Answered step by step

Verified Expert Solution

Question

1 Approved Answer

updated Required information Exercise 8-7A Calculate payroll withholdings and payroll taxes (LO8-3) [The following information applies to the questions displayed below.) Aspen Ski Resorts has

updated

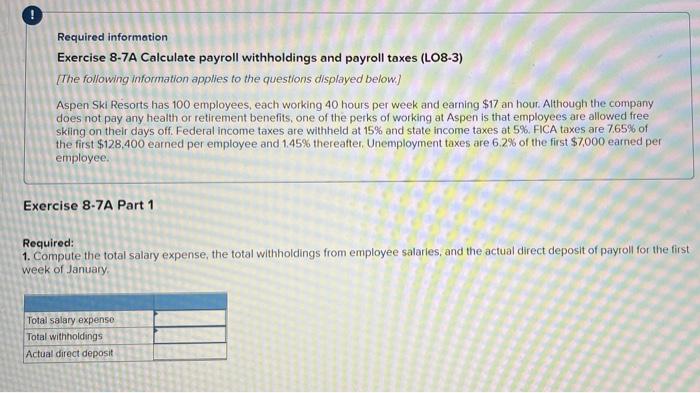

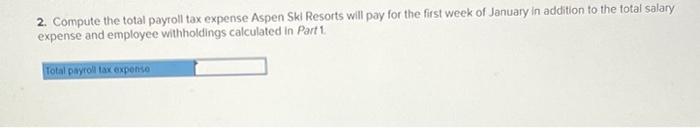

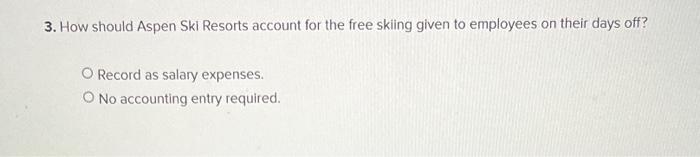

Required information Exercise 8-7A Calculate payroll withholdings and payroll taxes (LO8-3) [The following information applies to the questions displayed below.) Aspen Ski Resorts has 100 employees, each working 40 hours per week and earning $17 an hour. Although the company does not pay any health or retirement benefits, one of the perks of working at Aspen is that employees are allowed free skiing on their days off. Federal income taxes are withheld at 15% and state income taxes at 5%. FICA taxes are 7.65% of the first $128,400 earned per employee and 1.45% thereafter. Unemployment taxes are 6.2% of the first $7,000 earned per employee. Exercise 8-7A Part 1 Required: 1. Compute the total salary expense, the total withholdings from employee salaries, and the actual direct deposit of payroll for the first week of January. Total salary expense Total withholdings Actual direct depositi 2. Compute the total payroll tax expense Aspen Ski Resorts will pay for the first week of January in addition to the total salary expense and employee withholdings calculated in Part 1. Total payroll tax expense 3. How should Aspen Ski Resorts account for the free skiing given to employees on their days off? O Record as salary expenses. O No accounting entry required Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started