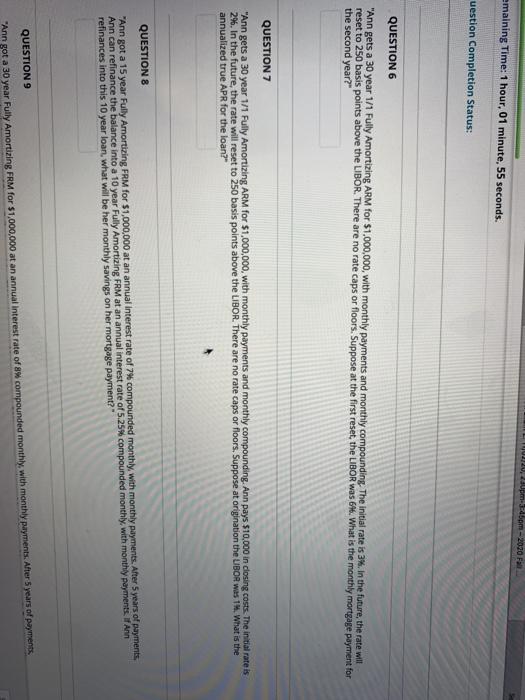

Upm-bom-2020 Ft emaining Time: 1 hour, 01 minute, 55 seconds. uestion Completion Status: QUESTION 6 "Ann gets a 30 year 1/1 Fully Amortizing ARM for $1,000,000, with monthly payments and monthly compounding. The initial rate is 3. In the future, the rate will reset to 250 basis points above the LIBOR. There are no rate caps or floors. Suppose at the first reset the LIBOR was 64. What is the monthly mortgage payment for the second year?" QUESTION 7 "Ann gets a 30 year 1/1 Fully Amortizing ARM for $1,000,000, with monthly payments and monthly compounding. Ann pays $10,000 in closing costs. The initial rate is 2%. In the future, the rate will reset to 250 basis points above the LIBOR. There are no rate caps or floors. Suppose at origination the LIBOR was 1. What is the annualized true APR for the loan?" QUESTIONS "Ann got a 15 year Fully Amortizing FRM for $1,000,000 at an annual interest rate of 7 compounded monthly, with monthly payments. After 5 years of payments. Ann can refinance the balance into a 10 year Fully Amortizing FRM at an annual interest rate of 5.25% compounded monthly, with monthly payments. An refinances into this 10 year loan, what will be her monthly savings on her mortgage payment?" QUESTION 9 "Ann got a 30 year Fully Amortizing FRM for $1,000,000 at an annual Interest rate of 8% compounded monthly, with monthly payments. After 5 years of payments Upm-bom-2020 Ft emaining Time: 1 hour, 01 minute, 55 seconds. uestion Completion Status: QUESTION 6 "Ann gets a 30 year 1/1 Fully Amortizing ARM for $1,000,000, with monthly payments and monthly compounding. The initial rate is 3. In the future, the rate will reset to 250 basis points above the LIBOR. There are no rate caps or floors. Suppose at the first reset the LIBOR was 64. What is the monthly mortgage payment for the second year?" QUESTION 7 "Ann gets a 30 year 1/1 Fully Amortizing ARM for $1,000,000, with monthly payments and monthly compounding. Ann pays $10,000 in closing costs. The initial rate is 2%. In the future, the rate will reset to 250 basis points above the LIBOR. There are no rate caps or floors. Suppose at origination the LIBOR was 1. What is the annualized true APR for the loan?" QUESTIONS "Ann got a 15 year Fully Amortizing FRM for $1,000,000 at an annual interest rate of 7 compounded monthly, with monthly payments. After 5 years of payments. Ann can refinance the balance into a 10 year Fully Amortizing FRM at an annual interest rate of 5.25% compounded monthly, with monthly payments. An refinances into this 10 year loan, what will be her monthly savings on her mortgage payment?" QUESTION 9 "Ann got a 30 year Fully Amortizing FRM for $1,000,000 at an annual Interest rate of 8% compounded monthly, with monthly payments. After 5 years of payments