Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Upload your response as a word or pdf file using the 'Browse My Computer' button below. You manage an investment portfolio which has an

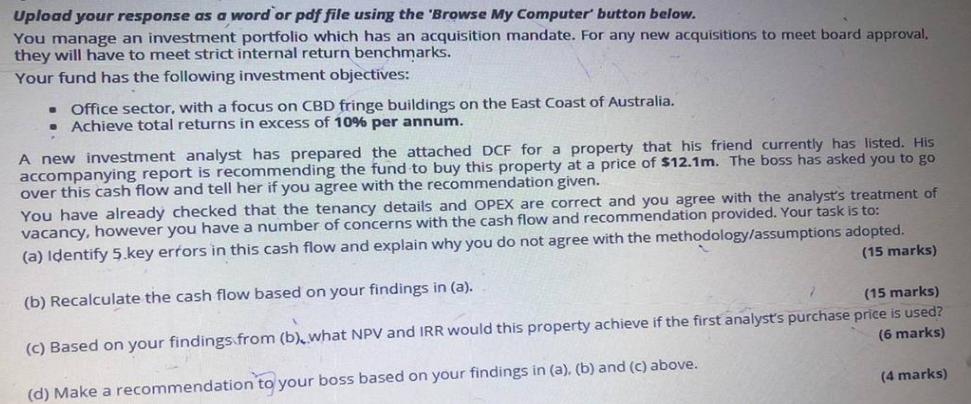

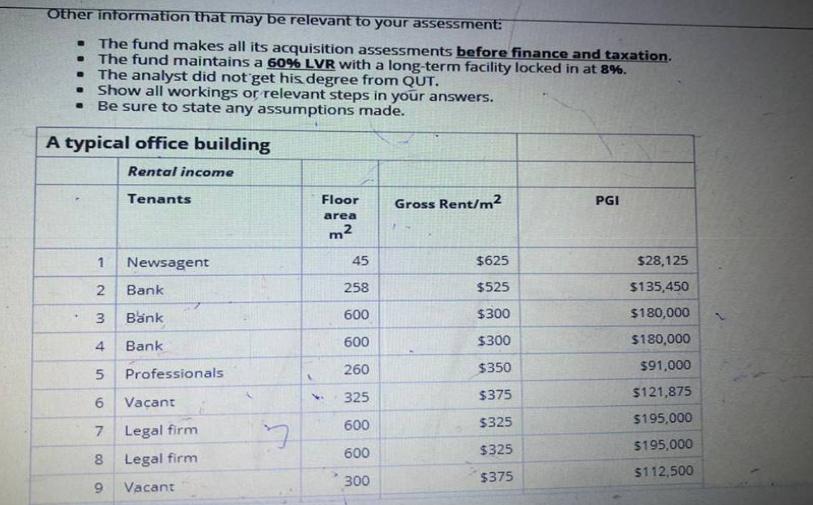

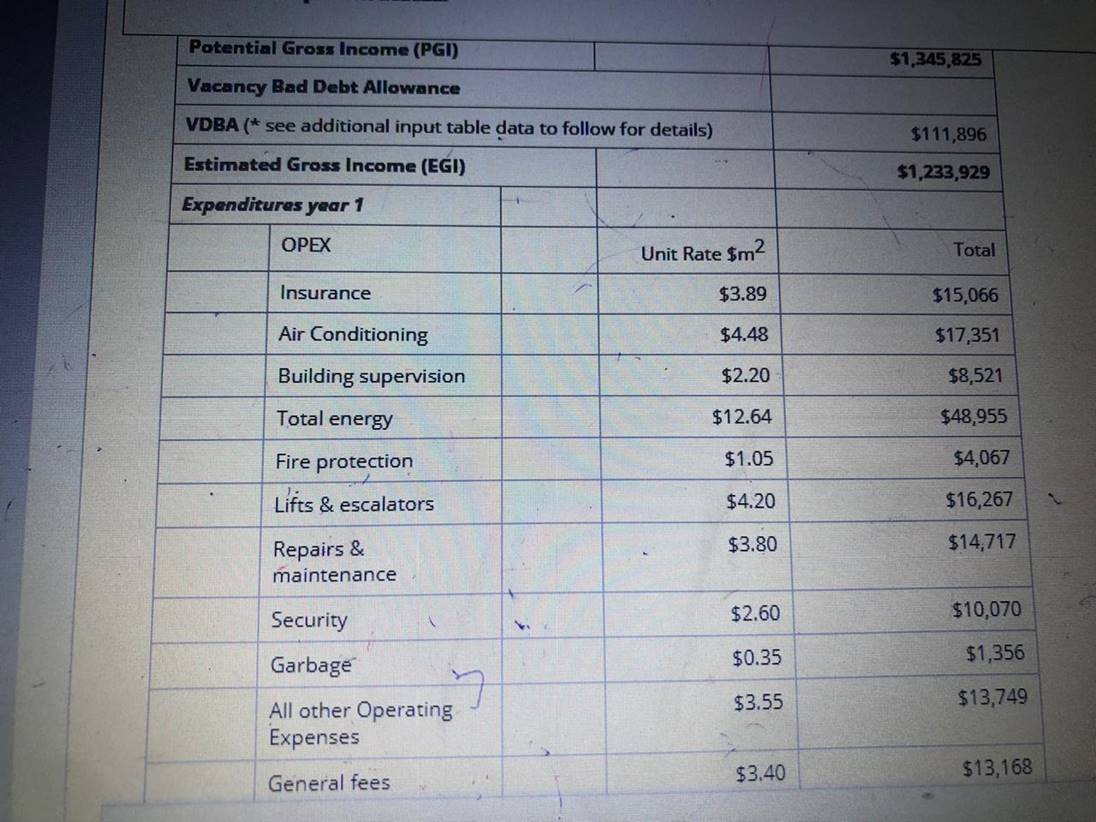

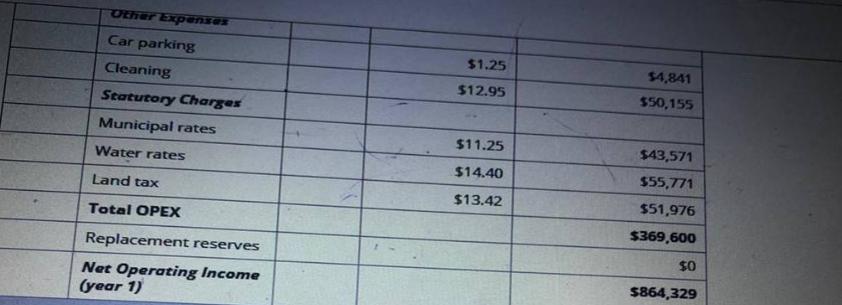

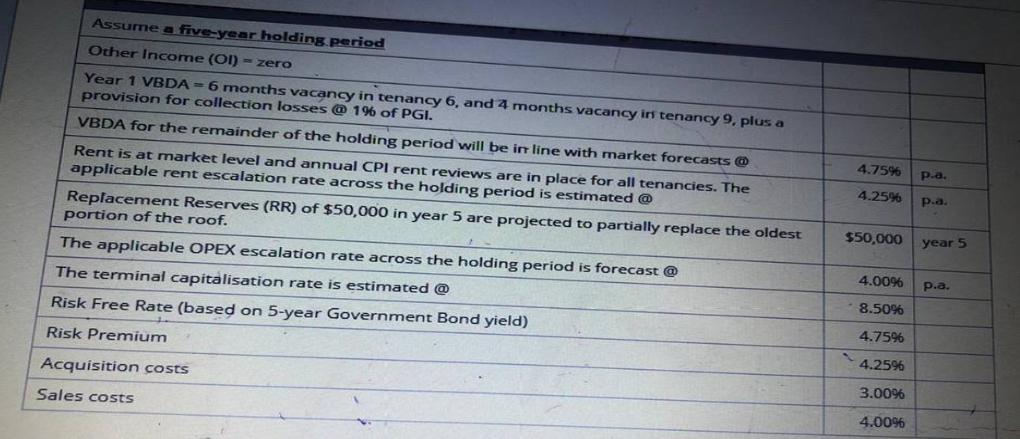

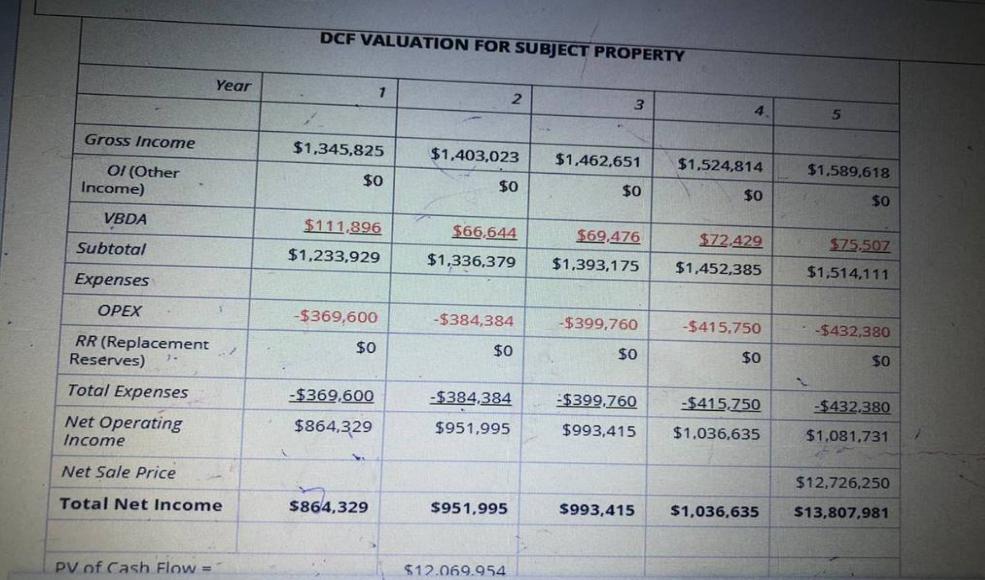

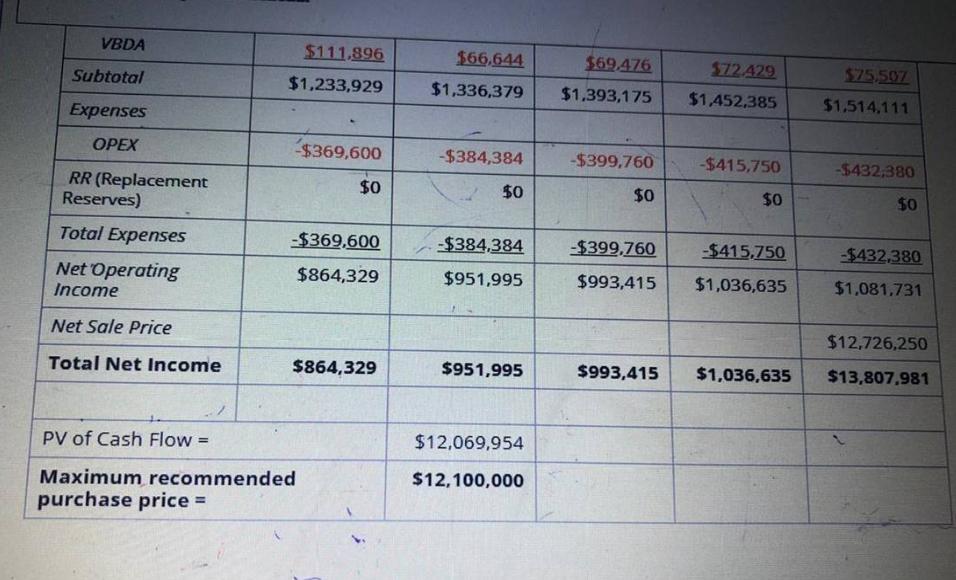

Upload your response as a word or pdf file using the 'Browse My Computer' button below. You manage an investment portfolio which has an acquisition mandate. For any new acquisitions to meet board approval, they will have to meet strict internal return benchmarks. Your fund has the following investment objectives: Office sector, with a focus on CBD fringe buildings on the East Coast of Australia. Achieve total returns in excess of 10% per annum. A new investment analyst has prepared the attached DCF for a property that his friend currently has listed. His accompanying report is recommending the fund to buy this property at a price of $12.1m. The boss has asked you to go over this cash flow and tell her if you agree with the recommendation given. You have already checked that the tenancy details and OPEX are correct and you agree with the analysts treatment of vacancy, however you have a number of