update desperately need help pls

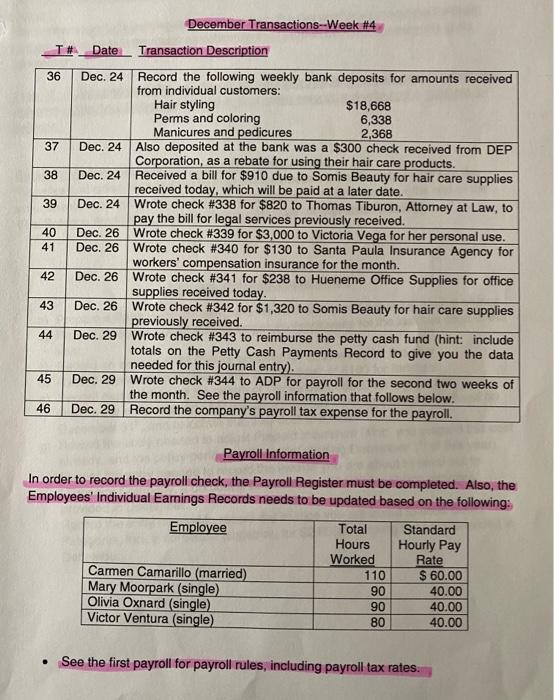

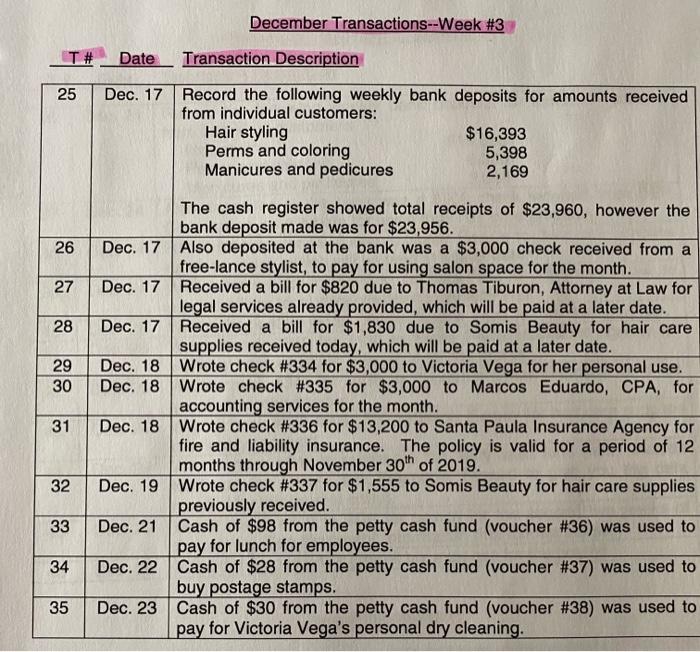

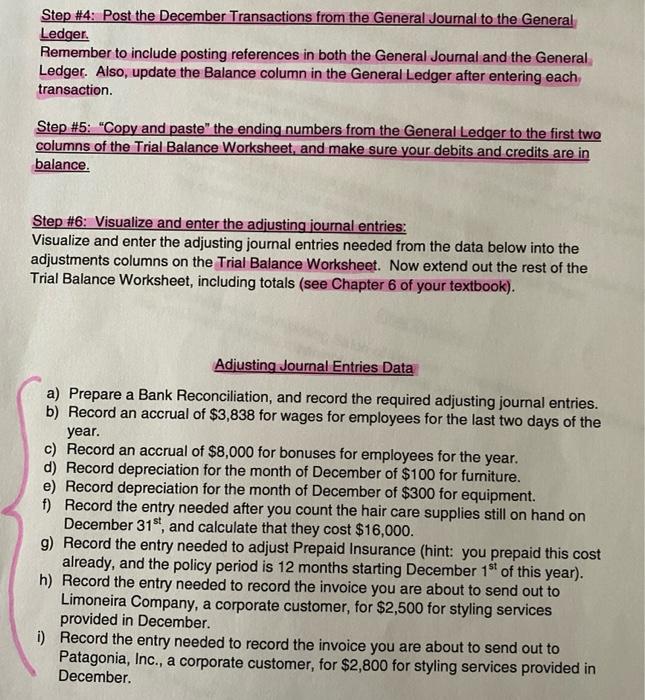

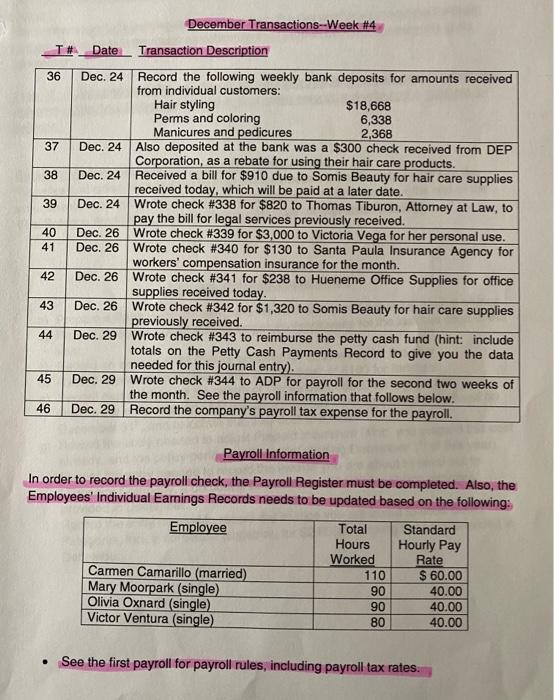

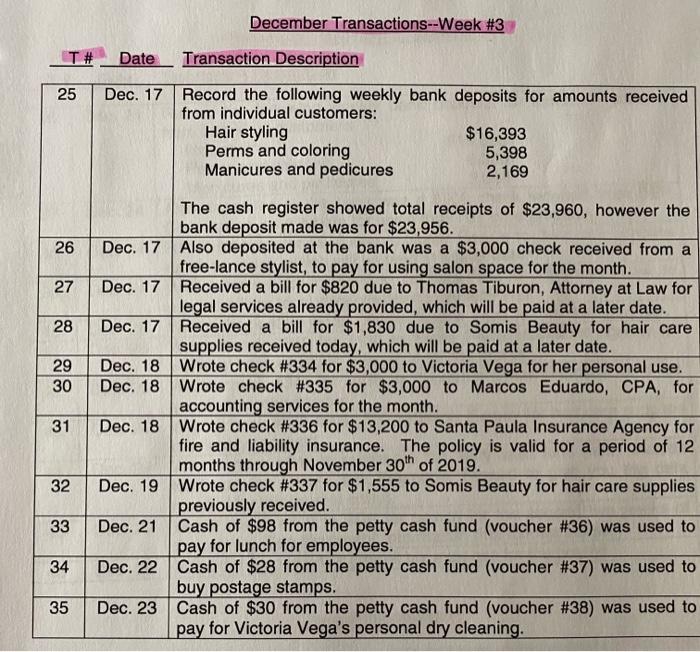

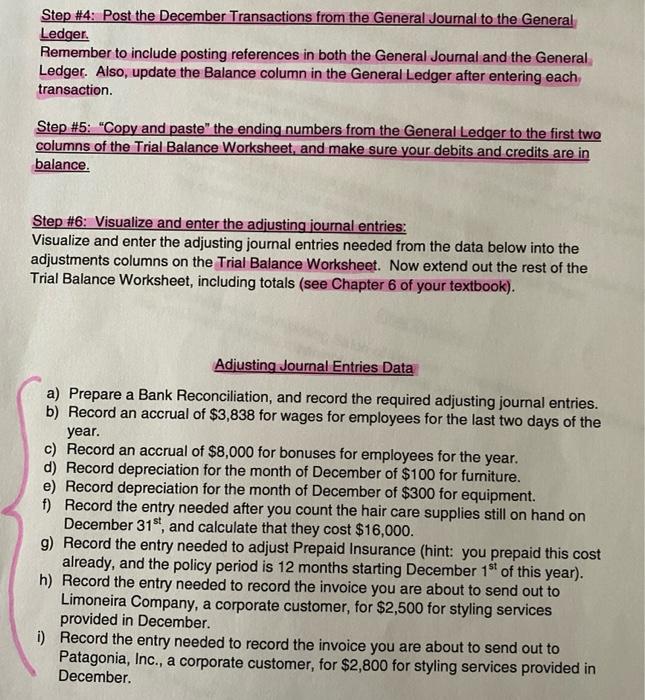

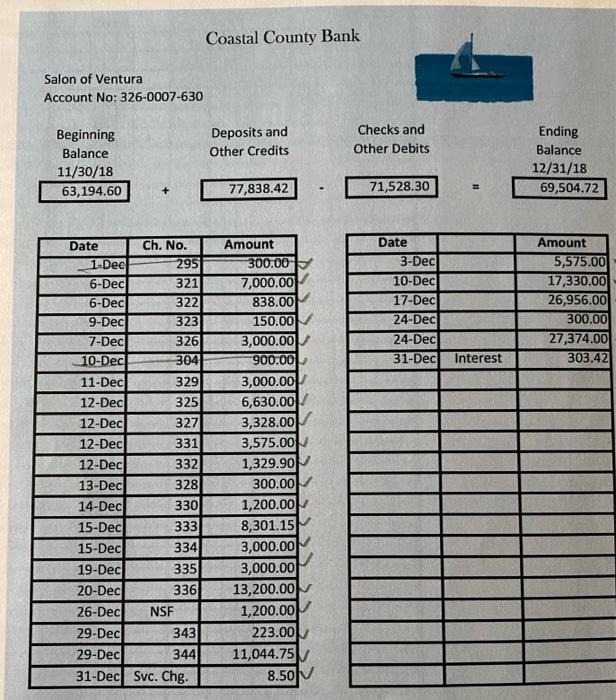

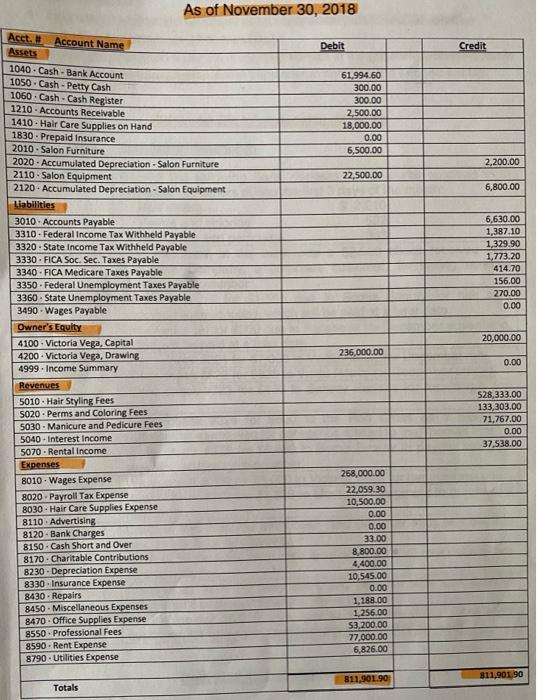

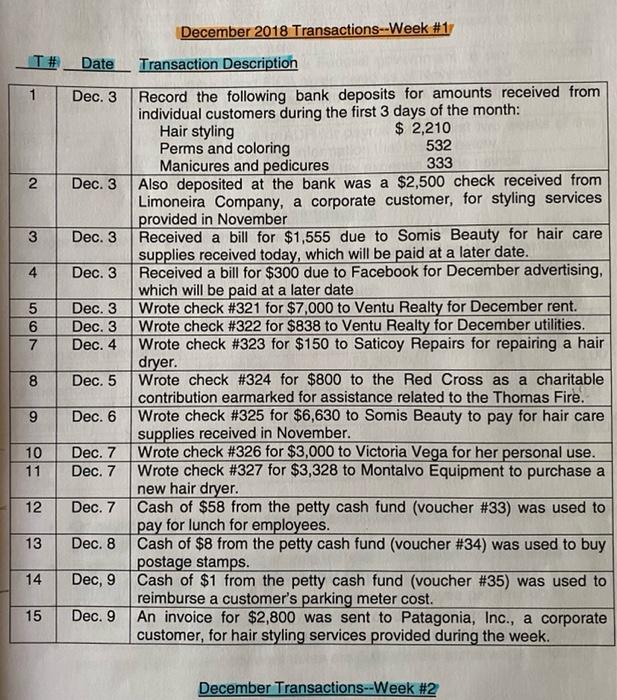

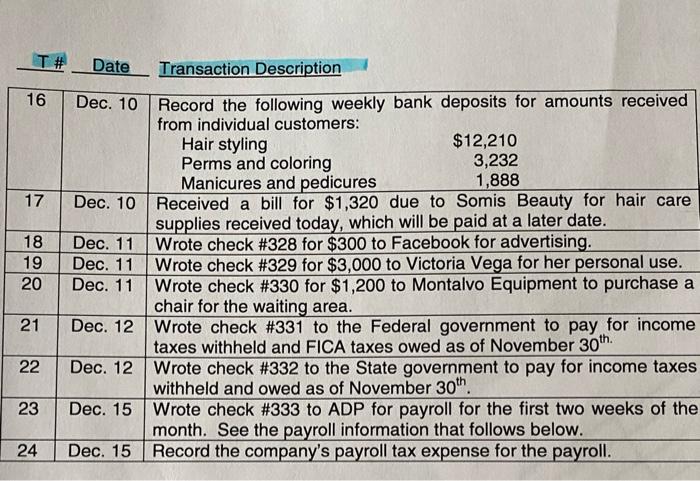

December Transactions--Week #4 T # Date Transaction Description 36 Dec. 24 Record the following weekly bank deposits for amounts received from individual customers: Hair styling $18,668 Perms and coloring 6,338 Manicures and pedicures 2.368 37 Dec. 24 Also deposited at the bank was a $300 check received from DEP Corporation, as a rebate for using their hair care products. 38 Dec. 24 Received a bill for $910 due to Somis Beauty for hair care supplies received today, which will be paid at a later date. 39 Dec. 24 Wrote check #338 for $820 to Thomas Tiburon, Attorney at Law, to pay the bill for legal services previously received. 40 Dec. 26 Wrote check #339 for $3,000 to Victoria Vega for her personal use. 41 Dec. 26 Wrote check #340 for $130 to Santa Paula Insurance Agency for workers' compensation insurance for the month. 42 Dec. 26 Wrote check #341 for $238 to Hueneme Office Supplies for office supplies received today. 43 Dec. 26 Wrote check #342 for $1,320 to Somis Beauty for hair care supplies previously received. 44 Dec. 29 Wrote check #343 to reimburse the petty cash fund (hint: include totals on the Petty Cash Payments Record to give you the data needed for this journal entry). 45 Dec. 29 Wrote check #344 to ADP for payroll for the second two weeks of the month. See the payroll information that follows below. 