Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Updated Oct 14, 2022 at 7:21 am ET Wells Fargo Says $2 Billion Charge Hit Earnings By Ben Eisen WELLS FARGO BAL Wells Fargo

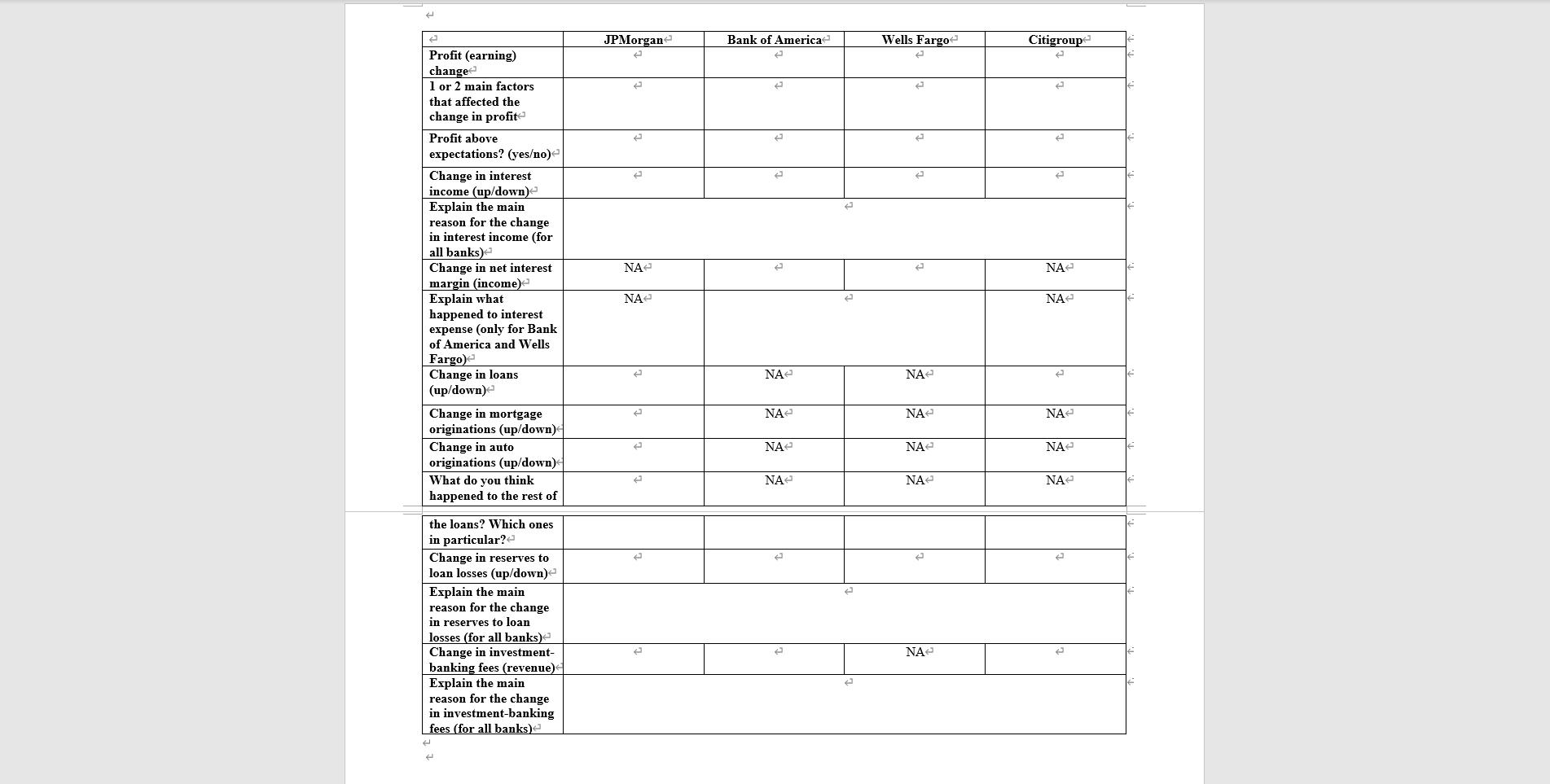

Updated Oct 14, 2022 at 7:21 am ET Wells Fargo Says $2 Billion Charge Hit Earnings By Ben Eisen WELLS FARGO BAL Wells Fargo reported earnings Friday morning. ELIZABETH BICK FOR THE WALL STREET JOURNAL Wells Fargo & Co's earnings report is out. One head-turner: a $2 billion charge. Here are the highlights: The bank said the charge was tied to resolving its long-running legal and regulatory issues. The bank didn't give much in the way of details except to say this: "Our solid business performance in the third quarter was significantly impacted by $(2.0) billion, or $(0.45) per share, in operating losses related to litigation, customer remediation, and regulatory matters primarily related to a variety of historical matters." . The bank earned $3.53 billion, down 31% from $5.12 billion a year earlier. That amounts to 85 cents per share, missing the $1.09 expected by analysts polled by FactSet. The bright spot was revenue, which rose 4% to $19.51 billion, topping analysts' expectations for $18.77 billion. The bank added $385 million to its reserves to cover potential loan losses, a move it attributed to the less favorable economic environment. Up: Net interest income, which rose 36%, since the bank can make more money lending when interest rates are higher. Down: Noninterest income, which fell 25%. The bank, which has been working to control costs, said noninterest expenses rose 8% to $14.33 billion. Citigroup Reports 25% Profit Decline in Third Quarter By David Benoit Citigold Citibank Citigroup reported earnings Friday. ELIZABETH BICK FOR THE WALL STREET JOURNAL Citigroup joins the bank-earnings parade. Here's what you need to know: Revenue rose 6% to $18.51 billion. Analysts expected $18.26 billion, according to FactSet. Profit fell 25% to $3.48 billion, or $1.63 per share. Wall Street was looking for $1.42. Citigroup set aside $370 million for potential loan losses, part of $1.37 billion in credit costs that dragged down profit. A year ago, it was freeing up rainy- day funds. . Citigroup's corporate- and investment-banking business posted $9.47 billion in revenue, down 5%. Revenue was up 6% to $6.19 billion in the consumer bank and wealth management arm. Expenses rose 8% to $12.75 billion. The bank is under pressure to cut costs. Return on tangible common equity, a key measure of profitability, fell to 8.2% from 11% a year ago. Analysts had expected 7.1%. Rising rates and currency moves helped Citi grow revenue by 40% in its all- important business managing bank accounts and cash for global companies. Trading revenue fell 7%. In its powerhouse fixed-income, currencies and commodities franchise, revenue was up 1%. Equity trading fell 25%. Investment-banking fees fell 64% to $631 million amid a plunge in M&A deals, equity and debt underwriting. Total spend on Citi credit cards rose 14%. Credit-card loans rose 12%. Read more on third-quarter bank earnings. Oct 17, 2022 at 6:51 am ET Bank of America Profit Falls 8% By Ben Eisen Earn 3% cash back your way Bank of America or re The bank added $378 million to its reserves to cover potential loan losses. ELIZABETH BICK FOR THE WALL STREET JOURNAL Bank of America is out with third-quarter earnings this morning. The numbers are in line with the other big banks, which said last week that they were socking away money in case of a recession. Here are the highlights: The nation's second-largest bank earned $7.1 billion, down 8% from $7.7 billion a year earlier. That amounts to 81 cents per share. Analysts expected 78 cents, according to FactSet. Revenue rose 8% to $24.5 billion. Analysts expected $23.5 billion. The bank added $378 million to its reserves to cover