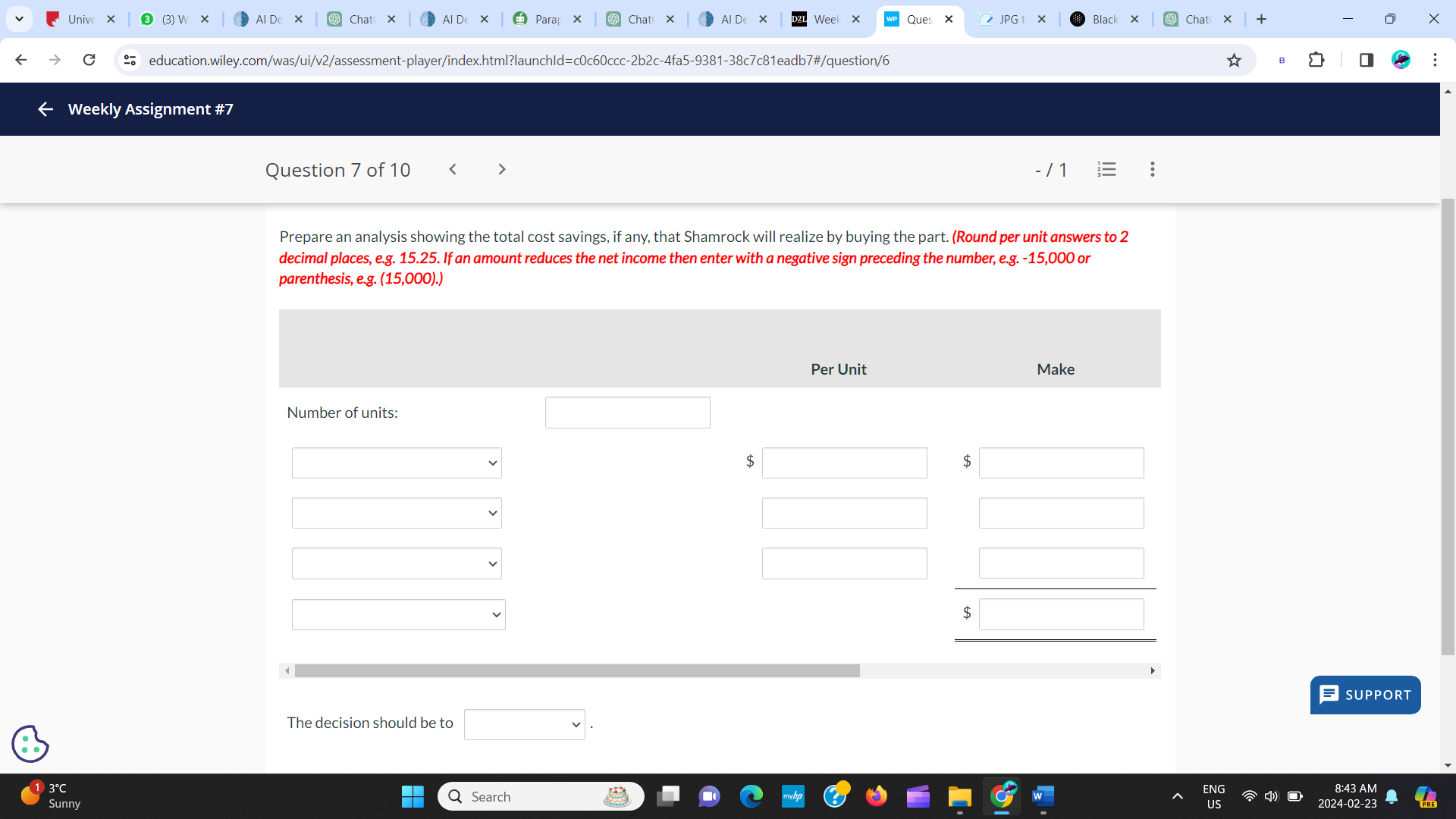

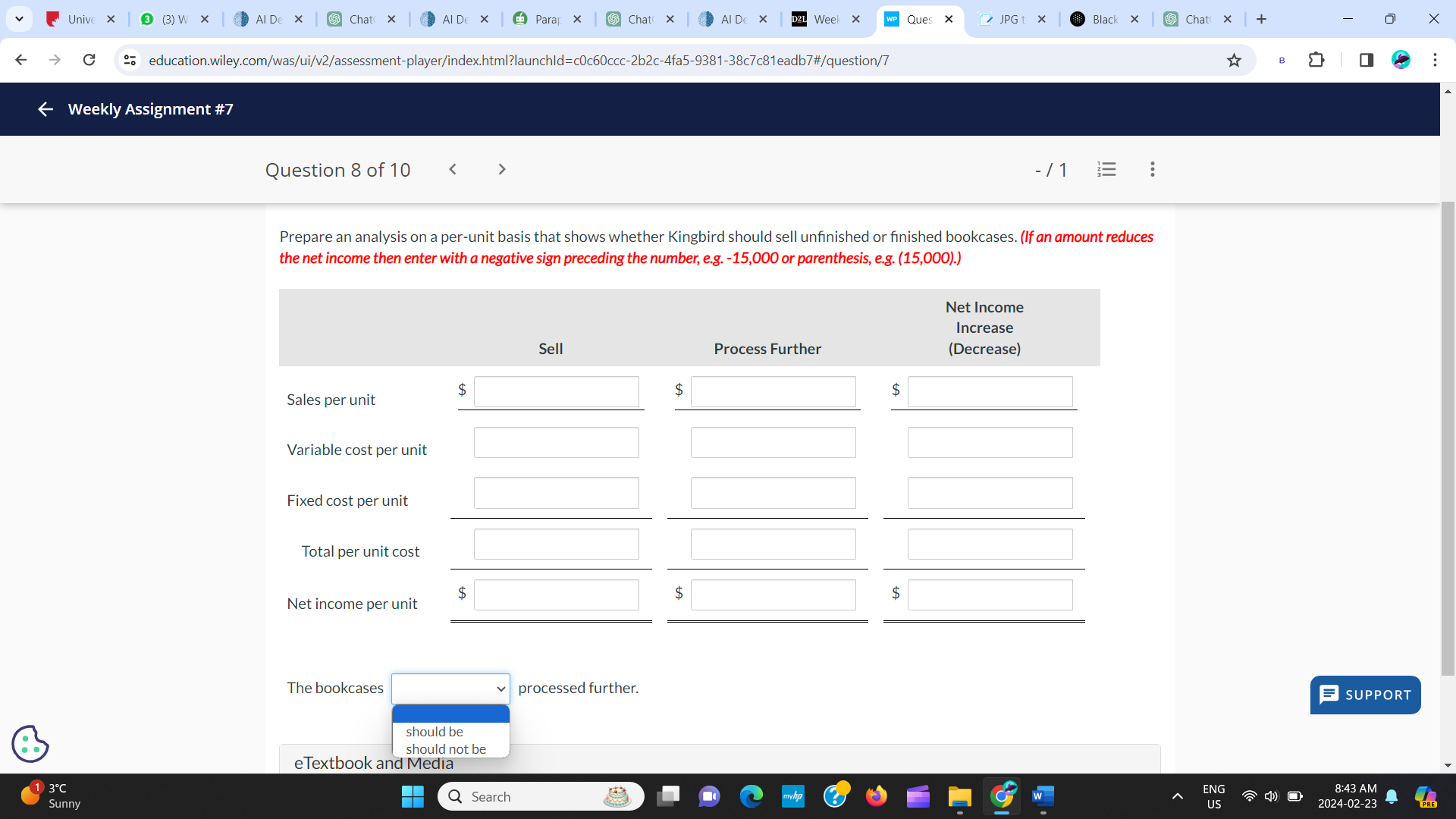

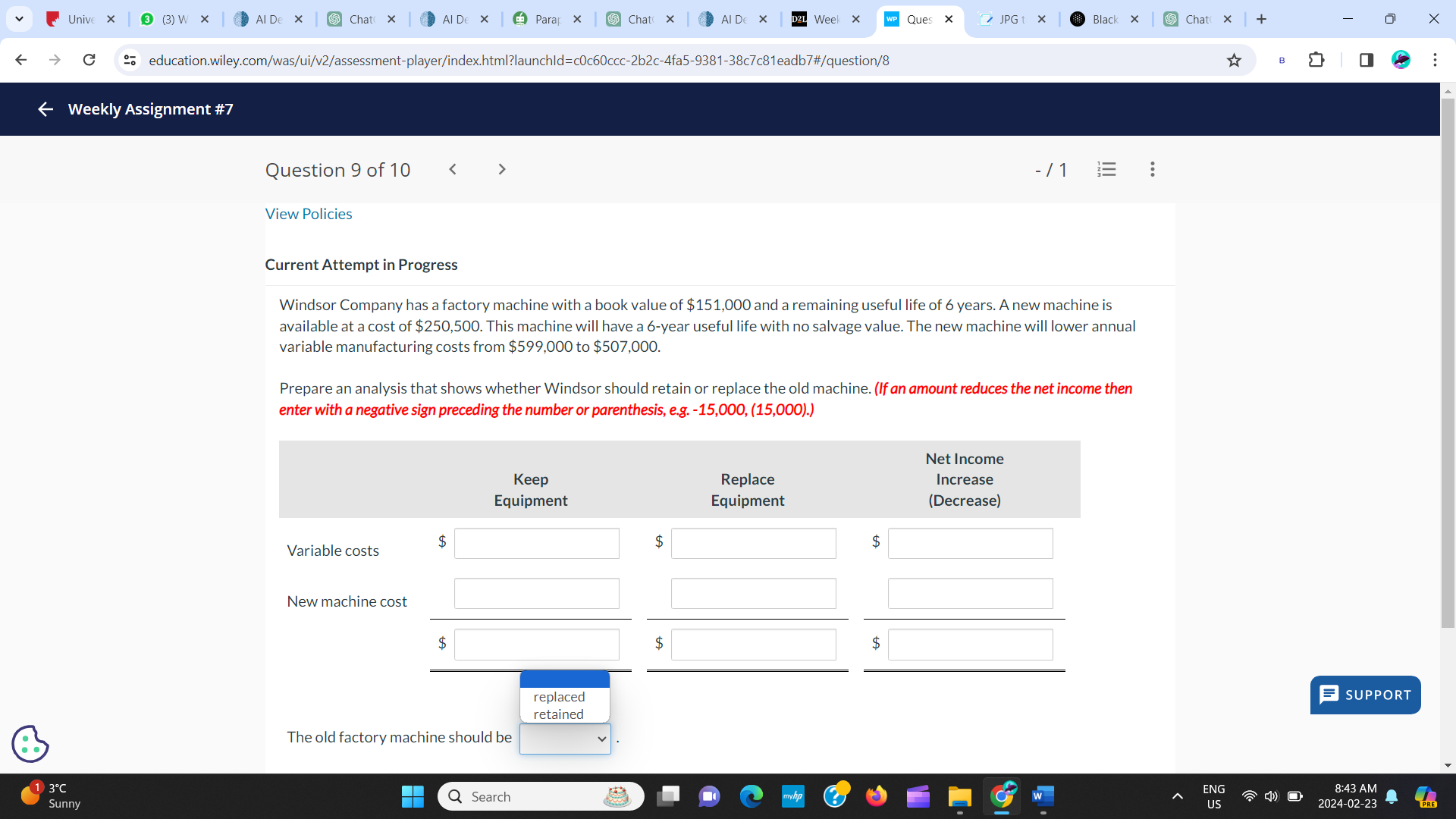

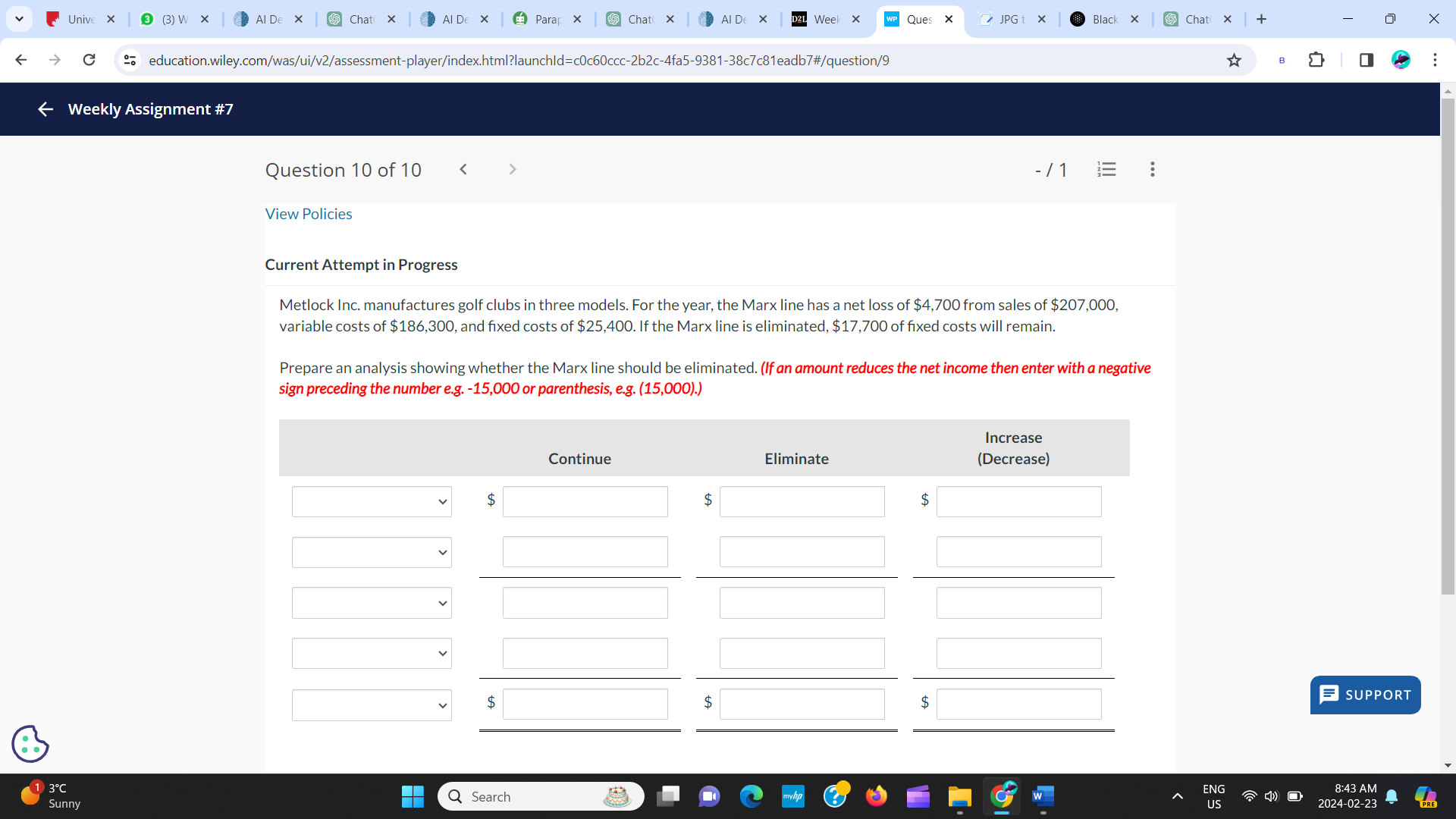

Unive 3 (3) W X Al De Chat Al De X Para Chat Al De X D2L Week X WP Ques JPG t Black Chat + education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=c0c60ccc-2b2c-4fa5-9381-38c7c81eadb7#/question/6 Weekly Assignment #7 3C Sunny Question 7 of 10 < > - / 1 === Prepare an analysis showing the total cost savings, if any, that Shamrock will realize by buying the part. (Round per unit answers to 2 decimal places, e.g. 15.25. If an amount reduces the net income then enter with a negative sign preceding the number, e.g. -15,000 or parenthesis, e.g. (15,000).) Number