concerns with the cash flow and recommendation provided. Your task is to: (a) Identify 5.key errors in this cash flow and explain why you do not agree with the methodology/assumptions adopted. (15 marks) (b) Recalculate the cash flow based on your findings in (a). (15 marks) (C) Based on your findings.from (b), what NPV and IRR would this property achieve if the first analyst's purchase price is used? (6 marks) (d) Make a recommendation to your boss based on your findings in (a), (b) and (c) above. (4 marks) Other intormation that may be relevant to your assessment: The fund makes all its acquisition assessments before finance and taxation. The fund maintains a 60% LVR with a long-term facility locked in at 8%. The analyst did not get his degree from QUT. Show all workings or relevant steps in your answers. Be sure to state any assumptions made. A typical office building Rental income Tenants Floor Gross Rent/m PGI area Newsagent 45 $625 $28,125 Bank 258 $525 $135,450 3 Bnk 600 $300 $180,000 600 $300 $180,000 4 Bank 260 $350 $91,000 Professionals 325 $375 $121,875 6 Vacant $325 $195,000 600 7 Legal firm to $325 $195,000 600 Legal firm $375 $112,500 300 Vacant 2. Potential Gross Income (PGI) $1,345,825 Vacancy Bad Debt Allowance VDBA (* see additional input table data to follow for details) $111,896 Estimated Gross Income (EGI) $1,233,929 Expenditures year 1 OPEX Unit