Question

Unless instructed otherwise assume: (1) So = $100 (2) Each period the stock price will either rise 10% or fall 5%. [Usually in binomial models,

Unless instructed otherwise assume:

(1) So = $100

(2) Each period the stock price will either rise 10% or fall 5%. [Usually in binomial models, the price either goes up or goes down the same percentage but well do this one this way.]

(3) The one period risk free rate = 3.9225% so ert=1.04

(4) European options (unless instructed otherwise)

(5) No dividends or transaction costs

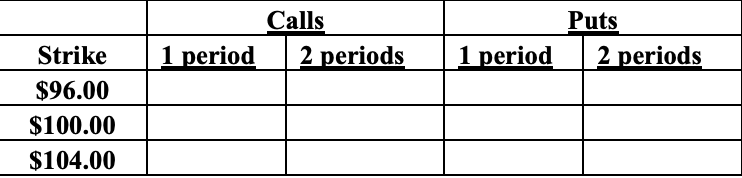

1. Fill in the following table of European option prices as implied by the no arbitrage condition for options that expire in 1 period and 2 periods. Any method is okay but quicker using the risk neutral probabilities.

2. Repeat question 1 for American options and explain when early exercise would occur.

Calls 1 period_ 2 periods Puts 1 period_2 periods Strike $96.00 $100.00 $104.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started