potential loan losses. Net interest income jumped 24% to $13.8 billion because the bank earned more from lending money as rates rose. Noninterest income fell 8% to $10.7 billion. A dealmaking drought caused investment-banking fees to fall 46% to $1.2 billion. Morgan Stanley and other Wall Street banks reported similar declines. Trading revenue rose 13% to $4.1 billion during a turbulent quarter for markets. The bank took a $354 million charge to help pay for a settlement over financial crisis-era mortgages, its last major litigation tied to its 2008 purchase of Countrywide Financial. That helped drive up expenses by 6% to $15.3 billion. BANK OF AMERICA CORP. BAC (US: NYSE) $35.73 USD 0.03 0.08% JPMorgan Chase Earnings Show Economy Is Resilient, but Jamie Dimon's 'Hurricane' Looms Profit fell at JPMorgan, Wells Fargo and Citigroup as banks prepped for bad loans, though revenue rose By David Benoit Updated Oct. 14, 2022 12:47 pm ET The nation's largest banks are nervous about a recession, but their third-quarter earnings showed few signs of one yet. , Ben Eisen and Matt Grossman JPMorgan JPM 1.15% Chase & Co., Wells Fargo WFC 0.73% & Co. and Citigroup Inc. C 0.20% all said Friday they had socked away hundreds of millions of dollars apiece to cover potential loan defaults, dragging down their profits. Still, revenue rose at all three banks and beat analyst forecasts. The lower profits were also largely in line with what Wall Street had expected. Profit fell 17% at JPMorgan and 25% at Citigroup, but both topped expectations. Wells Fargo reported a 31% drop in earnings, missing expectations, though it said a $2 billion charge for legal and regulatory issues hurt what was otherwise a solid quarter. The banks sit smack in the middle of an uncertain economy. Inflation is near its highest level in decades and the Federal Reserve is trying to curb it by rapidly lifting rates. That is making loans more expensive, putting pressure on Americans on multiple fronts. Investors worry that the higher interest rates will eventually tip the U.S. into recession. Bank executives said Friday that central banks' efforts to tighten credit conditions leave the economy's path forward uncertain. But today, businesses and households still look like they are in good shape, and consumers still appear to be spending and borrowing at a healthy clip. Jamie Dimon, chief executive of JPMorgan, has been predicting a recession, or what he calls an economic "hurricane," for months. It still hasn't shown up in his bank's numbers, but he said Friday he isn't changing his view. https://www.wsj.com/articles/jpmorgans-third-quarter-profit-drops-17-on-recession-planning-11685747402?mod=hp_lead_pos2 10/26/22, 6:14 PM JPMorgan Chase Earnings Show Economy Is Resilient, but Jamie Dimon's 'Hurricane' Looms - WSJ "We're just getting closer to what you and I might consider bad events and my hurricane," he said in a call with analysts. 1/4 For now, higher rates are actually helping the banks in some ways, allowing them to charge more on loans to businesses and consumers. JPMorgan, Wells Fargo and Citigroup each reported double-digit growth in interest income. Total loans rose at both JPMorgan and Wells Fargo. Smaller banks U.S. Bancorp and PNC Financial Services Group Inc. also sported broad-based loan growth in the quarter. Customers also spent more money on their credit cards, the banks said. That spending is partly the result of high consumer prices. Americans are paying more for groceries, rent, child care and other expenses, and government data this week showed that inflation remains strong despite the Fed's aggressive rate increases. That, in turn, has started to erode the strong savings that households built up during the pandemic, even though the banks' credit losses still remain historically low. "While credit quality remains strong, we're actively monitoring