unsure if im doing this correct. can you pkease write out how you obtain the answers for this question.

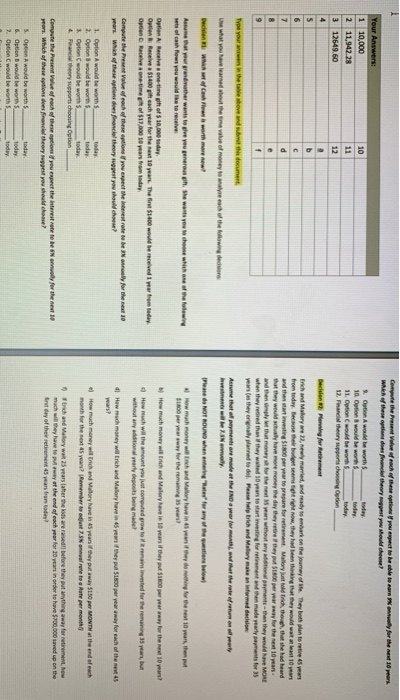

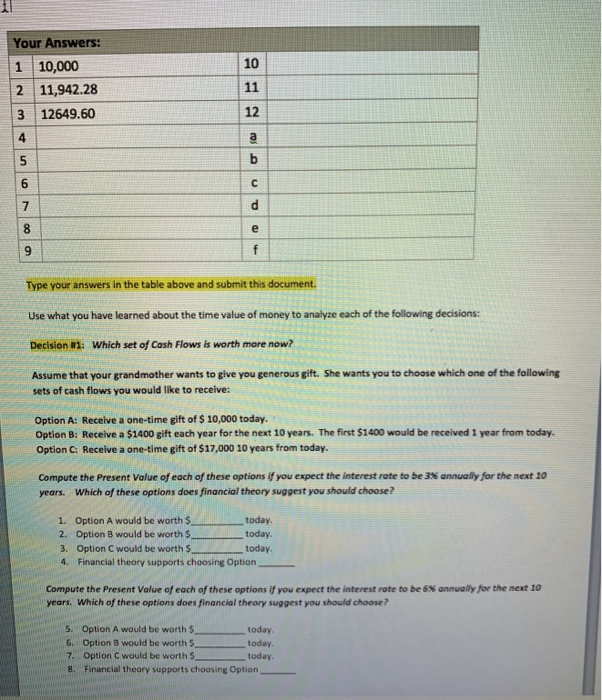

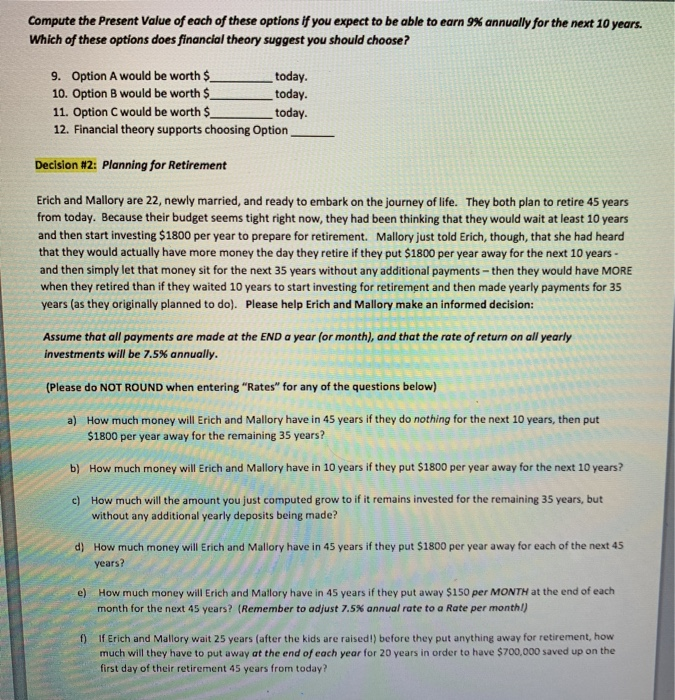

anr Compute the Present Volue of each of these options f you espect to be oble to earn anualy for the next 10 pears wheh of these options does fncl theory ggest yo should cheose Your Answers Option A woud be worth S Option & wouid be worth Option Cwould be worth $a Financial theory supports choosing Options today today today 1 10,000 10 10 2 11,942.28 11 11. 12. 3 12649.60 12 4 Decsien Plenang for Retirement 5 b Erich and Malory are 22, newly married, and ready to embark on the jouney of ife They both plan to retire 45 years from today. Bease their budget seems ight right now, they had been thinking that they would wat at least 10 yearn and then start investing $1800 per year to prepare for retirement. Malory junt told Erich, though, that she had heard that they weuld acualy have more money the day they retire if they put S1800 per year away for the nest 10 years and then simply let that money st for the nest 35 years without any additional payments-then they weuld have MORE when they retired than f they waited 10 years to start investing for retirement and then made yearly payments for 35 6 7 e years (s they orignally planned to del. Please help Erich and Malory make an infarmed decision Type your antwers in the table above and submit ts document Assume that afl pyments are made at the END a year for menth and that the rate of retun on oll yearty nvestments wibe 7.5N anully Use what you have learned about the time value of money te analye each of the following decision (Please do NOT ROUND when entering "Rates for any of the questiens beiow Decsien Which set of Cash Flewn i worth mare new Assume that your grandmather wants to glve yeu generous gift. She wants you te choose which ane of the falewing sets of cash fows you would ke to recelve )How math money will Eich and Malory have in 45 years if they do nothing for the net 10 years, then put si00per year away fer the remaining a5 years Hew much money will Erich and Malery have in 10 years if they put 53800 per year away for the nest 10 years Optien A Recelve one-time gift of $ 10,000 teday. Optien B Receive a $1400 g each year far the next 10 year The finst $1400 would be recelved 1 year frem teday Optien C Recelve a one-time gt of $17,000 10 years fram today Hew much will the amount you just computed grow to i remains invested for the remaining 35 years, but without any additional yearly deposits being made Compute the Present Value of each of these aptionsyou expect the inteest rote to be N asnually for the next 10 ear Which of these optiens does financlel theory suggest you should choese dHaw much money will trich and Malory have in 45 years if they put $1800 per year away for each of the nest 4S years? 1. Option A would be worth S 2. Option would be worth $ today How much money will Erich and Mallory have in 45 years if they put away $150 per MONTH at the end of eachs month for the next 45 years? Remember to adjunt 7.5% annual rete te e Rate per month e today today Financial theory supports choosing Option 3 Option Cwouid be worth $ 4 Erich and Maliory walt 25 years lafher the kids are rased) before they put anything away far netirement, how much will they have to put away at the end of each year for 20 years in arder to have $700,000 saved up on the frst day of thei retirenent 45 years from tadey? Compute the Present Value of each of these optionsyou expet the interest rate te be SN annuelly fer the newt yrors. Which of these options dees financiel theery sugest you should choase? S. Option A would be worth 5, & Option B would be worth P 7. Option Cwould be worth $ today