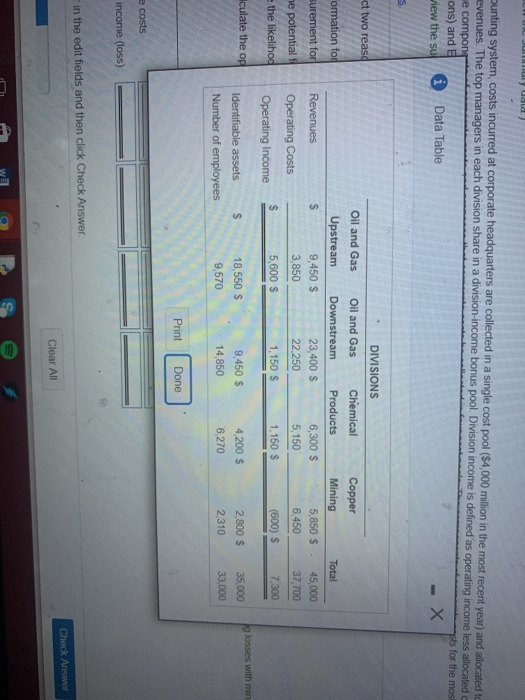

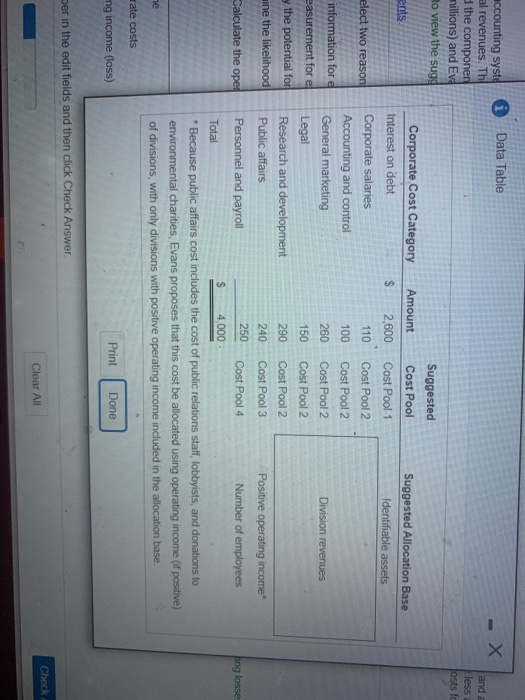

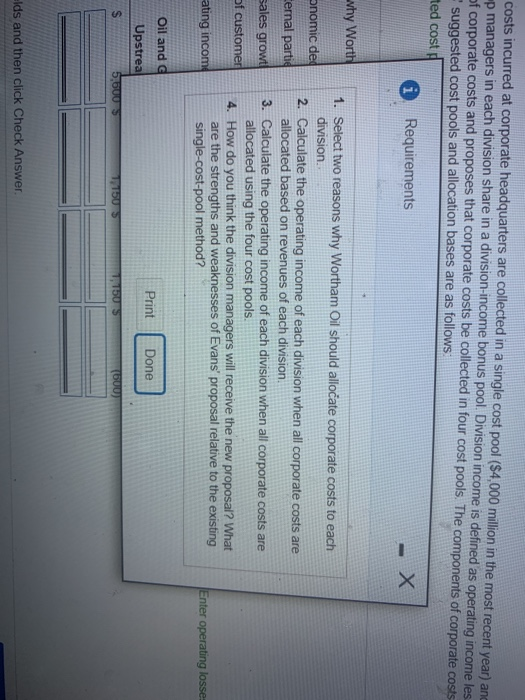

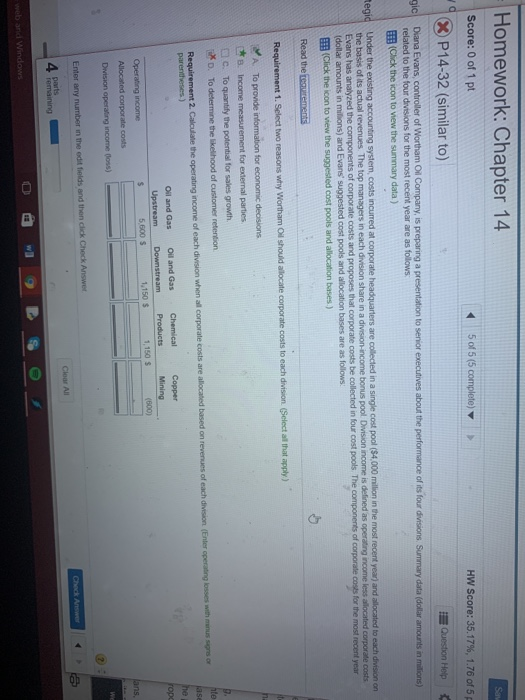

unting system, costs incurred at corporate headquarters are collected in a single cost pool ($4,000 million in the most recent year) and allocated to evenues. The top managers in each division share in a division-income bonus pool. Division income is defined as operating income less allocated e compong ons) and asts for the mos view the su B Data Table ct two reaso Formation for surement for he potential f the likelihod DIVISIONS Oil and Gas Oil and Gas Chemical Upstream Downstream Products 9,450 $ 23,400 $ 6,300 $ 3,850 22,250 5,150 $ 5,600 $ 1,150 $ 1,150 $ Revenues Operating Costs Operating Income Copper Mining 5,850 $ 6,450 (600) $ Total 45,000 37,700 7,300 lculate the op glosses with min $ Identifiable assets Number of employees 18,550 S 9,570 9,450 $ 14,850 4,200 $ 6,270 2,800 $ 2,310 35,000 33,000 Print Done e costs income (loss) in the edit fields and then click Check Answer Check Answer Clear All i Data Table accounting syste al revenues. Th the componen millions) and Eve to view the sugg and a less Josts fc ents elect two reason information for easurement for el y the potential for Suggested Corporate Cost Category Amount Cost Pool Suggested Allocation Base Interest on debt 2,600 Cost Pool 1 Identifiable assets Corporate salaries 110 Cost Pool 2 Accounting and control 100 Cost Pool 2 General marketing Cost Pool 2 Division revenues Legal Cost Pool 2 Research and development Cost Pool 2 Public affairs Cost Pool 3 Positive operating income" Personnel and payroll Cost Pool 4 Number of employees $ 4,000 Total * Because public affairs cost includes the cost of public relations staff, lobbyists, and donations to environmental charities, Evans proposes that this cost be allocated using operating income (if positive) of divisions, with only divisions with positive operating income included in the allocation base. mine the likelihood Calculate the opel ping losse he rate costs mng income (loss) Print Done Der in the edit fields and then click Check Answer Check Clear All costs incurred at corporate headquarters are collected in a single cost pool ($4,000 million in the most recent year) and up managers in each division share in a division-income bonus pool. Division income is defined as operating income les of corporate costs and proposes that corporate costs be collected in four cost pools. The components of corporate costs suggested cost pools and allocation bases are as follows: ted cost Requirements why Worth onomic de Cernal partie sales growt of customer 1. Select two reasons why Wortham Oil should allocate corporate costs to each division. 