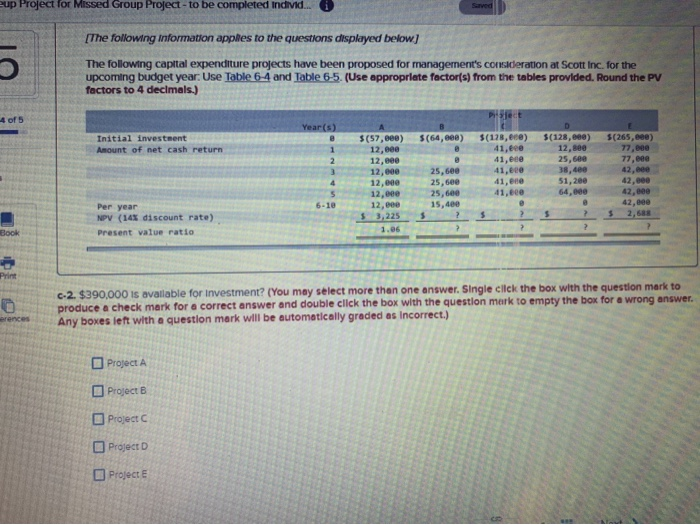

up Project lor Missed Group Project - to be completed individ. i [The following information applies to the questions displayed below) The following capital expenditure projects have been proposed for managements conceration at Scott Inc. for the upcoming budget year: Use Table 6-4 and Table 6-5. (Use appropriate factor(s) from the tables provided. Round the PV factors to 4 decimals.) Year(s) Initial investment Amount of net cash return 5(64,00) 5(178, ece) $(57,000) 12, cee 12.00e 12,600 12.ee 12,eee 12,00 (128,00) 12,800 25,600 18.de 51. 20 5(265, cee) 77, 77. 25,600 25, see 11.ee 11.ee 42.000 42,000 42. 2,683 Per year NPV (14% discount rate) Present value ratio 3,225 $ 1 0.2 $390,000 is available for investment? [You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) rence Project A Project B Project Project D Project up Project lor Missed Group Project - to be completed individ. i [The following information applies to the questions displayed below) The following capital expenditure projects have been proposed for managements conceration at Scott Inc. for the upcoming budget year: Use Table 6-4 and Table 6-5. (Use appropriate factor(s) from the tables provided. Round the PV factors to 4 decimals.) Year(s) Initial investment Amount of net cash return 5(64,00) 5(178, ece) $(57,000) 12, cee 12.00e 12,600 12.ee 12,eee 12,00 (128,00) 12,800 25,600 18.de 51. 20 5(265, cee) 77, 77. 25,600 25, see 11.ee 11.ee 42.000 42,000 42. 2,683 Per year NPV (14% discount rate) Present value ratio 3,225 $ 1 0.2 $390,000 is available for investment? [You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) rence Project A Project B Project Project D Project