Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Until recently, Augean Cleaning Products sold its products on terms of net 64, with an average collection period of 79 days. In an attempt

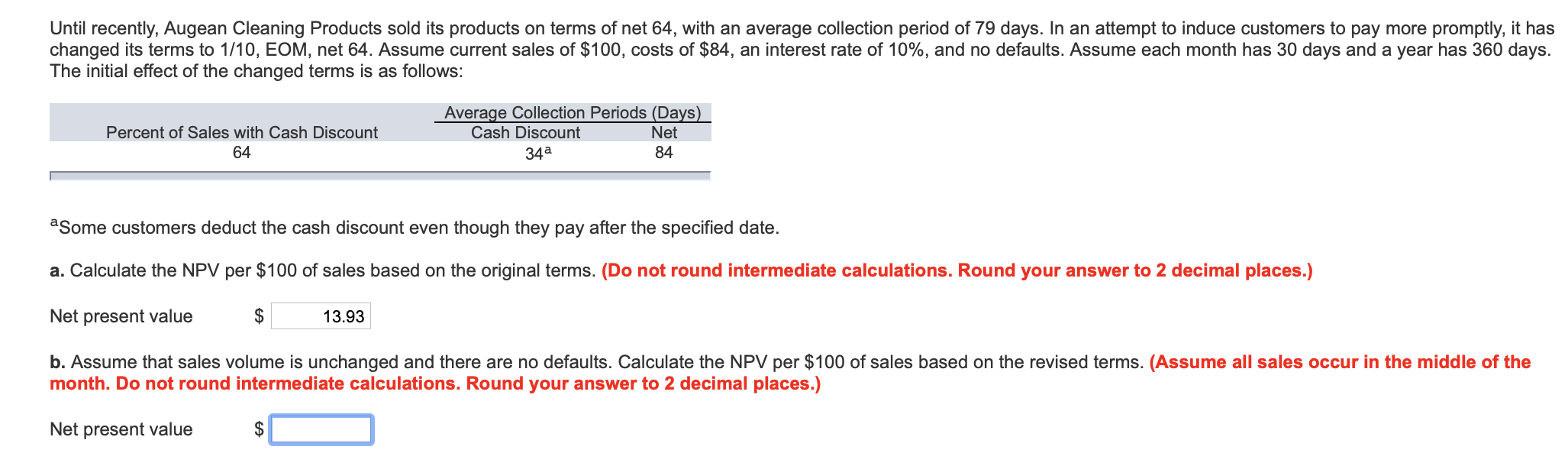

Until recently, Augean Cleaning Products sold its products on terms of net 64, with an average collection period of 79 days. In an attempt to induce customers to pay more promptly, it has changed its terms to 1/10, EOM, net 64. Assume current sales of $100, costs of $84, an interest rate of 10%, and no defaults. Assume each month has 30 days and a year has 360 days. The initial effect of the changed terms is as follows: Percent of Sales with Cash Discount 64 Average Collection Periods (Days) Cash Discount 34 Net 84 aSome customers deduct the cash discount even though they pay after the specified date. a. Calculate the NPV per $100 of sales based on the original terms. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Net present value $ 13.93 b. Assume that sales volume is unchanged and there are no defaults. Calculate the NPV per $100 of sales based on the revised terms. (Assume all sales occur in the middle of the month. Do not round intermediate calculations. Round your answer to 2 decimal places.) Net present value $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the net present value NPV per 100 of sales based on the original terms we need to consider the cash flows associated with the collection ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started