Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Unless otherwise stated, assume all payments are made in arrears (end of period), and stated interest rates are annual rates. Last year you purchased a

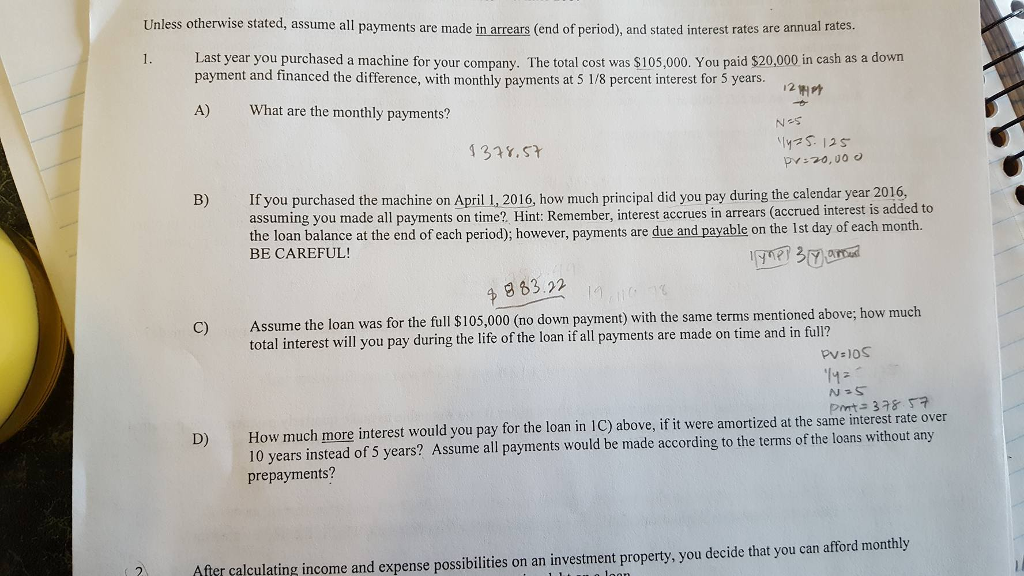

Unless otherwise stated, assume all payments are made in arrears (end of period), and stated interest rates are annual rates. Last year you purchased a machine for your company. The total cost was $105,000. You paid $20,000 in cash as a down payment and financed the difference, with monthly payments at 5 1/8 percent interests for 5 years. What are the monthly payments? If you purchased the machine on April 1, 2016, how mu Ch principal did you pay during the calendar year 2016, assuming you made all payments on time? Remember, interest accrues in arrears (accrued interest is added to the loan balance at the end of each period); however, payments are due and payable on the 1st day of each month. BE CAREFUL! Assume the loan was for the full $105,000 (no down payment) with the same terms mentioned above; how mu Ch total interest will you pay during the life of the loan if all payments are made on time and in full? How mu Ch more interest would you pay for the loan in 1C) above, if it were amortized at the same interest rate over 10 years instead of 5 years? Assume all payments would be made according to the terms of the loans without any prepayments? After calculating income and expense possibilities on an investment property, you decide that you can afford monthly

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started