Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Update the partial Statement of Financial Position of Omron Berhad showing the shareholders equity and liability account balances at 31 December, 2020. (4 Marks) Compare

- Update the partial Statement of Financial Position of Omron Berhad showing the shareholders’ equity and liability account balances at 31 December, 2020.

(4 Marks)

- Compare and contrast (similarity and difference) between a right issue and a normal issue of ordinary shares in a company? State one (1) similarity and one (1) difference.

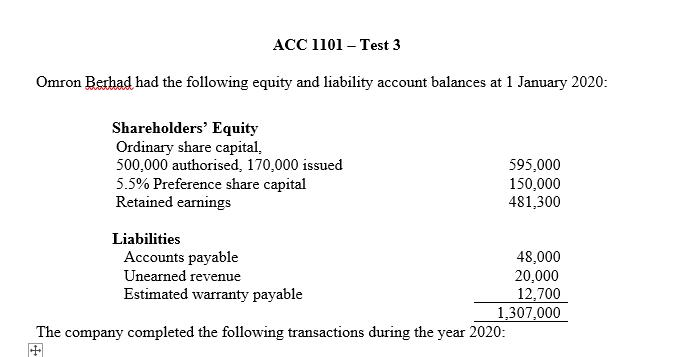

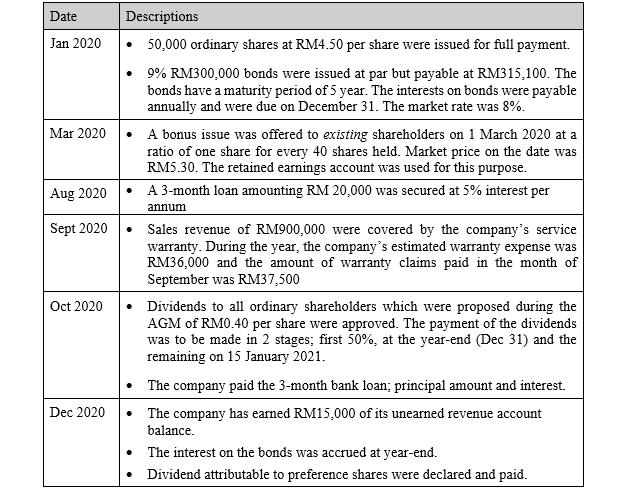

ACC 1101 - Test 3 Omron Berhad had the following equity and liability account balances at 1 January 2020: Shareholders' Equity Ordinary share capital. 500,000 authorised, 170,000 issued 5.5% Preference share capital Retained earnings Liabilities Accounts payable Unearned revenue Estimated warranty payable The company completed the following transactions during the year 2020: 595,000 150,000 481,300 48,000 20,000 12,700 1,307,000 ACC 1101 - Test 3 Omron Berhad had the following equity and liability account balances at 1 January 2020: Shareholders' Equity Ordinary share capital. 500,000 authorised, 170,000 issued 5.5% Preference share capital Retained earnings Liabilities Accounts payable Unearned revenue Estimated warranty payable The company completed the following transactions during the year 2020: 595,000 150,000 481,300 48,000 20,000 12,700 1,307,000

Step by Step Solution

★★★★★

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Rights Issue is a right issued to its existing shareholders to subscribe to the shares at a discounted price within a specified time period A bonus issue is an issue of shares by the Company to its ex...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started