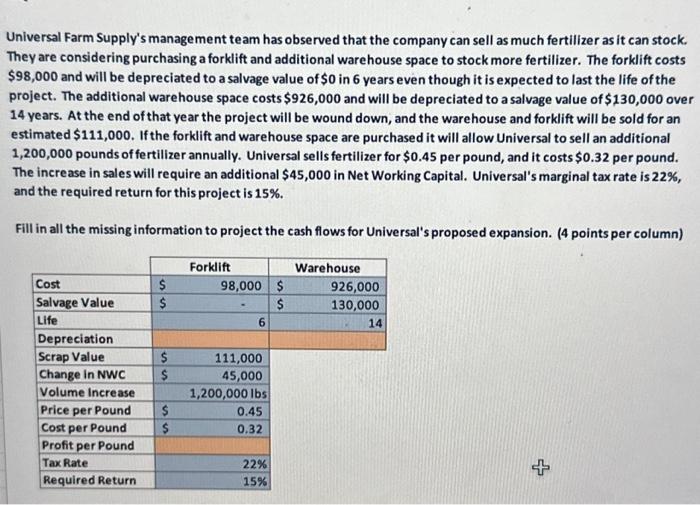

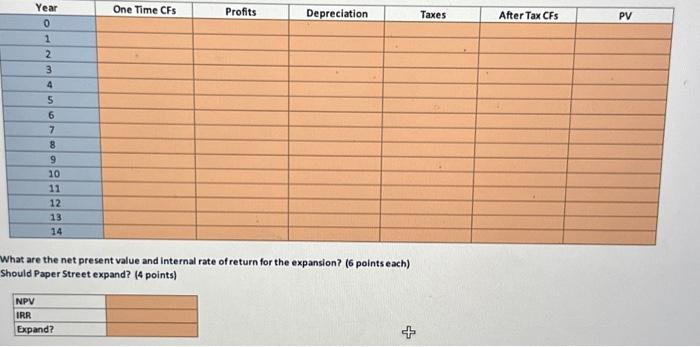

Universal Farm Supply's management team has observed that the company can sell as much fertilizer as it can stock. They are considering purchasing a forklift and additional warehouse space to stock more fertilizer. The forklift costs $98,000 and will be depreciated to a salvage value of $0 in 6 years even though it is expected to last the life of the project. The additional warehouse space costs $926,000 and will be depreciated to a salvage value of $130,000 over 14 years. At the end of that year the project will be wound down, and the warehouse and forklift will be sold for an estimated $111,000. If the forklift and warehouse space are purchased it will allow Universal to sell an additional 1,200,000 pounds of fertilizer annually. Universal sells fertilizer for $0.45 per pound, and it costs $0.32 per pound. The increase in sales will require an additional $45,000 in Net Working Capital. Universal's marginal tax rate is 22%, and the required return for this project is 15%. Fill in all the missing information to project the cash flows for Universal's proposed expansion. (4 points per column) What are the net present value and internal rate of return for the expansion? ( 6 points each) Should Paper Street expand? (4 points) Universal Farm Supply's management team has observed that the company can sell as much fertilizer as it can stock. They are considering purchasing a forklift and additional warehouse space to stock more fertilizer. The forklift costs $98,000 and will be depreciated to a salvage value of $0 in 6 years even though it is expected to last the life of the project. The additional warehouse space costs $926,000 and will be depreciated to a salvage value of $130,000 over 14 years. At the end of that year the project will be wound down, and the warehouse and forklift will be sold for an estimated $111,000. If the forklift and warehouse space are purchased it will allow Universal to sell an additional 1,200,000 pounds of fertilizer annually. Universal sells fertilizer for $0.45 per pound, and it costs $0.32 per pound. The increase in sales will require an additional $45,000 in Net Working Capital. Universal's marginal tax rate is 22%, and the required return for this project is 15%. Fill in all the missing information to project the cash flows for Universal's proposed expansion. (4 points per column) What are the net present value and internal rate of return for the expansion? ( 6 points each) Should Paper Street expand? (4 points)