Rate $m2 Total Insurance $3.89 $15,066 Air Conditioning $4.48 $17,351 Building supervision $2.20 $8,521 Total energy $12.64 $48,955 Fire protection $1.05 $4,067 Lifts & escalators $4.20 $16,267 $14,717 Repairs & maintenance $3.80 $2.60 $10,070 Security Garbage $0.35 $1,356 $3.55 $13,749 All other Operating Expenses $3.40 $13,168 General fees Other Expeenses Car parking $1.25 $4,841 Cleaning $12.95 $50,155 Statutory Charges Municipal rates $11.25 $43,571 Water rates $14.40 $55,771 Land tax $13.42 $51,976 Total OPEX $369,600 0$ $864,329 Replacement reserves Net Operating Income (year 1) Assume a five-year holding period Other Income (Ol) = zero Year 1 VBDA = 6 months vacancy in tenancy 6, and 4 months vacancy in tenancy 9, plus a provision for collection losses @ 19% of PGI. VBDA for the remainder of the holding period will be in line with market forecasts @ 4.75% p.a. Rent is at market level and annual CPI rent reviews are in place for all tenancies. The 4.25% applicable rent escalation rate across the holding period is estimated @ p.a. Replacement Reserves (RR) of $50,000 in year 5 are projected to partially replace the oldest portion of the roof. $50,000 year 5 The applicable OPEX escalation rate across the holding period is forecast @ 4.00% p.a. The terminal capitalisation rate is estimated @ 8.50% Risk Free Rate (based on 5-year Government Bond yield) 4.75% Risk Premium 