today today Your Answers: 10 10,000 2 11,942.28 11 12 3 12649.60 4 b 5 d 7 8 e f Type your answers in the table above and submit this document. Use what you have learned about the time value of money to analyze each of the following decisions: Decision #1: Which set of Cash Flows is worth more now? Assume that your grandmother wants to give you generous gift. She wants you to choose which one of the following sets of cash flows you would like to receive: Option A: Receive a one-time gift of $ 10,000 today. Option B: Receive a $1400 gift each year for the next 10 years. The first $1400 would Option C: Receive a one-time gift of $17,000 10 years from today. be received 1 year from today. rate to be 3 % annually for the next 10 Compute the Present Value of each of these options if you expect the interest Which of these options does financial theory suggest you should choose? years. Option A would be worth $ today. 1. Aepo today. Option B would be worth $ 2. Option C would be worth S 3. 4. Financial theory supports choosing Option Compute the Present Value of each of these options if you expect the interest rate to be 6 % annually for the next 10 years. Which of these options does financial theory suggest you should choose? Option A would be worth $ 5. today. Option B would be worth $ 6 oday. today. 8. Financial theory supports choosing Option 7. Option C would be worth S Compute the Present Value of each of these options if you expect to be able to earn 9% annually for the next 10 years. Which of these options does financial theory suggest you should choose? 9. Option A would be worth $ 10. Option B would be worth $ 11. Option C would be worth $ 12. Financial theory supports choosing Option today. today. today. Decision #2: Planning for Retirement Erich and Mallory are 22, newly married, and ready to embark on the journey of life. They both plan to retire 45 years from today. Because their budget seems tight right now, they had been thinking that they would wait at least 10 years and then start investing $1800 per year to prepare for retirement. Mallory just told Erich, though, that she had heard that they would actually have more money the day they retire if they put $1800 per year away for the next 10 years and then simply let that money sit for the next 35 years without any additional payments-then they would have MORE when they retired than if they waited 10 years to start investing for retirement and then made yearly payments for 35 years (as they originally planned to do). Please help Erich and Mallory make an informed decision: Assume that all payments are made at the END a year (or month), and that the rate of return on all yearly investments will be 7.5 % annually (Please do NOT ROUND when entering "Rates" for any of the questions below) How much money will Erich and Mallory have in 45 years if they do nothing for the next 10 years, then put $1800 per year away for the remaining 35 years? a) How much money will Erich and Mallory have in 10 years if they put $1800 per year away for the next 10 years? b) c) How much will the amount you just computed grow to if it remains invested for the remaining 35 years, but without any additional yearly deposits being made? d) How much money will Erich and Mallory have in 45 years if they put $1800 per year away for each of the next 45 years? per MONTH at the end of each e) How much money will Erich and Mallory have in 45 years if they put away $150 month for the next 45 years? (Remember to adjust 7.5 % annual rate to a Rate per month!) f) If Erich and Mallory wait 25 years (after the kids are raised!) before they put anything away for retirement, how much will they have to put away at the end of each year for 20 years in order to have $700,000 saved up on the first day of their retirement 45 years from today