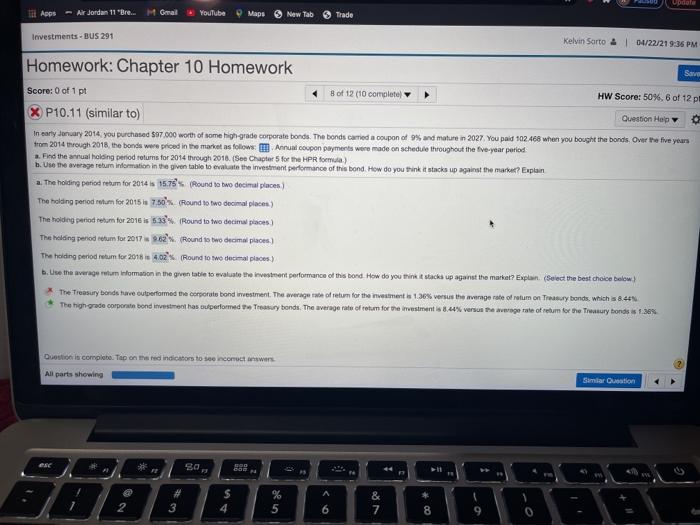

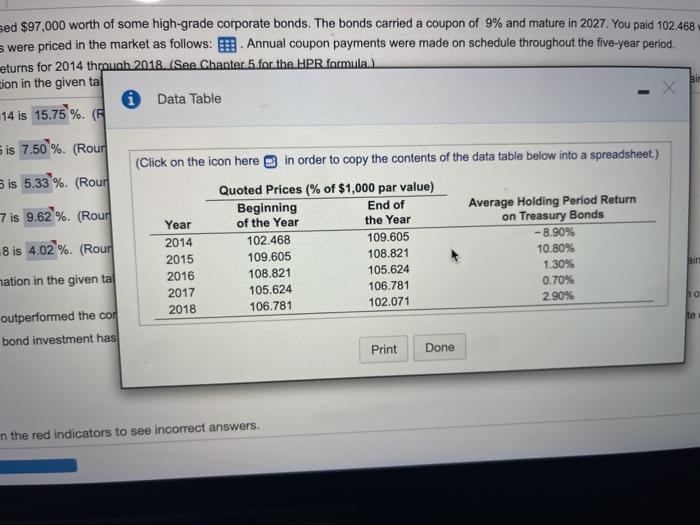

Update Apps Air Jordan 11 Bre... M Gmal YouTube Maps New Tab Trade Investments - BUS 291 Kelvin Sarto & 01/22/21 9:36 PM Homework: Chapter 10 Homework Save Score: 0 of 1 pt 8 of 12 (10 complete HW Score: 50%, 6 of 12 p X P10.11 (similar to) Question Help In early January 2014, you purchased $97.000 worth of some high-grade corporate bonds. The bonds carried a coupon of 9% and mature in 2027. You paid 102.468 when you bought the bonds. Over the five years for 2014 through 2018, the bonds were priced in the market as follows Annual coupon payments were made on schedule throughout the five-year period a. Find the annual holding period returns for 2014 through 2018. (See Chapters for the HPR formula) b. Use the average return information in the given table to evaluate the investment performance of this bond. How do you think it stacks up against the marker? Explain a. The holding period return for 2014 i 15.78% (Round to two decimal places) The holding period return for 2015 17.50% (Round to two decimal places) The holding period return for 2016 is 33% Round to two decimal places) The holding period reum for 2017 02 (Round to two decimal places) The holding period reum for 2018 4:02. Round to wo decimal places) b. Use the average rulum information in the given table to evaluate the investment performance of this bord. How do you think stacks up against the market? Explain. (Select the best choice below) The Treasury bonds tuve outperformed the corporate bond investment. The average rate of return for the netent is 1.36% versus the average rate of retum on Truy bonds, which 8.40N The high grade corporate bond investment has outperformed a Treasury bonds. The average rate of return for the moustment is 8.44% versus the wage rate of retum for the Treaty bonds is 1.26% Dution is completeTap on the red indicators to see incorrect answers All parts showing Similar ustion e *** so F CO $ 4 2 3 & 7 5 6 8 9 0 sed $97,000 worth of some high-grade corporate bonds. The bonds carried a coupon of 9% and mature in 2027. You paid 102.468 were priced in the market as follows: Annual coupon payments were made on schedule throughout the five-year period. eturns for 2014 through 2018. (See Chapter 5 for the HPR formula.) cion in the given tal X i Data Table 14 is 15.75%. Bir is 7.50 %. (Rour (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Sis 5.33 %. (Rour 7 is 9.62 %. (Rour 8 is 4.02%. (Rour Year 2014 2015 2016 2017 2018 Quoted Prices % of $1,000 par value) Beginning End of of the Year the Year 102.468 109.605 109.605 108.821 108.821 105.624 105.624 106.781 106.781 102.071 Average Holding Period Return on Treasury Bonds -8.90% 10.80% 1.30% 0.70% 2.90% mation in the given ta ho outperformed the com bond investment has Print Done in the red indicators to see incorrect answers