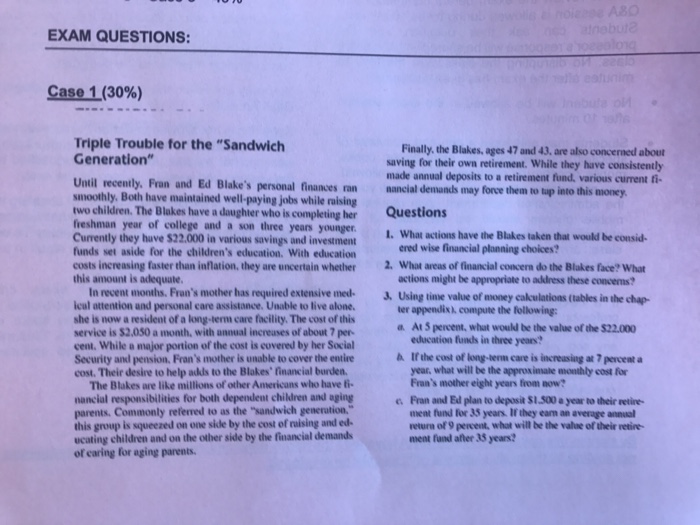

Until recently, Fran and Ed Blake's personal finances ran smoothly. Both haw maintained well-paying jobs while rowing two children. The Blakes haw a daughter who is completing her freshman year of college and a son three years younger. Currently they have exist22,000 in various savings and investment funds set aside for the children's education. With education costs increasing faster than inflation, they are uncertain whether this amount is adequate. In recent months. Fran's mother has required extensive medical attention and personal care assistance. Unable to live alone. she it now a resident of a long-term care facility. The cost of this service is exist2.050 a month, with annual increases of about 7 per-cent. While a major portion of cost is covered by her Social Security and pension. Fran's mother is unable to cover the entire cost. Their desire to help adds to the Blakes' financial burden. The Blakes are like millions of other Americans who have financial responsibilities for both dependent children and aging parents. Commonly referred to us the "sandwich generation, this group is squeezed on one side by the cost of raising and educating Children and on the tuber side by the financial demands of caring for aging parents. Finally, the Blakes ages 47 and 43, art also concerned about saving for their own retirement. While they have consistently made annual deposits to a retirement fund, various current financial demands may force them to tap into this money. What actions have the Blakes taken that would be considered wise financial planning choices? What areas of financial concern do the Blakes face? What actions might be appropriate to address these concerns? Using time value of money calculations (tables in the chapter appendix), compute the following: a. At 5 percent, what would be the value of the exist22,000 education funds in three year? b. If the cost of long-term care is increasing at 7 percent a year, what will be the approximate monthly cost for Fran's mother eight year from now? c. Fran and Ed plan to deposit exist1.500 a year to their retire-item fund for 35 years. If they earn an average annual return of 9 percent, what will be the value of their retirement fund after 35 years