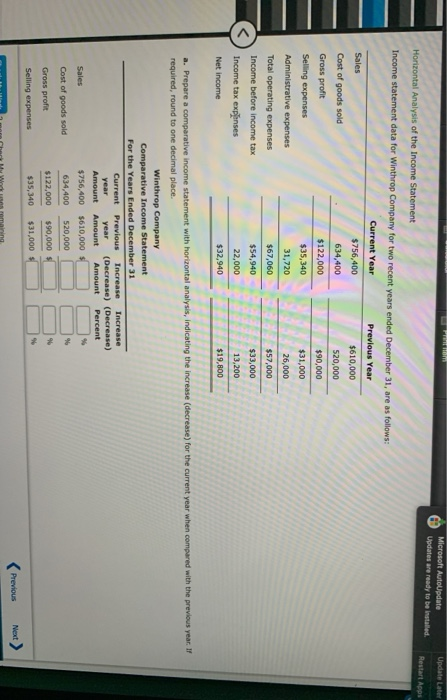

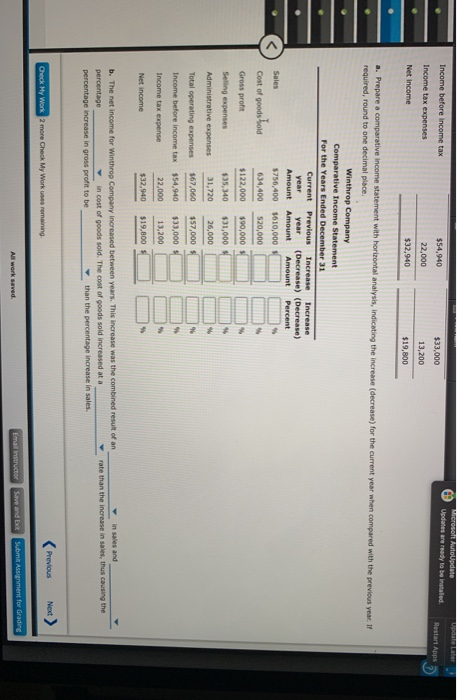

Update Later Microsoft AutoUpdate Updates are ready to be installed. Restart Apps Horizontal Analysis of the Income Statement Income statement data for Winthrop Company for two recent years ended December 31, are as follows: Current Year Previous Year $756,400 $610,000 520,000 634,400 $122,000 $90,000 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total operating expenses Income before income tax Income tax expenses $35,340 31,720 $31,000 26,000 $67,060 $57,000 $54,940 $33,000 13,200 22,000 $32,940 Net income $19,800 a. Prepare a comparative income statement with horizontal analysis, indicating the increase (decrease) for the current year when compared with the previous year. If required, round to one decimal place Winthrop Company Comparative Income Statement For the Years Ended December 31 Current Previous Increase Increase year year (Decrease) (Decrease) Amount Amount Amount Percent $756,400 $610,000 Cost of goods sold 634.400 520,000 Gross profit $122,000 $90,000 96 Selling expenses $35,340 $31,000 Sales Previous Next USO AutoUpdate Updates are ready to be installed $54,940 Income before income tax Income tax expenses Restart Apps $33,000 13,200 22,000 Net Income $32,940 $19,800 a. Prepare a comparative Income statement with horizontal analysis, indicating the increase (decrease) for the current year when compared with the previous year. If required, round to one decimal place Winthrop Company Comparative Income Statement For the Years Ended December 31 Current Previous Increase Increase year year (Decrease) (Decrease) Amount Amount Amount Percent Sales 5756,400 $610,000 Cost of goods Solid 634.400 520,000 Gross pront $122,000 $90,000 $ Seling expenses $35,340 $31,000 Administrative expenses 31,720 26,000 $57,000 Total operating expenses $67,060 Income before income tax $54,940 Income tax expense 22,000 $33,000 13,200 Net income $32,940 $19,800 b. The net income for Winthrop Company increased between years. This increase was the combined result of an percentage in cost of goods sold. The cost of goods sold increased at a percentage increase in gross profit to be than the percentage increase in sales. in sales and rate than the increase in sales, thus causing the Previous Next Check My Work 2 more Check My Works remaining Email instructor All work saved Submk Assignment for Grading Save and E