46 Dec. 29 Record the company's payroll tax expense for the payroll. Payroll Information In order to record the payroll check, the Payroll Register must be completed. Also, the Employees' Individual Earnings Records needs to be updated based on the following: Employee Total Standard Hours Hourly Pay Worked Rate Carmen Camarillo (married) 110 $ 60.00 Mary Moorpark (single) 90 40.00 Olivia Oxnard (single) 90 40.00 Victor Ventura (single) BO 40.00 See the first payroll for payroll rules, including payroll tax rates. December Transactions--Week #3 T# Date Transaction Description 25 Dec. 17 Record the following weekly bank deposits for amounts received from individual customers: Hair styling $16,393 Perms and coloring 5,398 Manicures and pedicures 2,169 26 27 28 29 30 31 The cash register showed total receipts of $23,960, however the bank deposit made was for $23,956. Dec. 17 Also deposited at the bank was a $3,000 check received from a free-lance stylist, to pay for using salon space for the month. Dec. 17 Received a bill for $820 due to Thomas Tiburon, Attorney at Law for legal services already provided, which will be paid at a later date. Dec. 17 Received a bill for $1,830 due to Somis Beauty for hair care supplies received today, which will be paid at a later date. Dec. 18 Wrote check #334 for $3,000 to Victoria Vega for her personal use. Dec. 18 Wrote check #335 for $3,000 to Marcos Eduardo, CPA, for accounting services for the month. Dec. 18 Wrote check #336 for $13,200 to Santa Paula Insurance Agency for fire and liability insurance. The policy is valid for a period of 12 months through November 30th of 2019. Dec. 19 Wrote check #337 for $1,555 to Somis Beauty for hair care supplies previously received. Dec. 21 Cash of $98 from the petty cash fund (voucher #36) was used to pay for lunch for employees. Dec. 22 Cash of $28 from the petty cash fund (voucher #37) was used to buy postage stamps. Dec. 23 Cash of $30 from the petty cash fund (voucher #38) was used to pay for Victoria Vega's personal dry cleaning. 