Answered step by step

Verified Expert Solution

Question

1 Approved Answer

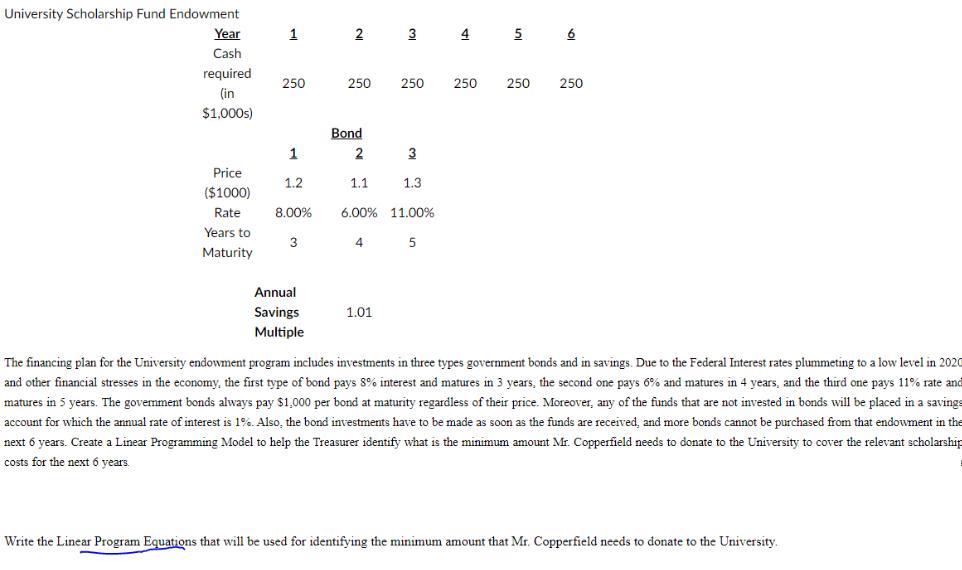

University Scholarship Fund Endowment Year Cash required (in $1,000s) Price ($1000) Rate Years to Maturity 1 2 3 4 5 6 250 1 1.2

University Scholarship Fund Endowment Year Cash required (in $1,000s) Price ($1000) Rate Years to Maturity 1 2 3 4 5 6 250 1 1.2 8.00% 3 Annual Savings Multiple 250 250 250 250 250 Bond 2 1.1 3 1.01 1.3 6.00% 11.00% 4 5 The financing plan for the University endowment program includes investments in three types government bonds and in savings. Due to the Federal Interest rates plummeting to a low level in 2020 and other financial stresses in the economy, the first type of bond pays 8% interest and matures in 3 years, the second one pays 6% and matures in 4 years, and the third one pays 11% rate and matures in 5 years. The government bonds always pay $1,000 per bond at maturity regardless of their price. Moreover, any of the funds that are not invested in bonds will be placed in a savings account for which the annual rate of interest is 1%. Also, the bond investments have to be made as soon as the funds are received, and more bonds cannot be purchased from that endowment in the next 6 years. Create a Linear Programming Model to help the Treasurer identify what is the minimum amount Mr. Copperfield needs to donate to the University to cover the relevant scholarship costs for the next 6 years. Write the Linear Program Equations that will be used for identifying the minimum amount that Mr. Copperfield needs to donate to the University.

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER See the table below Bolded are answers for a and b Expla...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started