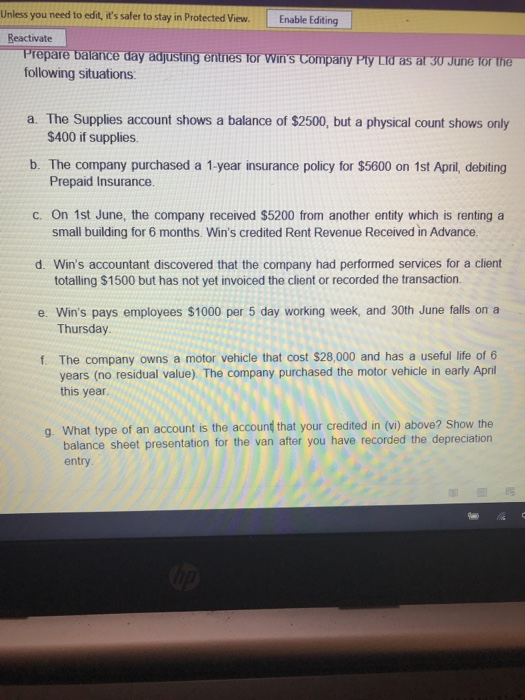

Unless you need to edit, it's safer to stay in Protected View. Enable Editing Reactivate Prepare balance day adjusting entries for Win's Company Ply Lid as al 30 June for the following situations a. The Supplies account shows a balance of $2500, but a physical count shows only $400 if supplies b. The company purchased a 1-year insurance policy for $5600 on 1st April, debiting Prepaid Insurance c. On 1st June, the company received $5200 from another entity which is renting a small building for 6 months. Win's credited Rent Revenue Received in Advance d. Win's accountant discovered that the company had performed services for a client totalling $1500 but has not yet invoiced the client or recorded the transaction. e. Win's pays employees $1000 per 5 day working week, and 30th June falls on a Thursday f. The company owns a motor vehicle that cost $28,000 and has a useful life of 6 years (no residual value). The company purchased the motor vehicle in early April this year g. What type of an account is the account that your credited in (vi) above? Show the balance sheet presentation for the van after you have recorded the depreciation entry Unless you need to edit, it's safer to stay in Protected View. Enable Editing Reactivate Prepare balance day adjusting entries for Win's Company Ply Lid as al 30 June for the following situations a. The Supplies account shows a balance of $2500, but a physical count shows only $400 if supplies b. The company purchased a 1-year insurance policy for $5600 on 1st April, debiting Prepaid Insurance c. On 1st June, the company received $5200 from another entity which is renting a small building for 6 months. Win's credited Rent Revenue Received in Advance d. Win's accountant discovered that the company had performed services for a client totalling $1500 but has not yet invoiced the client or recorded the transaction. e. Win's pays employees $1000 per 5 day working week, and 30th June falls on a Thursday f. The company owns a motor vehicle that cost $28,000 and has a useful life of 6 years (no residual value). The company purchased the motor vehicle in early April this year g. What type of an account is the account that your credited in (vi) above? Show the balance sheet presentation for the van after you have recorded the depreciation entry