2. Calculate the operating income of each division when all corporate costs are allocated based on revenues of each division 3. Calculate the operating income of each division when all corporate costs are allocated using the four cost pools. 4. How do you think the division managers will receive the new proposal? What are the strengths and weaknesses of Evans' proposal relative to the existing single-cost-pool method? ating income Enter operating losse Print Done Oil and Upstrea 5,500 $ 150 $ (500) elds and then click Check Answer Homework: Chapter 14 Score: 0 of 1 pt 9X P14-32 (similar to) 5 of 5 (5 complete) HW Score: 35.17%, 1.76 of 5 Question Help gic Diana Evans, controller of Wortham Oil Company, is preparing a presentation to senior executives about the performance of its four divisions. Summary data (dollar amounts in millions) related to the four divisions for the most recent year are as follows: (Click the icon to view the summary data) Under the existing accounting system, costs incurred at corporate headquarters are collected in a single cost pool ($4.000 million in the most recent year) and allocated to each division on the basis of its actual revenues the top managers in each division share in a division-income bonus pool vision income is delined as operating income less allocated corporate costs Evans has analyzed the components of corporate costs and proposes that corporate costs be collected in four cost pools. The components of corporate costs for the most recent year (dollar amounts in milions) and Evans' suggested cost pools and allocation bases are as follows: (Click the icon to view the suggested cost pools and allocation bases.) Read the new Requirement 1. Select two reasons why Wortham Oil should allocate corporate costs to each division (Select all that apply) A BAB To provide information for economic decisions Income measurement for external parties To quantify the potential for sales growth To determine the likelihood of customer retention o lase he ropa Requirement 2. Calculate the operating income of each division when all corporate costs are allocated based on revenues of each division (Enter operating losses with muss parentheses) Oil and Gas Oil and Gas Chemical Copper Upstream Downstream Products Mining Operating income 5600 S 1,150 $ 1,150 $ (500) Allocated corporate costs Division operating income foss) lans, Enter any number in the edit fields and then click Check Answer Check A Clour All A parts 4 orang web and Windows