Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Universal Solutions operates a defined benefit pension scheme on behalf of its employees. The company conducts an annual review of funding in conjunction with

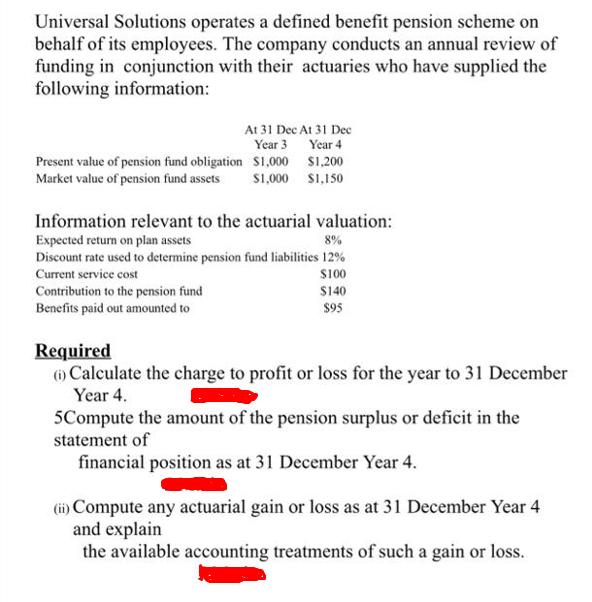

Universal Solutions operates a defined benefit pension scheme on behalf of its employees. The company conducts an annual review of funding in conjunction with their actuaries who have supplied the following information: At 31 Dec At 31 Dec Year 4 Year 3 Present value of pension fund obligation $1,000 $1,200 Market value of pension fund assets $1,000 $1,150 Information relevant to the actuarial valuation: Expected return on plan assets 8% Discount rate used to determine pension fund liabilities 12% Current service cost $100 Contribution to the pension fund Benefits paid out amounted to $140 $95 Required (1) Calculate the charge to profit or loss for the year to 31 December Year 4. 5Compute the amount of the pension surplus or deficit in the statement of financial position as at 31 December Year 4. (ii) Compute any actuarial gain or loss as at 31 December Year 4 and explain the available accounting treatments of such a gain or loss.

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the charge to profit or loss for the year to 31 December Year 4 we need to consider the following components 1 Current service cost 100 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started