of units: The decision should be to Q Search $ Per Unit $ $ Make B 0 : SUPPORT ENG US 8:43 AM 2024-02-23 PRE Unive 3 (3) W X Al De Chat Al De X Para Chat Al De X D2L Week X WP Ques JPG t Black Chat + education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=c0c60ccc-2b2c-4fa5-9381-38c7c81eadb7#/question/7 Weekly Assignment #7 Question 8 of 10 < > 3C Sunny - / 1 === Prepare an analysis on a per-unit basis that shows whether Kingbird should sell unfinished or finished bookcases. (If an amount reduces the net income then enter with a negative sign preceding the number, e.g. -15,000 or parenthesis, e.g. (15,000).) Sales per unit Variable cost per unit Fixed cost per unit Total per unit cost $ Net income per unit The bookcases should be should not be eTextbook and Media Q Search Sell Process Further Net Income Increase (Decrease) $ $ processed further. $ $ ENG US B 0 : SUPPORT 8:43 AM 2024-02-23 PRE Unive 3 (3) W X Al De Chat Al De X Para Chat Al De X D2L Week X WP Ques JPG t Black Chat + education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=c0c60ccc-2b2c-4fa5-9381-38c7c81eadb7#/question/8 Weekly Assignment #7 3C Sunny Question 9 of 10 < > View Policies - / 1 Current Attempt in Progress Windsor Company has a factory machine with a book value of $151,000 and a remaining useful life of 6 years. A new machine is available at a cost of $250,500. This machine will have a 6-year useful life with no salvage