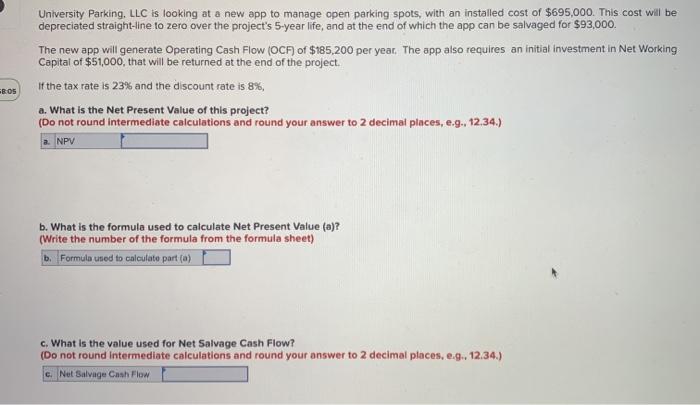

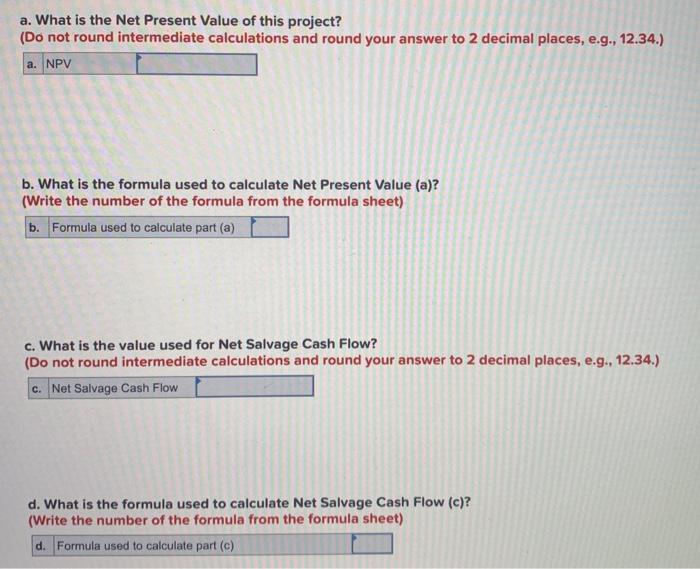

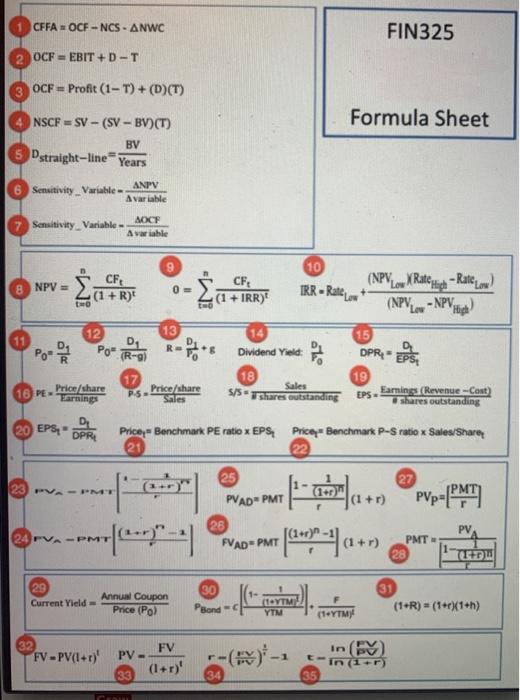

University Parking, LLC is looking at a new app to manage open parking spots, with an installed cost of $695,000. This cost will be depreciated straight-line to zero over the project's 5-year life, and at the end of which the app can be salvaged for $93,000. The new app will generate Operating Cash Flow (OCF) of $185,200 per year. The app also requires an initial investment in Net Working Capital of $51,000, that will be returned at the end of the project. if the tax rate is 23% and the discount rate is 8%, a. What is the Net Present Value of this project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 12.34.) EROS a. NPV b. What is the formula used to calculate Net Present Value (a)? (Write the number of the formula from the formula sheet) b. Formula used to calculate part (a) c. What is the value used for Net Salvage Cash Flow? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 12.34.) c. Net Salvage Cash Flow a. What is the Net Present Value of this project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 12.34.) a. NPV b. What is the formula used to calculate Net Present Value (a)? (Write the number of the formula from the formula sheet) b. Formula used to calculate part (a) c. What is the value used for Net Salvage Cash Flow? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 12.34.) c. Net Salvage Cash Flow d. What is the formula used to calculate Net Salvage Cash Flow (c)? (Write the number of the formula from the formula sheet) d. Formula used to calculate part (c) CFFA OCF-NCS - ANWC FIN325 OCF-EBIT +D-T OCF-Profit (1-T)+(D)(T) Formula Sheet NSCFSV - (SV-BV)(T) BV straight-line Years 6 Sensitivity Variable ANPV A variable Sensitivity Variable AOCF A variable 10 8 NPV = CF (1 + R)' 0- CF (1 + IRR) RR-Rate (NPV Ratenie - Rates (NPV - NPV High Low 12 13 11 D (R-9) R- Dividend Yield: 16 PE Price/share DPR - 19 EPS. Earnings (Revenue - Cost) shares outstanding 18 S/S Price/share Sales Sales shares outstanding PS Earnings 20 EPS, - DPRE Price - Benchmark PE ratio x EPS Pricez-Benchmark P-S ratio x Sales/Share 22 27 (1+r) 25 PVADEPMT 28 |(1+r)" FVADEPMT PVP=(PMT PV 24 FVA-PMT [Crow-4a+ (1+r) PMT 28 (CEDU 30 29 Current Yield Annual Coupon Price (Po) (YTM 31 (1+R) = (1+r)(1+h) PBond - YTM 11 YTM 32 FV-PV(1+r) -1 PV. FV 33 (1+r)' t-in (1) 34 35