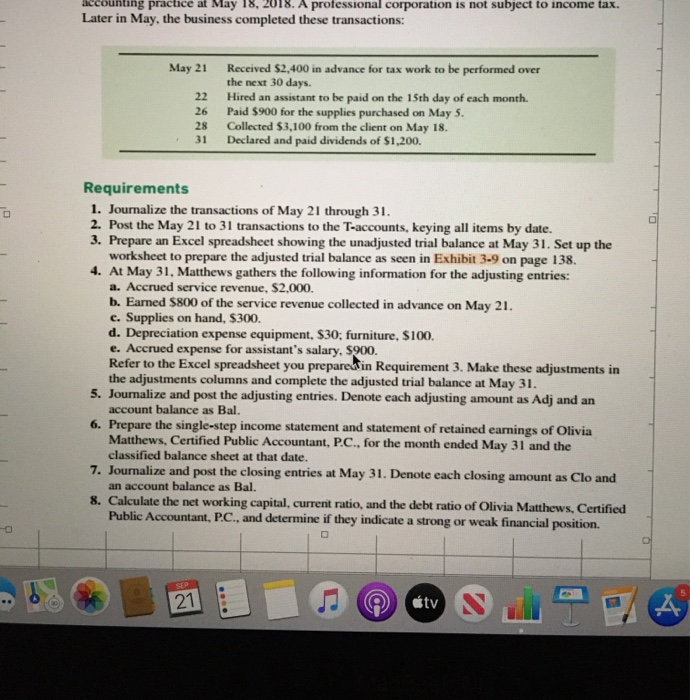

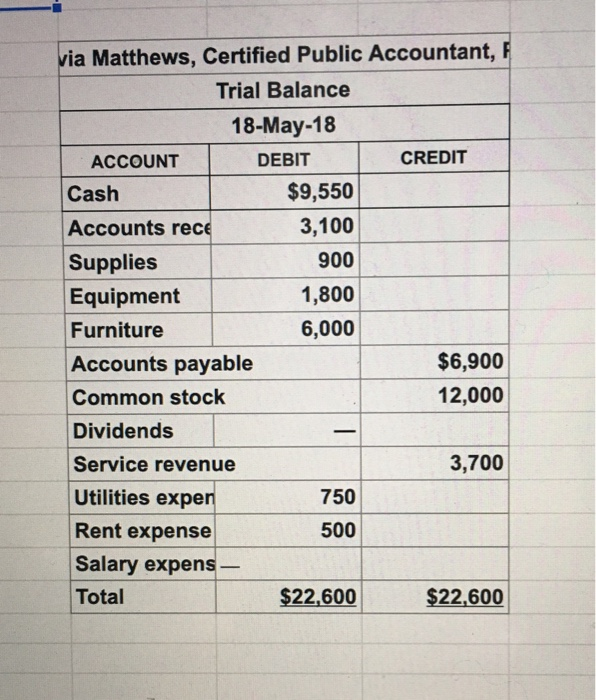

unting practice at May 18, 2018. A professional corporation is not subject to income tax. Later in May, the business completed these transactions: May 21 22 26 28 31 Received $2,400 in advance for tax work to be performed over the next 30 days. Hired an assistant to be paid on the 15th day of each month. Paid $900 for the supplies purchased on May 5. Collected $3,100 from the client on May 18. Declared and paid dividends of $1,200. Requirements 1. Journalize the transactions of May 21 through 31. 2. Post the May 21 to 31 transactions to the T-accounts, keying all items by date. 3. Prepare an Excel spreadsheet showing the unadjusted trial balance at May 31. Set up the worksheet to prepare the adjusted trial balance as seen in Exhibit 3-9 on page 138. 4. At May 31, Matthews gathers the following information for the adjusting entries: a. Accrued service revenue, $2,000. b. Earned $800 of the service revenue collected in advance on May 21. c. Supplies on hand, $300. d. Depreciation expense equipment, $30; furniture, $100. e. Accrued expense for assistant's salary. $900. Refer to the Excel spreadsheet you prepareutin Requirement 3. Make these adjustments in the adjustments columns and complete the adjusted trial balance at May 31. 5. Journalize and post the adjusting entries. Denote each adjusting amount as Adj and an account balance as Bal. 6. Prepare the single-step income statement and statement of retained earnings of Olivia Matthews, Certified Public Accountant, P.C., for the month ended May 31 and the classified balance sheet at that date. 7. Journalize and post the closing entries at May 31. Denote cach closing amount as Clo and an account balance as Bal. 8. Calculate the net working capital, current ratio, and the debt ratio of Olivia Matthews, Certified Public Accountant, P.C., and determine if they indicate a strong or weak financial position. 21 C tv via Matthews, Certified Public Accountant, F Trial Balance 18-May-18 ACCOUNT DEBIT CREDIT Cash $9,550 Accounts rece 3,100 Supplies 900 Equipment 1,800 Furniture 6,000 Accounts payable $6,900 Common stock 12,000 Dividends Service revenue 3,700 Utilities expen 750 Rent expense 500 Salary expens - Total $22,600 $22,600 unting practice at May 18, 2018. A professional corporation is not subject to income tax. Later in May, the business completed these transactions: May 21 22 26 28 31 Received $2,400 in advance for tax work to be performed over the next 30 days. Hired an assistant to be paid on the 15th day of each month. Paid $900 for the supplies purchased on May 5. Collected $3,100 from the client on May 18. Declared and paid dividends of $1,200. Requirements 1. Journalize the transactions of May 21 through 31. 2. Post the May 21 to 31 transactions to the T-accounts, keying all items by date. 3. Prepare an Excel spreadsheet showing the unadjusted trial balance at May 31. Set up the worksheet to prepare the adjusted trial balance as seen in Exhibit 3-9 on page 138. 4. At May 31, Matthews gathers the following information for the adjusting entries: a. Accrued service revenue, $2,000. b. Earned $800 of the service revenue collected in advance on May 21. c. Supplies on hand, $300. d. Depreciation expense equipment, $30; furniture, $100. e. Accrued expense for assistant's salary. $900. Refer to the Excel spreadsheet you prepareutin Requirement 3. Make these adjustments in the adjustments columns and complete the adjusted trial balance at May 31. 5. Journalize and post the adjusting entries. Denote each adjusting amount as Adj and an account balance as Bal. 6. Prepare the single-step income statement and statement of retained earnings of Olivia Matthews, Certified Public Accountant, P.C., for the month ended May 31 and the classified balance sheet at that date. 7. Journalize and post the closing entries at May 31. Denote cach closing amount as Clo and an account balance as Bal. 8. Calculate the net working capital, current ratio, and the debt ratio of Olivia Matthews, Certified Public Accountant, P.C., and determine if they indicate a strong or weak financial position. 21 C tv via Matthews, Certified Public Accountant, F Trial Balance 18-May-18 ACCOUNT DEBIT CREDIT Cash $9,550 Accounts rece 3,100 Supplies 900 Equipment 1,800 Furniture 6,000 Accounts payable $6,900 Common stock 12,000 Dividends Service revenue 3,700 Utilities expen 750 Rent expense 500 Salary expens - Total $22,600 $22,600