Answered step by step

Verified Expert Solution

Question

1 Approved Answer

unsure if these are the correct answer, please fix if necessary David, age 62, retires and receives $1,000 per month annuity from his employer's qualified

unsure if these are the correct answer, please fix if necessary

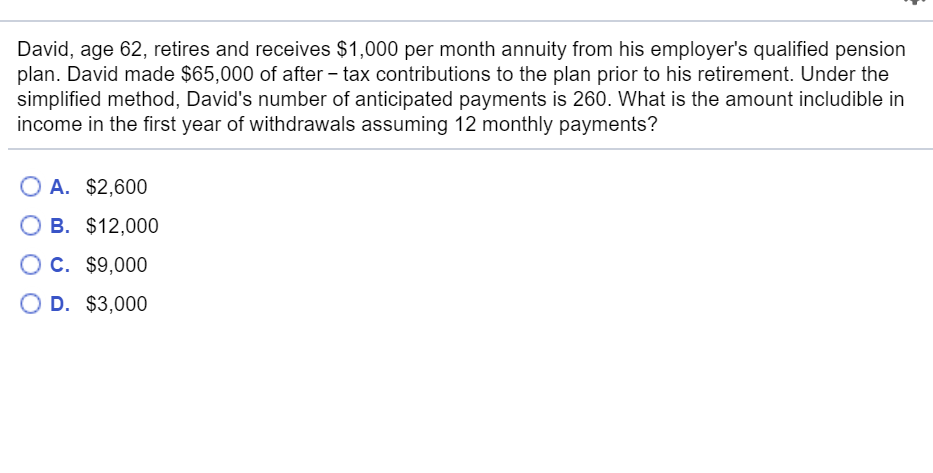

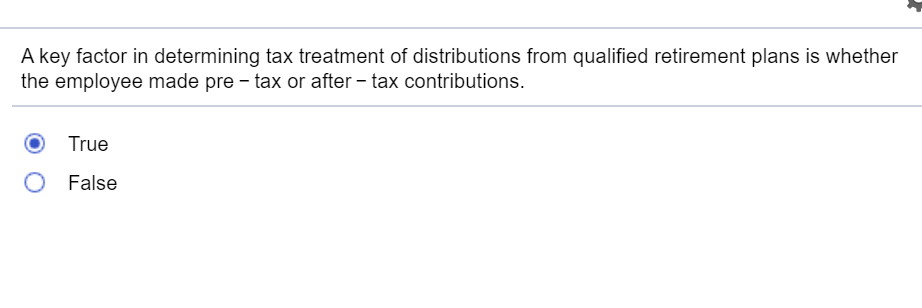

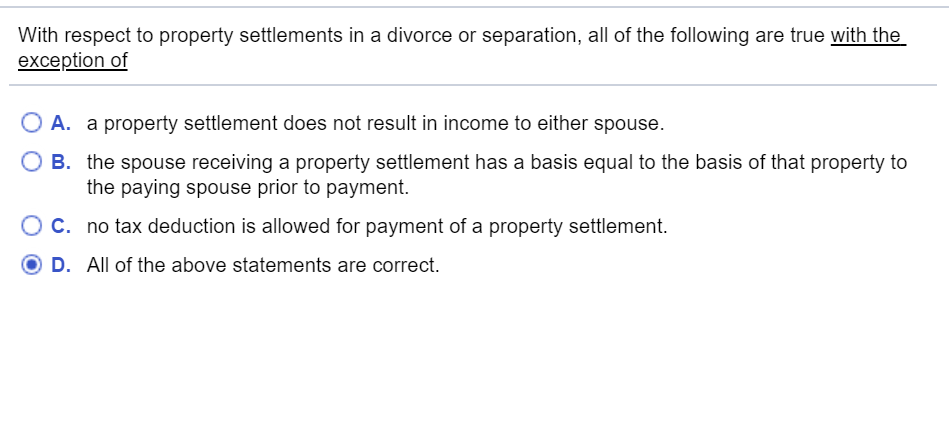

David, age 62, retires and receives $1,000 per month annuity from his employer's qualified pension plan. David made $65,000 of after-tax contributions to the plan prior to his retirement. Under the simplified method, David's number of anticipated payments is 260. What is the amount includible in income in the first year of withdrawals assuming 12 monthly payments? O A. $2,600 O B. $12,000 O c. $9,000 OD. $3,000 A key factor in determining tax treatment of distributions from qualified retirement plans is whether the employee made pre- tax or after-tax contributions. O O True False With respect to property settlements in a divorce or separation, all of the following are true with the exception of O A. a property settlement does not result in income to either spouse. O B. the spouse receiving a property settlement has a basis equal to the basis of that property to the paying spouse prior to payment. O c. no tax deduction is allowed for payment of a property settlement. OD. All of the above statements are correct. David, age 62, retires and receives $1,000 per month annuity from his employer's qualified pension plan. David made $65,000 of after-tax contributions to the plan prior to his retirement. Under the simplified method, David's number of anticipated payments is 260. What is the amount includible in income in the first year of withdrawals assuming 12 monthly payments? O A. $2,600 O B. $12,000 O c. $9,000 OD. $3,000 A key factor in determining tax treatment of distributions from qualified retirement plans is whether the employee made pre- tax or after-tax contributions. O O True False With respect to property settlements in a divorce or separation, all of the following are true with the exception of O A. a property settlement does not result in income to either spouse. O B. the spouse receiving a property settlement has a basis equal to the basis of that property to the paying spouse prior to payment. O c. no tax deduction is allowed for payment of a property settlement. OD. All of the above statements are correctStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started