4.25% 3.00% Acquisition costs 4.00% Sales costs DCF VALUATION FOR SUBJECT PROPERTY Year 2 4. Gross Income $1,345,825 $1,403,023 $1,462,651 $1,524,814 $1,589,618 OI (Other Income) $0 $0 $0 $0 $0 VBDA $111.896 $66.644 $69,476 $72.429 $75.507 Subtotal $1,233,929 $1,336,379 $1,393,175 $1,452,385 $1,514,111 Expenses -$369,600 -$384,384 -$399,760 -$415,750 $432,380 $0 s0 RR (Replacement Reserves) $0 $0 Total Expenses -$369,600 -$384,384 -$399.760 -$415.750 -$432,380 $993,415 Net Operating Income $864,329 $951,995 $1.036,635 $1,081,731 Net Sale Price $12,726,250 Total Net Income $864,329 $951,995 $993,415 $1,036,635 $13,807,981 PV of Cash Flow = $12.069.954 VBDA $111,896 $66.644 $69.476 $72.429 $75.507 Subtotal $1,233,929 $1,336,379 $1,393,175 $1,452,385 $1,514,111 Expenses $369,600 -$384,384 -$399,760 -$415,750 -$432,380 RR (Replacement Reserves) $0 $0 $0 $0 $0 Total Expenses -$369,600 -$384,384 -$399,760 $415.750 $432.380 Net Operating $864,329 $951,995 $993,415 $1,036,635 $1,081,731 Income Net Sale Price $12,726,250 Total Net Income $864,329 $951,995 $993,415 $1,036,635 $13,807,981 PV of Cash Flow = $12,069,954 Maximum recommended $12,100,000 purchase price =

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Here are the full calculations with workings a Key errors identified 15 points explained above b Rec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started