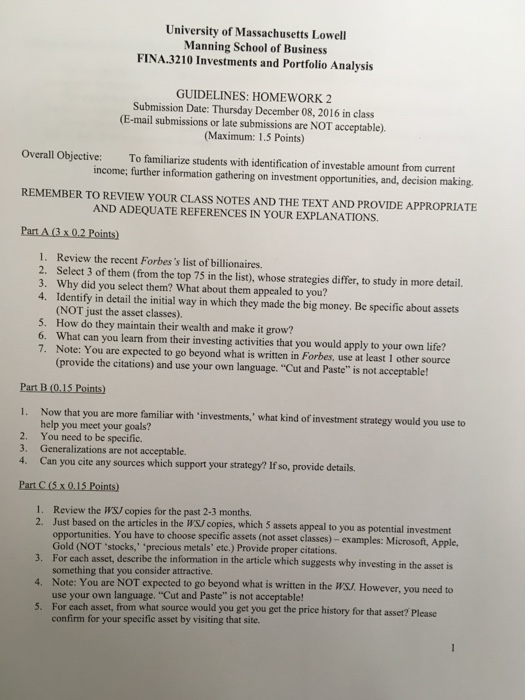

University of Massachusetts Lowell Manning School of Business FINA 3210 Investments and Portfolio Analysis GUIDELINES: HOMEWORK 2 Submission Date: Thursday December 08, 2016 in class (E-mail submissions or late submissions are NOT acceptable). (Maximum: 1.5 Points overall objective: To familiarize students with identification of investable amount from current income; further information gathering on investment opportunities, and, decision making. REMEMBER TO REVIEW YOUR CLASS NOTES AND THE TExT AND PROVIDE APPROPRIATE ANDADEQUATE REFERENCES IN YOUR EXPLANATIONS Part A x 0.2 Points) 1. Review the recent Forbes's list of billionaires. 2. Select 3 of them (from the top 75 in the list whose strategies differ, to study in more detail. 3. Why did you select them? What about them appealed to you? 4. Identify in detail the initial way in which they made the big money. Be specific about assets just the asset classes). 5. How do they maintain their wealth and make it grow? 6. What can you learn from their investing activities that you would apply to your own life? 7. Note: You are expected to go beyond what is written in Forbes, use at least 1 other source (provide the citations) and use your own language. "Cut and Paste" is not acceptable! Part B (0.15 Points l. Now that you are more familiar with 'investments," what kind ofinvestment strategy would you use to help you meet your goals? 2. You need to be specific. 3. Generalizations are not acceptable. 4. Can you cite any sources which support your strategy? If so, provide details. Part C (5 x 0 ls Points l. Review the WsU copies for the past 2-3 months. 2. Just based on articles in the WS copies, which 5 assets appeal to you as potential investment opportunities. You have to choose specific assets (not asset classes)-example Microsoft, Apple. Gold (NOT 'stocks,' 'precious metals' etc.) Provide proper citations. 3. For each asset, describe the information in the article which suggests why investing in the asset is 4. something that you consider attractive. what is written in the wsJ However, you need to are beyond use your own language, "Cut and Paste" is not acceptable! 5. For each asset, from what source would you get you get the price history for that asset? Please confirm for your specific asset by visiting that site. University of Massachusetts Lowell Manning School of Business FINA 3210 Investments and Portfolio Analysis GUIDELINES: HOMEWORK 2 Submission Date: Thursday December 08, 2016 in class (E-mail submissions or late submissions are NOT acceptable). (Maximum: 1.5 Points overall objective: To familiarize students with identification of investable amount from current income; further information gathering on investment opportunities, and, decision making. REMEMBER TO REVIEW YOUR CLASS NOTES AND THE TExT AND PROVIDE APPROPRIATE ANDADEQUATE REFERENCES IN YOUR EXPLANATIONS Part A x 0.2 Points) 1. Review the recent Forbes's list of billionaires. 2. Select 3 of them (from the top 75 in the list whose strategies differ, to study in more detail. 3. Why did you select them? What about them appealed to you? 4. Identify in detail the initial way in which they made the big money. Be specific about assets just the asset classes). 5. How do they maintain their wealth and make it grow? 6. What can you learn from their investing activities that you would apply to your own life? 7. Note: You are expected to go beyond what is written in Forbes, use at least 1 other source (provide the citations) and use your own language. "Cut and Paste" is not acceptable! Part B (0.15 Points l. Now that you are more familiar with 'investments," what kind ofinvestment strategy would you use to help you meet your goals? 2. You need to be specific. 3. Generalizations are not acceptable. 4. Can you cite any sources which support your strategy? If so, provide details. Part C (5 x 0 ls Points l. Review the WsU copies for the past 2-3 months. 2. Just based on articles in the WS copies, which 5 assets appeal to you as potential investment opportunities. You have to choose specific assets (not asset classes)-example Microsoft, Apple. Gold (NOT 'stocks,' 'precious metals' etc.) Provide proper citations. 3. For each asset, describe the information in the article which suggests why investing in the asset is 4. something that you consider attractive. what is written in the wsJ However, you need to are beyond use your own language, "Cut and Paste" is not acceptable! 5. For each asset, from what source would you get you get the price history for that asset? Please confirm for your specific asset by visiting that site