32 33 34 35 Step #4: Post the December Transactions from the General Journal to the General Ledger Remember to include posting references in both the General Journal and the General Ledger. Also, update the Balance column in the General Ledger after entering each transaction. Step #5: "Copy and paste" the ending numbers from the General Ledger to the first two columns of the Trial Balance Worksheet, and make sure your debits and credits are in balance. Step #6: Visualize and enter the adjusting journal entries: Visualize and enter the adjusting journal entries needed from the data below into the adjustments columns on the Trial Balance Worksheet. Now extend out the rest of the Trial Balance Worksheet, including totals (see Chapter 6 of your textbook). Adjusting Journal Entries Data a) Prepare a Bank Reconciliation, and record the required adjusting journal entries. b) Record an accrual of $3,838 for wages for employees for the last two days of the year. c) Record an accrual of $8,000 for bonuses for employees for the year. d) Record depreciation for the month of December of $100 for furniture. e) Record depreciation for the month of December of $300 for equipment. f) Record the entry needed after you count the hair care supplies still on hand on December 31st, and calculate that they cost $16,000. g) Record the entry needed to adjust Prepaid Insurance (hint: you prepaid this cost already, and the policy period is 12 months starting December 19 of this year). h) Record the entry needed to record the invoice you are about to send out to Limoneira Company, a corporate customer, for $2,500 for styling services provided in December. i) Record the entry needed to record the invoice you are about to send out to Patagonia, Inc., a corporate customer, for $2,800 for styling services provided in December. Coastal County Bank Salon of Ventura Account No: 326-0007-630 Deposits and Other Credits Checks and Other Debits Beginning Balance 11/30/18 63,194.60 Ending Balance 12/31/18 69,504.72 = + 77,838.42 71,528.30 Date 3-Dec 10-Dec 17-Dec 24-Dec 24-Dec 31-Dec Amount 5,575.00 17,330.00 26,956.00 300.00 27,374.00 303.42 Interest Date Ch. No. 1-Dec 295 6-Dec 321) 6-Dec 322 9-Dec 323 7-Dec 326 10-Dec 304 11-Dec 329 12-Dec 325 12-Dec 327 12-Dec 331 12-Dec 332 13-Dec 328 14-Dec 330 15-Dec 333 15-Dec 334 19-Dec 335 20-Dec 336 26-Dec NSF 29-Dec 343 29-Dec 344 31-Dec Svc. Chg. Amount 300.00 7,000.00 838.00 150.00 3,000.00 900.00 3,000.00 6,630.00 3,328.00 3,575.00 1,329.90 300.00 1,200.00 8,301.15| 3,000.00 3,000.00 13,200.00 1,200.00 223.00 11,044.75 8.50 As of November 30, 2018 Debit Credit 61.994.60 300.00 300.00 2,500.00 18,000.00 0.00 6,500.00 2,200.00 22,500.00 6,800.00 6,630.00 1,387.10 1,329.90 1.773.20 414.70 156.00 270.00 0.00 20,000.00 Acct. Account Name Assets 1040 - Cash - Bank Account 1050 - Cash - Petty Cash 1060 - Cash Cash Register 1210 - Accounts Receivable 1410 - Hair Care Supplies on Hand 1830 - Prepaid Insurance 2010 - Salon Furniture 2020. Accumulated Depreciation - Salon Furniture 2110. Salon Equipment 2120. Accumulated Depreciation - Salon Equipment Liabilities 3010. Accounts Payable 3310 - Federal Income Tax Withheld Payable 3320 - State Income Tax Withheld Payable 3330 - FICA Soc. Sec. Taxes Payable 3340. FICA Medicare Taxes Payable 3350 - Federal Unemployment Taxes Payable 3360 - State Unemployment Taxes Payable 3490. Wages Payable Owner's Equity 4100 - Victoria Vega, Capital 4200 - Victoria Vega, Drawing 4999. Income Summary Revenues 5010. Hair Styling Fees S020. Perms and Coloring Fees 5030 - Manicure and pedicure Fees 5040. Interest Income 5070 - Rental Income Expenses 8010. Wages Expense 8020 Payroll Tax Expense 8030 - Hair Care Supplies Expense 8110 Advertising 8120 - Bank Charges 8150 Cash Short and Over 8170 - Charitable Contributions 8230 - Depreciation Expense 8330. Insurance Expense 8430. Repairs 8450. Miscellaneous Expenses 8470 - Office Supplies Expense 8550 - Professional Fees 8590 - Rent Expense 8790 Utilities Expense 236,000.00 0.00 528,333.00 133,303.00 71,767.00 0.00 37,538.00 268,000.00 22,059.30 10,500.00 0.00 0.00 33.00 8,800.00 4.400.00 10.545.00 0.00 1,188.00 1,256.00 53,200.00 77,000.00 6,826.00 811,901.90 811,901.90 Totals December 2018 Transactions--Week #1 T# Date 1 Dec. 3 2 Dec. 3 3 3 Dec. 3 4 Dec. 3 Vool 5 6 7 Dec. 3 Dec. 3 Dec. 4 Transaction Description Record the following bank deposits for amounts received from individual customers during the first 3 days of the month: Hair styling $ 2,210 Perms and coloring 532 Manicures and pedicures 333 Also deposited at the bank was a $2,500 check received from Limoneira Company, a corporate customer, for styling services provided in November Received a bill for $1,555 due to Somis Beauty for hair care supplies received today, which will be paid at a later date. Received a bill for $300 due to Facebook for December advertising, which will be paid at a later date Wrote check #321 for $7,000 to Ventu Realty for December rent. Wrote check #322 for $838 to Ventu Realty for December utilities. Wrote check #323 for $150 to Saticoy Repairs for repairing a hair dryer. Wrote check #324 for $800 to the Red Cross as a charitable contribution earmarked for assistance related