Answered step by step

Verified Expert Solution

Question

1 Approved Answer

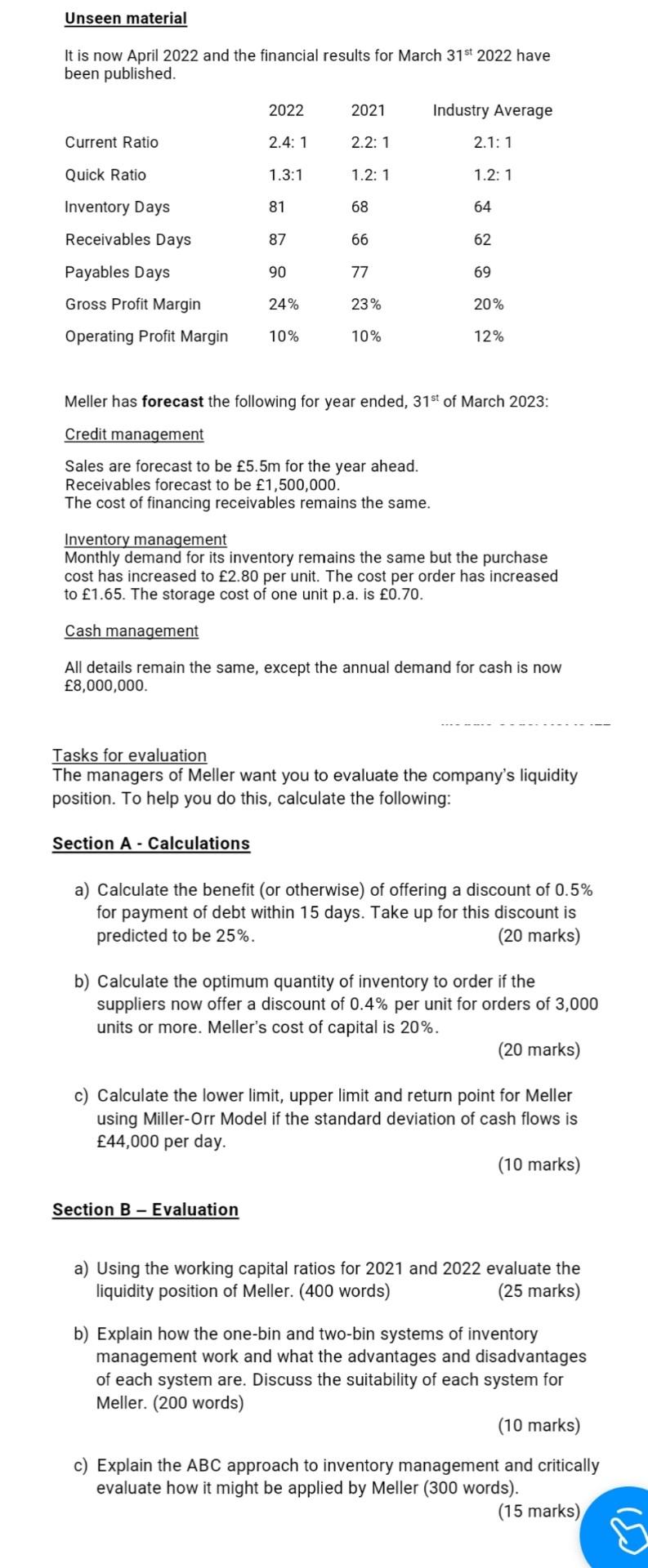

Unseen material It is now April 2022 and the financial results for March 31st 2022 have been published. Current Ratio Quick Ratio Inventory Days Receivables

Unseen material It is now April 2022 and the financial results for March 31st 2022 have been published. Current Ratio Quick Ratio Inventory Days Receivables Days Payables Days Gross Profit Margin Operating Profit Margin 2022 2.4: 1 Section A - Calculations 1.3:1 81 87 90 24% 10% Section B - Evaluation 2021 2.2: 1 1.2: 1 68 66 77 23% 10% Industry Average 2.1: 1 1.2: 1 64 62 69 Meller has forecast the following for year ended, 31st of March 2023: Credit management Sales are forecast to be 5.5m for the year ahead. Receivables forecast to be 1,500,000. The cost of financing receivables remains the same. 20% 12% Inventory management Monthly demand for its inventory remains the same but the purchase cost has increased to 2.80 per unit. The cost per order has increased to 1.65. The storage cost of one unit p.a. is 0.70. Cash management All details remain the same, except the annual demand for cash is now 8,000,000. Tasks for evaluation The managers of Meller want you to evaluate the company's liquidity position. To help you do this, calculate the following: a) Calculate the benefit (or otherwise) of offering a discount of 0.5% for payment of debt within 15 days. Take up for this discount is predicted to be 25%. (20 marks) b) Calculate the optimum quantity of inventory to order if the suppliers now offer a discount of 0.4% per unit for orders of 3,000 units or more. Meller's cost of capital is 20%. marks) c) Calculate the lower limit, upper limit and return point for Meller using Miller-Orr Model if the standard deviation of cash flows is 44,000 per day. (10 marks) a) Using the working capital ratios for 2021 and 2022 evaluate the liquidity position of Meller. (400 words) (25 marks) b) Explain how the one-bin and two-bin systems of inventory management work and what the advantages and disadvantages of each system are. Discuss the suitability of each system for Meller. (200 words) (10 marks) c) Explain the ABC approach to inventory management and critically evaluate how it might be applied by Meller (300 words). (15 marks) Unseen material It is now April 2022 and the financial results for March 31st 2022 have been published. Current Ratio Quick Ratio Inventory Days Receivables Days Payables Days Gross Profit Margin Operating Profit Margin 2022 2.4: 1 Section A - Calculations 1.3:1 81 87 90 24% 10% Section B - Evaluation 2021 2.2: 1 1.2: 1 68 66 77 23% 10% Industry Average 2.1: 1 1.2: 1 64 62 69 Meller has forecast the following for year ended, 31st of March 2023: Credit management Sales are forecast to be 5.5m for the year ahead. Receivables forecast to be 1,500,000. The cost of financing receivables remains the same. 20% 12% Inventory management Monthly demand for its inventory remains the same but the purchase cost has increased to 2.80 per unit. The cost per order has increased to 1.65. The storage cost of one unit p.a. is 0.70. Cash management All details remain the same, except the annual demand for cash is now 8,000,000. Tasks for evaluation The managers of Meller want you to evaluate the company's liquidity position. To help you do this, calculate the following: a) Calculate the benefit (or otherwise) of offering a discount of 0.5% for payment of debt within 15 days. Take up for this discount is predicted to be 25%. (20 marks) b) Calculate the optimum quantity of inventory to order if the suppliers now offer a discount of 0.4% per unit for orders of 3,000 units or more. Meller's cost of capital is 20%. marks) c) Calculate the lower limit, upper limit and return point for Meller using Miller-Orr Model if the standard deviation of cash flows is 44,000 per day. (10 marks) a) Using the working capital ratios for 2021 and 2022 evaluate the liquidity position of Meller. (400 words) (25 marks) b) Explain how the one-bin and two-bin systems of inventory management work and what the advantages and disadvantages of each system are. Discuss the suitability of each system for Meller. (200 words) (10 marks) c) Explain the ABC approach to inventory management and critically evaluate how it might be applied by Meller (300 words). (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started