Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Upon learning about the situation, Ms. Martinez immediately sought the help of her former colleague, Crisfolo S. Montareal, from CSM Tax and Consultancy Services,

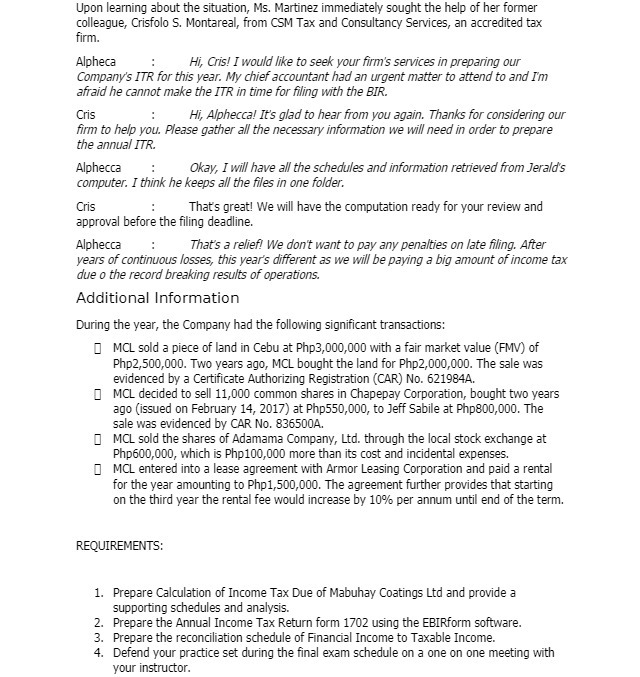

Upon learning about the situation, Ms. Martinez immediately sought the help of her former colleague, Crisfolo S. Montareal, from CSM Tax and Consultancy Services, an accredited tax firm. Alpheca : Hi, Cris! I would like to seek your firm's services in preparing our Company's ITR for this year. My chief accountant had an urgent matter to attend to and I'm afraid he cannot make the ITR in time for filing with the BIR. Cris : Hi, Alphecca! It's glad to hear from you again. Thanks for considering our firm to help you. Please gather all the necessary information we will need in order to prepare the annual ITR. : Alphecca Okay, I will have all the schedules and information retrieved from Jerald's computer. I think he keeps all the files in one folder. Cris approval before the filing deadline. That's great! We will have the computation ready for your review and Alphecca : That's a relief! We don't want to pay any penalties on late filing. After years of continuous losses, this year's different as we will be paying a big amount of income tax due o the record breaking results of operations. Additional Information During the year, the Company had the following significant transactions: MCL sold a piece of land in Cebu at Php3,000,000 with a fair market value (FMV) of Php2,500,000. Two years ago, MCL bought the land for Php2,000,000. The sale was evidenced by a Certificate Authorizing Registration (CAR) No. 621984A. MCL decided to sell 11,000 common shares in Chapepay Corporation, bought two years ago (issued on February 14, 2017) at Php550,000, to Jeff Sabile at Php800,000. The sale was evidenced by CAR No. 836500A. MCL sold the shares of Adamama Company, Ltd. through the local stock exchange at Php600,000, which is Php100,000 more than its cost and incidental expenses. MCL entered into a lease agreement with Armor Leasing Corporation and paid a rental for the year amounting to Php1,500,000. The agreement further provides that starting on the third year the rental fee would increase by 10% per annum until end of the term. REQUIREMENTS: 1. Prepare Calculation of Income Tax Due of Mabuhay Coatings Ltd and provide a supporting schedules and analysis. 2. Prepare the Annual Income Tax Return form 1702 using the EBIRform software. 3. Prepare the reconciliation schedule of Financial Income to Taxable Income. 4. Defend your practice set during the final exam schedule on a one on one meeting with your instructor.

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

I can help you with the initial steps in preparing the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started