to the Thomas Fire. Wrote check #325 for $6,630 to Somis Beauty to pay for hair care supplies received in November. Wrote check #326 for $3,000 to Victoria Vega for her personal use. Wrote check #327 for $3,328 to Montalvo Equipment to purchase a new hair dryer. Cash of $58 from the petty cash fund (voucher #33) was used to pay for lunch for employees. Cash of $8 from the petty cash fund (voucher #34) was used to buy postage stamps. Cash of $1 from the petty cash fund (voucher #35) was used to reimburse a customer's parking meter cost. An invoice for $2,800 was sent to Patagonia, Inc., a corporate customer, for hair styling services provided during the week. 8 8 Dec. 5 9 Dec. 6 10 11 Dec. 7 Dec. 7 12 Dec. 7 13 Dec. 8 14 Dec, 9 15 Dec. 9 December Transactions--Week #2 T# 16 17 18 19 Date Transaction Description Dec. 10 Record the following weekly bank deposits for amounts received from individual customers: Hair styling $12,210 Perms and coloring 3,232 Manicures and pedicures 1,888 Dec. 10 Received a bill for $1,320 due to Somis Beauty for hair care supplies received today, which will be paid at a later date. Dec. 11 Wrote check #328 for $300 to Facebook for advertising. Dec. 11 Wrote check #329 for $3,000 to Victoria Vega for her personal use. Dec. 11 Wrote check #330 for $1,200 to Montalvo Equipment to purchase a chair for the waiting area. Dec. 12 Wrote check #331 to the Federal government to pay for income taxes withheld and FICA taxes owed as of November 30th. Dec. 12 Wrote check #332 to the State government to pay for income taxes withheld and owed as of November 30th. Dec. 15 Wrote check #333 to ADP for payroll for the first two weeks of the month. See the payroll information that follows below. Dec. 15 Record the company's payroll tax expense for the payroll. 20 21 22 23 24