inflation-sensitive industries," Wells Fargo CEO Charlie Scharf said on a call with analysts. "We do expect to see increases in delinquencies and ultimately credit losses but the timing remains unclear." JPMorgan Chief Financial Officer Jeremy Barnum said that while consumer deposits remain strong, inflation is starting to bite. "That extra money they have in their checking accounts will deplete probably by sometime midyear next year," he told analysts. At the start of the pandemic, lenders set aside billions of dollars to cover loan losses. But the economy held up better than expected, thanks in part to massive government stimulus. Last year, the banks were releasing some of that money, supercharging their earnings. JPMorgan CEO Jamie Dimon said he isn't changing his prediction that 'bad events' are coming for the economy. PHOTO: TOM WILLIAMS/ZUMA PRESS https://www.wsj.com/articles/pmorgans-third-quarter-profit-drops-17-on-recession-planning-11665747402?mod=hp lead pos2 3/4 Now economic uncertainty is increasing again. On Friday, the three banks set aside a combined $1.56 billion for potential bad loans. Citigroup's baseline economic forecast calls for unemployment to rise to about 4% over the next eight quarters, CFO Mark Mason said. While that's adding some concern about future loan performance, 4% is still historically low. "I don't think there is a financial crisis coming," Mr. Mason told reporters. The U.S. unemployment rate is currently 3.5%. Another change from last year: The Fed's higher rates are pushing markets into disarray. That has put a chill on deal making, which powered bank earnings through the pandemic. Investment-banking revenue fell 47% at JPMorgan and 64% at Citigroup. It fell 55% at Morgan Stanley, which also reported a double-digit profit drop on Friday. The higher rates did hold people back from big-ticket purchases such as homes and cars, which they had splurged on during the pandemic. Mortgage rates recently hit their highest level in 20 years, adding pressure to an already-slowing housing market. Wells Fargo, which until recently was the largest U.S. mortgage lender, said home lending revenue dropped by more than half, driving an overall decline in noninterest income. Executives said mortgage banking revenue might decline more in the last three months of the year. Mortgage originations dropped 71% at JPMorgan. Auto loan originations also fell sharply at Wells Fargo and JPMorgan. -Charley Grant contributed to this article. Write to David Benoit at david.benoit@wsj.com, Ben Eisen at ben.eisen@wsj.com and Matt Grossman at matt.grossman@wsj.com Appeared in the October 15, 2022, print edition as 'Banking Giants Report Lower Profits'. 2 Profit (earning) change 1 or 2 main factors that affected the change in profit Profit above expectations? (yes/no) Change in interest income (up/down) Explain the main reason for the change in interest income (for all banks) Change in net interest margin (income) Explain what happened to interest expense (only for Bank of America and Wells Fargo) Change in loans (up/down) Change in mortgage originations (up/down) Change in auto originations (up/down) What do you think happened to the rest of the loans? Which ones in particular? Change in reserves to loan losses (up/down) Explain the main reason for the change in reserves to loan losses (for all banks) Change in investment- banking fees (revenue) Explain the main reason for the change in investment-banking fees (for all banks) H JPMorgan e P J NA 2 J Bank of America E A P NA Wells Fargo J P P NA NA NA NA Citigroup 2 A NA NA NA

Step by Step Solution

★★★★★

3.23 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Here is a summary of the key financial metrics from the earnings reports of JPMorgan Chase Bank of America Wells Fargo and Citigroup JPMorgan Chase Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started