value. The new machine will lower annual variable manufacturing costs from $599,000 to $507,000. Prepare an analysis that shows whether Windsor should retain or replace the old machine. (If an amount reduces the net income then enter with a negative sign preceding the number or parenthesis, e.g. -15,000, (15,000).) Keep Equipment $ Variable costs New machine cost $ The old factory machine should be Q Search replaced retained Replace Equipment $ $ $ $ Net Income Increase (Decrease) ENG US B 0 SUPPORT 8:43 AM 2024-02-23 PRE Unive 3 (3) W X Al De Chat Al De X Para Chat Al De X D2L Week X WP Ques JPG t Black Chat + education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=c0c60ccc-2b2c-4fa5-9381-38c7c81eadb7#/question/9 Weekly Assignment #7 3C Sunny Question 10 of 10 < > View Policies -/1 == Current Attempt in Progress Metlock Inc. manufactures golf clubs in three models. For the year, the Marx line has a net loss of $4,700 from sales of $207,000, variable costs of $186,300, and fixed costs of $25,400. If the Marx line is eliminated, $17,700 of fixed costs will remain. Prepare an analysis showing whether the Marx line should be eliminated. (If an amount reduces the net income then enter with a negative sign preceding the number e.g. -15,000 or parenthesis, e.g. (15,000).) Continue Eliminate Increase (Decrease) $ $ $ $ $ $ Q Search ENG US B 0 SUPPORT 8:43 AM 2024-02-23 PRE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started