Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Unless otherwise stated, for Problems 5, 6 EURJPY spot = 130.00 EUR rates = JPY rates = 0, in perpetuity Expiry for each forward

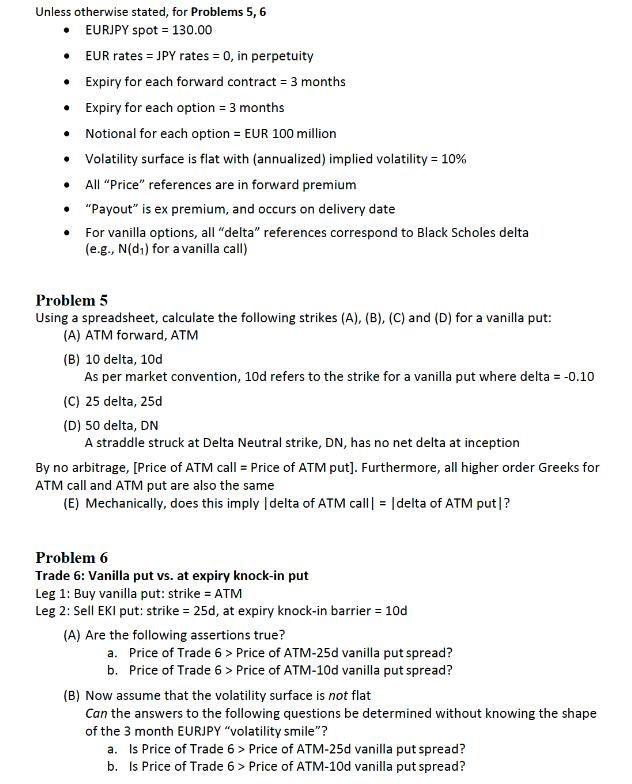

Unless otherwise stated, for Problems 5, 6 EURJPY spot = 130.00 EUR rates = JPY rates = 0, in perpetuity Expiry for each forward contract = 3 months Expiry for each option = 3 months Notional for each option = EUR 100 million Volatility surface is flat with (annualized) implied volatility = 10% All "Price" references are in forward premium "Payout" is ex premium, and occurs on delivery date For vanilla options, all "delta" references correspond to Black Scholes delta (e.g., N(d) for a vanilla call) . . . Problem 5 Using a spreadsheet, calculate the following strikes (A), (B), (C) and (D) for a vanilla put: (A) ATM forward, ATM (B) 10 delta, 10d As per market convention, 10d refers to the strike for a vanilla put where delta = -0.10 (C) 25 delta, 25d (D) 50 delta, DN A straddle struck at Delta Neutral strike, DN, has no net delta at inception By no arbitrage, [Price of ATM call = Price of ATM put]. Furthermore, all higher order Greeks for ATM call and ATM put are also the same (E) Mechanically, does this imply [delta of ATM call | = |delta of ATM put |? Problem 6 Trade 6: Vanilla put vs. at expiry knock-in put Leg 1: Buy vanilla put: strike = ATM Leg 2: Sell EKI put: strike = 25d, at expiry knock-in barrier = 10d (A) Are the following assertions true? a. Price of Trade 6 > Price of ATM-25d vanilla put spread? b. Price of Trade 6 > Price of ATM-10d vanilla put spread? (B) Now assume that the volatility surface is not flat Can the answers to the following questions be determined without knowing the shape of the 3 month EURJPY "volatility smile"? a. Is Price of Trade 6> Price of ATM-25d vanilla put spread? b. Is Price of Trade 6 > Price of ATM-10d vanilla put spread?

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To solve Problems 5 and 6 lets go step by step Problem 5 Using the given information we need to calculate the strikes for a vanilla put option at diff...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started